I have no intention of owning only three stocks. That’s because diversification helps me sleep soundly at night.

That said, I think it’s a useful exercise to ponder which select few shares I’d own, if I had to choose. It makes me focus on what I consider to be absolute quality.

So, here’s my three stocks.

Going for value

For my first pick, I’m going with Warren Buffett. Or, to be more exact, his holding company Berkshire Hathaway (NYSE:BRK.A)(NYSE:BRK.B).

Firstly, this stock would give me incredible diversification. That’s because Berkshire owns some 65 companies across many industries, including insurance giant GEICO and See’s Candies.

It also has positions in around 50 stocks, including massive stakes in Apple and Bank of America. And it owns 400m shares of Coca-Cola, worth about $25bn today.

Plus, the company was sitting on $129bn of cash at the end of 2022. This massive cash pile gives it enormous scope to buy more shares or make acquisitions.

Finally, I like that the stock tends to perform well in troubled markets. For instance, the S&P 500 is basically flat over the last two years, while Berkshire stock has risen 18.5%.

The flip side to this is that the shares could temporarily underperform if growth stocks came back into vogue.

Going cashless

The second stock I’d buy is Visa, which is also owned by Buffett. Its card network facilitates electronic transactions between consumers and retailers in more than 200 countries.

It’s one of the most stable businesses around, reflected in an operating margin that rarely fluctuates outside of the 62%-66% range.

Today, most transactions in the world are still cash-based. So the runway of growth still ahead of the firm seems enormous to me.

Some see cryptocurrencies as a threat to Visa, as such peer-to-peer payments could bypass its network. But I highly doubt the company is threatened. In fact, it’s just started connecting crypto and blockchain networks to its own global payment network.

Going for growth

Thirdly, I’d go with Scottish Mortgage Investment Trust (LSE: SMT). It was launched in 1909 to provide funding to rubber plantations in Malaya amid soaring demand for tyres for the newly created auto industry.

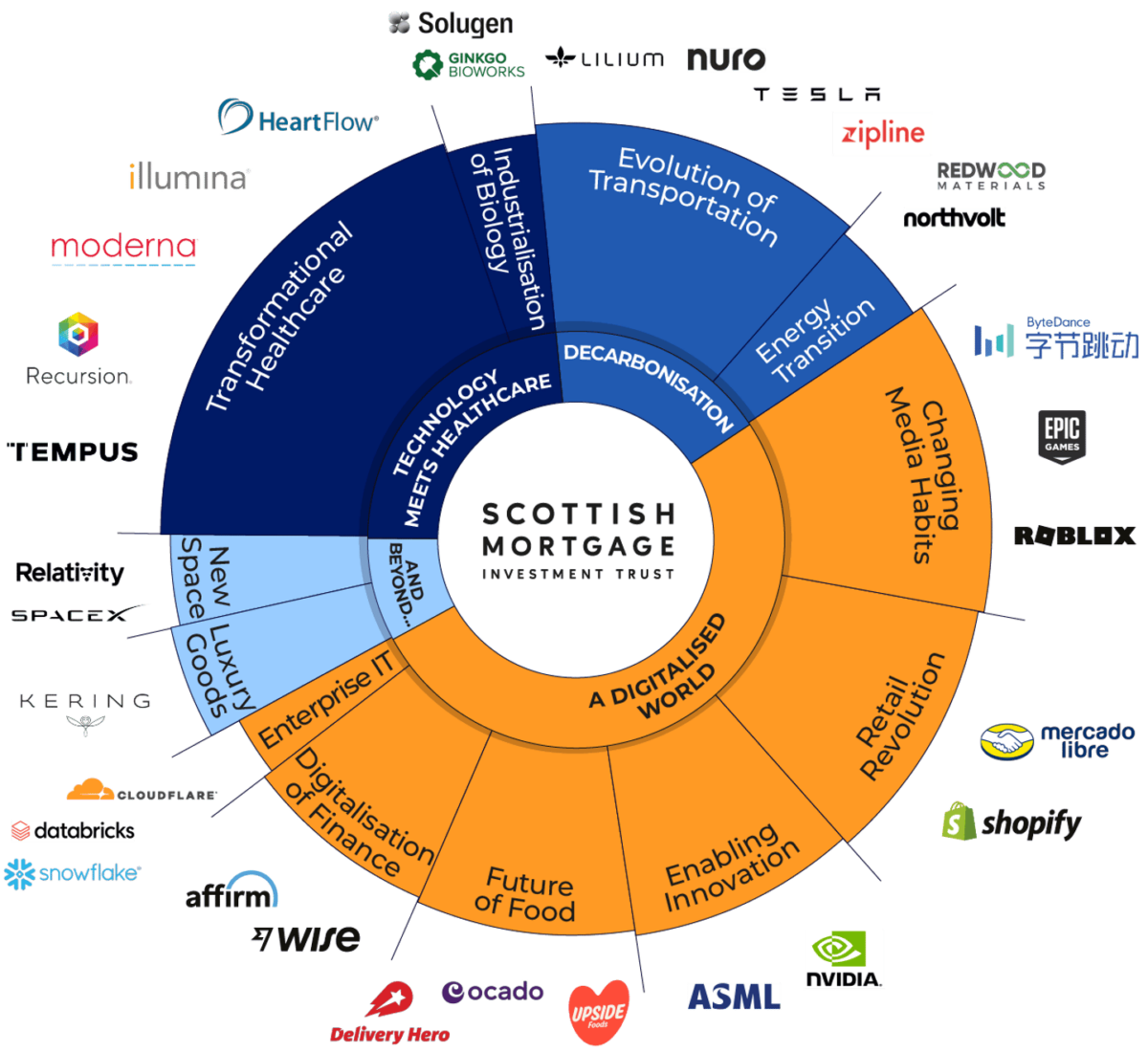

A quick look at the portfolio today shows me I’d be investing in a quite different beast from my previous picks.

Indeed, I’d hope the shares would work somewhat inversely to Berkshire. That is, by outperforming during bull markets and underperforming in times of uncertainty.

Importantly, the trust would also give me exposure to the world’s fastest-growing private companies. These include battery maker Northvolt — with its stated aim to “make oil history” — and SpaceX, which is revolutionising access to space with the ultimate goal of inhabiting other planets.

I’d find it hard to get access to such companies anywhere else — and certainty not for an ongoing charge of 0.32%.

That said, investing in private companies can create problems. Currently, the market fears that the present valuations of the trust’s private holdings may have much further to fall.

As a result, the shares now trade at a massive 20.9% discount to the net asset value (NAV) of the trust.

However, I think this provides some margin of safety for new long-term investors today.