BAE Systems (LSE: BA.) shares have been red-hot recently. They surged 55% last year, making them the best performers in the FTSE 100. And the stock is up a further 18% so far this year, taking the share price past the £10 mark.

But after such a strong rally, are the shares still be worth buying at today’s price?

Rising demand

The unfortunate catalyst for the outperformance of BAE shares isn’t hard to fathom. The near-vertical jump on the stock chart over a few days in February last year coincided with Russia’s full-scale invasion of Ukraine.

Should you invest £1,000 in BAE Systems right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if BAE Systems made the list?

With no end in sight to the tragic conflict, the defence stock has continued to rise.

One immediate consequence of the war has been an increase in global defence spending. And that has already been reflected in the company’s financials, as it reported a record order intake of £37.1bn last year. This propelled its order backlog to £58.9bn.

Overall group revenue for 2022 came in at £23.2bn, up from £21.3bn in 2021.

Looking ahead, the company expects further top-line growth, continued margin expansion, and higher earnings per share.

Despite this optimism, the share price would presumably take a hit if much-hoped-for peace talks developed between Ukraine and Russia. In theory, that could cause governments to pare back defence spending, thereby limiting BAE’s future growth.

Unfortunately though, I’m pessimistic about the direction in which the world of geopolitics is heading. Therefore I’m expecting the defence sector to outperform for the foreseeable future.

Valuation

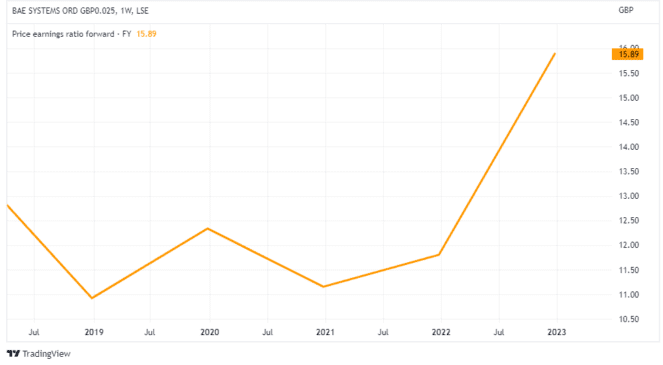

One consequence of BAE’s surging share price is that the stock is now more expensive. Here we can see how its forward price-to-earnings (P/E) ratio is higher today than it was in recent years. This is a metric that takes the company’s forecast future earnings into consideration.

Data by Trading View

This forward P/E of 15.8 is above the FTSE 100 average, which stands at 13.6.

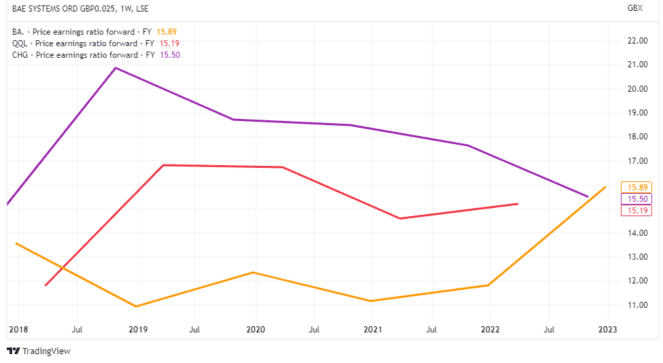

Yet I don’t think this shows the stock is expensive. In fact, it looks fairly valued to me, especially if we compare it to fellow defence stocks QinetiQ and Chemring.

All three are valued almost identically on a forward P/E basis. That is, around 15 times expected earnings.

Of course, the defence sector in general has marched higher due to the heightened geopolitical tensions. But this chart does suggest that BAE stock isn’t currently overvalued, relative to its industry.

Across the pond

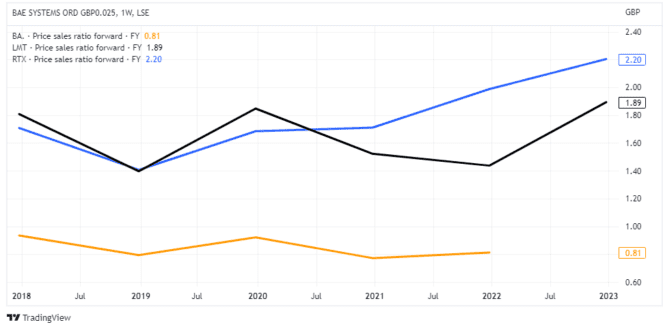

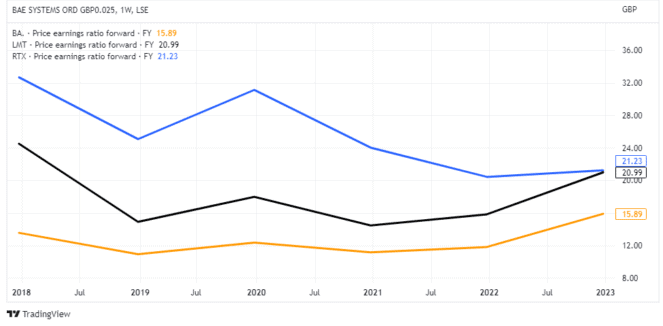

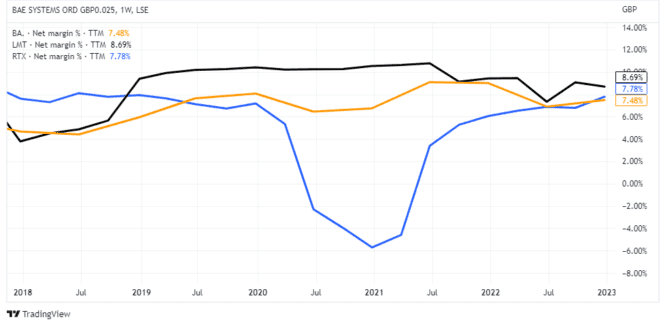

If we compare the stock to Lockheed Martin and Raytheon Technologies, two of its larger US-listed peers, then it actually looks cheap.

On a forward price-to-sales basis, both Lockheed (1.89) and Raytheon (2.2) are trading at much higher multiples than BAE (0.81). This can be seen again with the forward P/E metric, which shows BAE stock to be more than 30% cheaper.

So BAE is trading at a significant discount to its US peers. That’s understandable considering their shares are listed on the New York Stock Exchange and denominated in a strong US dollar.

However, these US defence companies don’t have much higher net profit margins. They’re broadly similar, with Lockheed just in front (8.69%).

All this leads me to believe that the stock is reasonably valued at £10. As such, I’ll be hanging on to my own BAE shares.