Every month, we ask our freelance writers to share their top ideas for dividend shares to buy with you — here’s what they said for April!

[Just beginning your investing journey? Check out our guide on how to start investing in the UK.]

BT

What it does: BT is a telecommunications giant that operates in nearly 200 countries.

Should you invest £1,000 in Bunzl Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Bunzl Plc made the list?

By Charlie Keough. The near-6% dividend yield offered by shares of FTSE 100 stalwart BT (LSE: BT.A) presents a great way for me to put my money to work at a time when it’s needed.

With UK inflation figures for February coming in hotter than expected, the dividend provided by BT offers, to an extent, a hedge against high rates.

On top of this, the stock also looks cheap, with a price-to-earnings ratio of around eight. For comparison, the FTSE 100 average sits at around 14.

The BT share price has rallied so far in 2023. And with its large infrastructure and brand history, the business seems like a solid investment.

With this said, the biggest threat to the company is its large debt, which sits just shy of £20bn. Further, BT has also been involved in numerous disputes with workers in recent months over pay.

Overall, though, with its solid foundations and high yield, I see BT as a decent dividend stock.

Charlie Keough does not own shares in BT.

Bunzl

What it does: Bunzl is a distributor of consumables. These include grocery packaging, hygiene products, and personal protective equipment.

By Stephen Wright. My top British dividend pick for April is Bunzl (LSE:BNZL). I think the underlying business has attractive economics, a good moat, and decent growth prospects.

Importantly, for an income stock, it also pays a decent dividend. The current yield is just over 2%, but the company has over 20 years of increasing shareholder payments.

I think the stock looks good going forward, too. The company has avenues for organic growth, acquisitions, and improved efficiency.

Furthermore, Bunzl’s business looks like it has good protection from competitors. The company’s focus on adding value through reliability and convenience gives it an edge.

I see this as a stock that could be a great passive-income investment for the long term. That’ why I’m looking to buy it in April.

Stephen Wright does not own shares in Bunzl.

Legal & General Group

What it does: Legal & General is a financial services company that provides insurance, investment, and retirement solutions.

By Edward Sheldon, CFA. Legal & General’s (LSE: LGEN) share price has come down recently and I think this has presented a great opportunity from a dividend investing perspective. For 2022, Legal & General declared a dividend of 19.4p per share. At today’s share price, that equates to a trailing yield of around 8.5%.

It gets better, though. Looking ahead, Legal & General is aiming to grow its dividend by around 5% per year over the next few years. This means those buying the dividend shares now could be set to enjoy even higher yields going forward.

One issue to be aware of here is that Legal & General’s CEO Sir Nigel Wilson is shortly about to step down. A new boss may want to change the dividend policy. This could result in lower payouts.

Right now, however, the yield on offer here is hard to ignore, in my view.

Edward Sheldon has no position in Legal & General Group.

M&G

What it does: M&G is an asset manager with over £300bn of assets under management and administration.

By Christopher Ruane. March saw the release of last year’s results for M&G (LSE: MNG) and they were a mixed bag.

Assets under management and administration fell. I see a risk that the decline could continue if jittery markets lead clients to withdraw funds, hurting revenues. Last year also saw the firm report a £1.6bn post-tax loss. That was largely down to valuation shifts, though: the adjusted operating profit before tax was over half a billion pounds.

M&G increased its annual dividend by 7%, delivering on its stated aim of maintaining or growing the payout each year — that means the shares now yield almost 11%, which for a FTSE 100 firm I think is highly attractive.

With strong brand recognition and millions of customers in nearly 30 markets, I believe the business can prosper. If I have spare cash to invest in April, I will be happy to add to my existing position in M&G.

Christopher Ruane owns shares in M&G.

National Grid

What it does: National Grid supplies gas and electricity to various customers and communities in the UK and the US.

By Paul Summers: If generating relatively stable income were my primary goal, my pick for April would be National Grid (LSE: NG).

Yes, I know. This is hardly exciting stuff. But my point is that National Grid is one of the most resilient stocks in the top tier. Although nothing is guaranteed, earnings are far more predictable, even when the economy is in the doldrums.

