I think these UK income shares are among the best stocks to buy for passive income. Here’s why I’ll increase my holdings in them if I have spare cash to invest.

Primary Health Properties

Real estate investment trusts (REITs) can be great ways to make dividend income during good times and bad. The contracted rents they receive tend to provide a steady flow of cash at all points of the economic cycle.

On top of this, tax-efficient REITs are required to pay out at least 90% of annual profits from their rental operations in the form of dividends.

Primary Healthcare Properties (LSE:PHP) is one REIT I own in my portfolio. This particular company operates healthcare facilities, such GP surgeries, and currently has more than 500 properties in its portfolio.

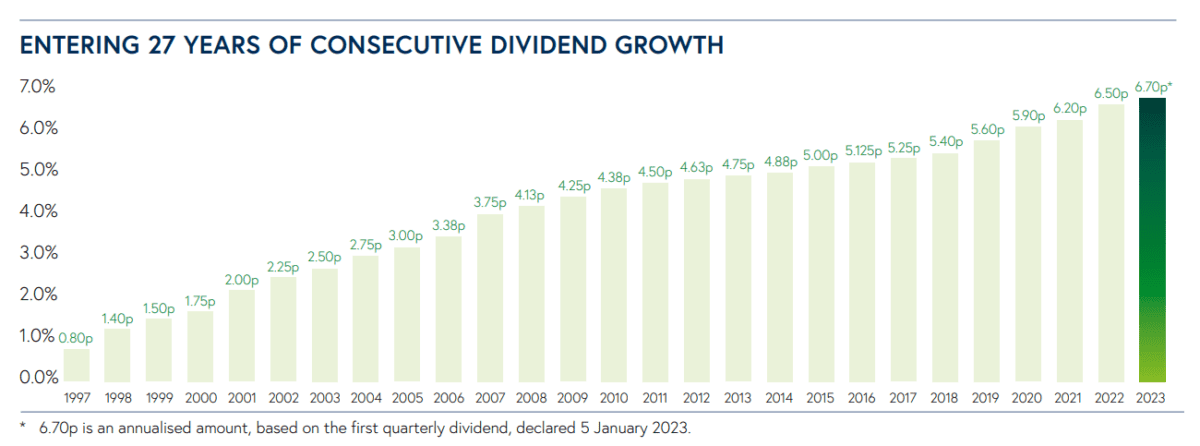

And it has a brilliant record of dividend growth. Shareholder payouts have grown each year for more than a quarter of a century, and by 20% in the past five years.

I believe this UK share offers terrific long-term investment potential. However, earnings at Primary Healthcare Properties could suffer if NHS policy changes. But as Britain’s elderly population rapidly grows, so is demand for everyday medical services. This is a trend that is set to intensify and boost footfall at doctors’ surgeries.

Now City analysts expect PHP to pay its planned full-year dividend of 6.7p per share in 2023. And they reckon total rewards will increase to 6.9p next year.

This pushes a 6.7% dividend yield for this year to 6.9% for 2024. Both readings beat the 3.3% average for FTSE 250 shares by a large margin.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Spire Healthcare

Admittedly, dividend yields at Spire Healthcare (LSE:SPI) sit well below the broader FTSE 250 average. For 2023 and 2024 , these sit at 1.3% and 1.6% for the medical services provider.

Yet as those increasing yields show, Spire — like Primary Health Properties — is a great share to own for dividend growth.

The business axed dividends during the height of the Covid-19 crisis. And they might be cancelled again if another public health emergency occurs in the future.

But on balance I think dividends will grow strongly over the long term as demand for private healthcare soars.

Huge underinvestment in the NHS has led to record waiting lists. And so people are either using medical insurance or paying themselves for treatment. Indeed, Spire’s revenues rose 8.3% and operating profit jumped 9.7% in 2022 as the number of patients using its services soared.

The British Medical Association has said that “it will take time and investment to put the NHS back on a sustainable footing”. In this climate, private healthcare providers can look forward to strong and sustained profits growth.

City analysts certainly expect Spire to report excellent profits growth. Bottom-line rises of 48% and 61% are forecast for 2023 and 2024 alone. This explains why dividends are also predicted to leap higher.

Today, Spire trades on a forward price-to-earnings growth (PEG) ratio of just 0.7. To recap, any reading below 1.0 suggests that a stock is undervalued.

At these prices, I’m considering topping up my existing holdings in the business. I think it could generate terrific capital appreciation and dividend income over the next decade.