This penny stock features in Shell’s monster portfolio of equity investments across the world.

Cazoo (NYSE:CZOO), the online used-car marketplace, had a valuation of £6bn when it went public at the end of 2020 through a SPAC merger.

The British car start-up’s market capitalisation has since collapsed to just £85m. Is this an opportunity for me to swoop in and buy shares on the cheap?

Why is Shell invested in Cazoo?

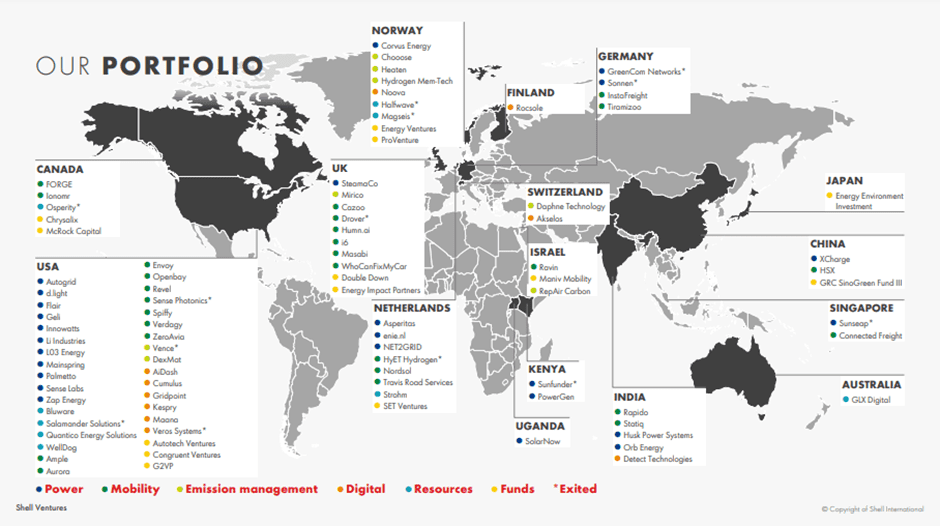

The oil and gas giant Shell has minority investments in tens of private and publicly listed companies around the world.

Cazoo sits in the ‘mobility’ segment of Shell’s portfolio, alongside companies like US self-driving developer Aurora Innovation, Indian ride-sharing application Rapido, and online car repair marketplace WhoCanFixMyCar.

According to Shell’s latest accounts, the value of its equity securities fell from $1.71bn at the end of 2021 to $1.53bn a year later.

That 11% fall in the value of Shell’s equity portfolio compares favourably with the S&P 500 index’s 18% drop in 2022.

However, Cazoo was an exception to that trend. The UK-based car marketplace saw its share price drop by 97% in 2022; currently, the stock is down 99% since it went public.

Shell has not disclosed how much equity it owns in Cazoo.

The oil and gas company invested £2.25m in Drover – a car subscription service – in December 2020. Later that same month, Drover was bought out by Cazoo, presumably leaving Shell with equity in the acquirer.

Running on fumes

So, what has gone wrong with Cazoo?

The second-hand car marketplace’s campaign to conquer Europe ended with a whimper, after it sold off its Spanish subscription business Swipcar and Italian auto-retailer Brumbrum for unknown amounts in late 2022.

Cazoo raised £728m before expenses from its flotation on the NYSE in December 2021. Its ill-fated European expansion, along with a raft of sports sponsorship deals, left the loss-making company with only £258m on hand by the end of 2022.

Founder and ex-CEO Alex Chesterman said that Cazoo was burning through that dwindling liquidity at a rate of around £10m a month, leaving it with a cash runway of around two years.

The company is now focusing solely on the UK market. However, it incurred heavy losses in 2021, with the size of its negative earnings more than tripling year on year to £329m. On the bright side, revenue grew by 91% in FY22, despite the challenging macro environment.

Rev up my returns?

Is Cazoo a shiny hubcap in the scrapyard? I don’t think so.

David Kendrick, a partner at accountancy firm UHY Hacker Young, hit the nail on the head. In his words, “For me, the online-only model doesn’t work and the market isn’t ready for it. The car retail consumer still wants to go to a dealership and the huge expenses that Cazoo must be incurring aren’t sustainable“.

Add in the fact that the UK economy seems to be slowing down, just as Cazoo desperately needs to put the pedal to the metal to avoid becoming insolvent.

Despite Shell’s involvement and the massive stock-price drop, I’m not interested in buying Cazoo shares.