The dividend credentials are solid as a result. In addition to regularly hiking its annual payout, the Grid is on course to yield a forecast 5.5% in FY24 (beginning April 1).

Available for 14 times earnings as I type, the stock strikes me as reasonably valued rather than a screaming bargain. That said, the price has dropped a fair amount from its 52-week high.

Full-year numbers for 2022 are due in May but I’d be happy to invest now.

Paul Summers does not own shares in National Grid

Primary Health Properties

What it does: Primary Health Properties is a real estate investment trust (REIT) that leases out a portfolio of healthcare facilities to the NHS, as well as private providers.

By Mark Tovey. Primary Health Properties (LSE:PHP) has seen its share price squashed by interest-rate hikes that are weighing on real estate valuations — as a result, its dividend yield has shot up to 6.4%.

If I want a sturdy source of passive income, why should I choose PHP, and not one of the bigger REITs, like British Land (6.2% yield) or Land Securities (6.6%)? Because, unlike these two, PHP did not cut its dividend during the Covid crash, or during the Great Recession, or at any other moment in the last three decades.

PHP’s dividend payout is well covered at 76% of cash flow. With a portfolio of 523 healthcare facilities, PHP has the kind of tenants that can be relied on to keep paying their rents even in hard times.

Admittedly, major changes in UK policy, like a prohibition on NHS commissioning of third-party providers, could leave PHP’s business in ailing health. Despite the risk, I plan to invest when I have spare cash.

Mark Tovey does not own shares in Primary Health Properties.

Target Healthcare REIT

What it does: Target Healthcare invests in care homes.

By Alan Oscroft. Anything related to property looks like poison right now.

But I think that’s missing the point of Target Healthcare (LSE: THRL), whose income does not depend of the value of its properties.

I’d rate it more closely with healthcare stocks, and the value comes from renting out its care homes on long leases.

That business is generating the cash to pay good dividends. For 2023, forecasts put the yield at more than 9%, and rising.

The main risk I see at the moment is that cover by earnings looks a bit weak. And further property weakness could cause pain too, even if I don’t think it’s too relevant.

Earnings are expected to be low this year, but should come back next year. That would put the 2023 price-to-earnings ratio at under eight.

Alan Oscroft does not own shares in Target Healthcare.

Taylor Wimpey

What it does: Taylor Wimpey is a FTSE 100-listed home construction company based in the United Kingdom.

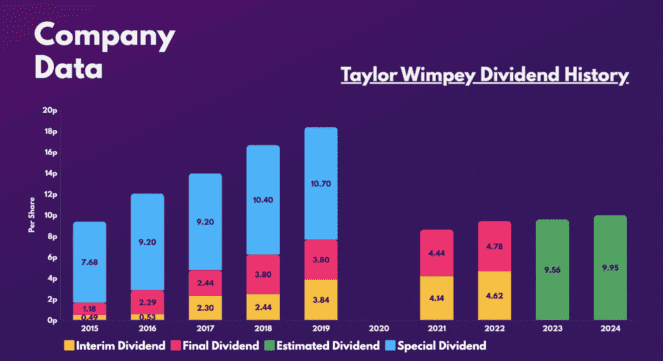

By John Fieldsend. The annual yield of British homebuilder Taylor Wimpey (LSE: TW) is currently sitting at 8.09%. That’s an extraordinary dividend payout, over double the average of the FTSE 100 index, which is around 3.7% currently. It perhaps explains why the firm is up 11% year to date while the Footsie is down a fraction of a percent.

The stock looks cheap, too. A price-to-earnings multiple of under seven seems like a bargain compared to both the FTSE 100 average of around 14 and the industry average of around 11.

The risks here are that housebuilding is traditionally a cyclical industry by nature. And with the Bank of England predicting a recession in 2023, Taylor Wimpey may be in for a rocky few years.

If this truly is going to be a rough period for the industry, then it may impact the company’s earnings. That could mean future dividend payouts may not be as substantial.

John Fieldsend does not own shares in Taylor Wimpey.

Taylor Wimpey

What it does: Taylor Wimpey is among the biggest four UK housebuilders. It completes tens of thousands of houses on average every year across the country.

