Aston Martin (LSE: AML) shares have been on a tear this year, rising 49% year to date. But the bad news is that they’re still down 94% since floating in October 2018.

Meanwhile, Ferrari (NYSE: RACE) shares are up 380% in less than eight years.

Unfortunately I can’t afford a luxury sports car. But I can stretch to investing in the shares of each company. I already hold Ferrari shares, so should I buy more or opt for the British firm?

Should you invest £1,000 in B&M right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if B&M made the list?

High aspirations

Aston Martin is attempting to emulate Ferrari, with higher vehicle prices and margins ultimately leading to increasing profitability. Last year, it even hired Amedeo Felisa, the former chief executive of the Italian carmaker, as its new boss.

And the early signs of pursuing this ultra-luxury strategy are encouraging.

First, the company reported strong demand across its portfolio last year. There was a record total average selling price of more than £200k, with its DBX model representing over 50% of volumes. This SUV is well and truly in the ultra-luxury market, and the new DBX 707 will have a starting price of £190,000.

And the firm’s gross margin increased to 33% from 31%, which reflects improved pricing. Plus a new range of sports cars is being launched this year.

Finally, recent success on the Formula 1 track is great marketing for the Aston Martin brand. It said 60% of customers were new last year, helped by its association with the sport.

However, the firm still made an annual £495m loss before tax. Its net debt stands at an eye-watering £766m and remains a major drag on its financials. Aston’s debt is an ever-present concern.

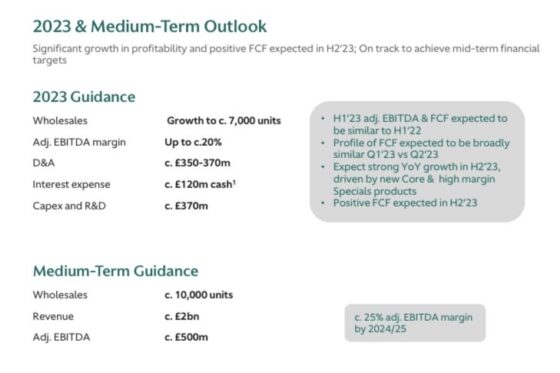

Here are the financial targets set out by management.

The Prancing Horse

Enzo Ferrari, founder of the automobile marque that bears his name, famously said: “Ferrari will always deliver one car less than the market demand.”

In reality, it manufactures thousands less than it could sell. This scarcity drives even more demand, and continues to give the firm almost unlimited pricing power.

And today, this leaves its financials in similar shape to its engines — in roaring good health.

The company refuses point-blank to devalue its brand in any way. It won’t even label its new Purosangue model — the first ever four-door Ferrari — an SUV because of its mass-market connotations.

Purosangue translates as ‘thoroughbred’ in Italian. And just to prove the point, the company put a V12 engine inside and slapped a £313,000 starting price on it.

My move

With a forward price-to-earnings (P/E) ratio of 40, Ferrari stock is priced like one of its supercars — very luxuriously. Even Kering, the parent company of Gucci, trades on a current earnings multiple of just 20. Much less than Ferrari.

So I see this stock as overvalued at the moment. I want to buy more but will wait before adding to my position.

Meanwhile, it’s hard to value Aston Martin stock as the firm’s still loss-making. It’s pretty much guesswork at this point. However, its market cap of £1.62bn is very low when compared to its £1.38bn in annual sales.

I want to see more evidence of improving financials before I’ll buy the stock. It remains on my watchlist though, as I’m intrigued by its turnaround.