By John Choong: The housing sector may be in decline, which has led to many builders like Persimmon to cut their dividend. However, I’m still buying Taylor Wimpey (LSE:TW) shares because of its secure dividend policy.

Unlike its peers, the latter’s dividend policy is asset based, rather than earnings based. The FTSE 100 developer promises to return at least £250m or 7.5% of its net assets to shareholders annually. As such, it can afford to continue churning out high yields (8.2%) despite earnings declining, as has been the case in recent months.

With an extremely robust balance sheet boasting a 2% debt-to-equity ratio, I’ve got full confidence in the company to combat the current downturn. After all, I’m invested for the long term, and with house prices expected to grow again in years to come, so should the firm’s earnings and dividends. Pair that with reasonable valuation multiples and I see Taylor Wimpey shares as a long-term bargain.

| Metrics | Taylor Wimpey | Industry Average |

| P/B value | 0.9 | 0.9 |

| P/S ratio | 0.9 | 0.8 |

| FP/S ratio | 1.2 | 1.2 |

| P/E ratio | 6.3 | 9.8 |

| FP/E ratio | 12.8 | 10.4 |

John Choong has positions in Taylor Wimpey.

The PRS REIT

What it does: The PRS REIT is a residential landlord that specialises in letting out newbuild family homes.

By Royston Wild. Property is one of the most popular safe-haven assets for nervous investors. This is why I believe The PRS REIT (LSE:PRSR) shares could be in high demand in the coming weeks.

This property company specialises in the private rental sector (hence PRS). This is a part of the market where rents remain stable at all points of the economic cycle. Spending on accommodation is one of the last things that people cut back on when times get tough.

I think The PRS REIT is highly attractive from a long-term perspective, too. As Britain’s rental housing shortage worsens the business can expect the rents it receives to keep rising. Analysts at Statista expect average UK rents to grow a cumulative 20.5% between 2022 and 2026.

Real estate investment trusts (or REITs) like this are obliged to distribute at least nine-tenths of annual rental profits in the form of dividends. As a result, this UK income stock carries a juicy 5% forward dividend yield.

Royston Wild does not own shares in The PRS REIT.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

The Renewables Infrastructure Group

What it does: The Renewables Infrastructure Group is an investment trust with assets generating electricity from renewable sources.

By Ben McPoland. The Renewables Infrastructure Group (LSE:TRIG) is a FTSE 250-listed renewable energy trust. It was set up nearly a decade ago and now has around £3.3bn in assets across the UK and five other European countries. These assets generated enough clean energy in 2022 to power 1.6m homes!

TRIG’s portfolio is predominantly made up of onshore and offshore wind and solar farms. This can present problems if adverse weather impacts its energy production. However, this is largely mitigated by the diversification of both geography and technology.

The trust is targeting total dividends for 2023 of 7.18p per share, which would be a 5% increase on 2022. That equates to a dividend yield of 5.7%, which is higher than the index average. Payouts are made quarterly.

Finally, I note the shares are trading at a 5% discount to net asset value (NAV). So I reckon now could be a good time to buy.

Ben McPoland owns shares in The Renewables Infrastructure Group.

Warehouse REIT

What it does: Warehouse REIT owns and leases a growing portfolio of commercial warehouses across the UK with a strong focus on the e-commerce sector.

By Zaven Boyrazian. With all the latest turmoil in the banking sector, the property sector has been getting hit hard lately, especially real estate investment trusts. And Warehouse REIT (LSE:WHR) is no exception.

The e-commerce warehouse operator has seen its market cap drop by over 45% in the last 12 months. Yet, despite what this trajectory would indicate, the firm is actually chugging along nicely.

What seems to be concerning investors is as interest rates increase, property values drop, making the firm’s asset portfolio less valuable. That’s perfectly justified thinking. But for long-term income investors, what ultimately matters is cash flow from rental income. And the latter is still growing, as are operating profits.

That’s why management just raised dividends even higher. And when paired with a falling stock price, the dividend yield now stands at an impressive 7%. That, to me, looks like a bargain income opportunity.

Zaven Boyrazian owns shares in Warehouse REIT.