Tesco (LSE:TSCO) shares have done well since the start of the year. The stock is up 15%, comfortably beating the FTSE 100. Having said that, could a change to its renowned Clubcard programme affect the conglomerate’s bottom line?

Minus points

Kantar’s latest retail report states that loyalty cards are a key driver in attracting business within the grocery industry. Therefore, it doesn’t help when Britain’s biggest supermarket is planning to reduce the value of its Clubcard points. This could put a dent in Tesco’s revenue, and subsequently, its share price.

What’s more, the retail giant has seen its customer satisfaction fall in recent times. According to Which?, ratings for the company have tumbled to the bottom half of the top 10 grocers in the country — not the best look during a cost-of-living crisis.

Time to cash out?

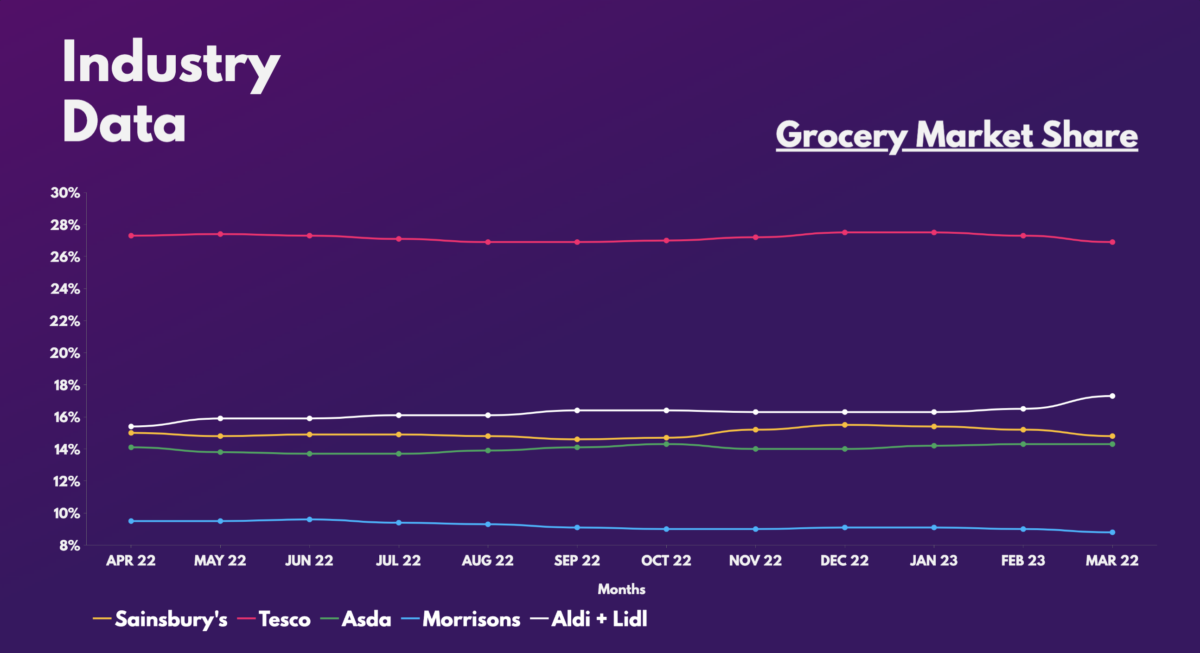

As a result, it’s been no surprise to see Tesco losing a bit of its dominant market share in March. In fact, it’s the lowest share the firm has held since October 2020, as customers flock to budget chains like Aldi and Lidl.

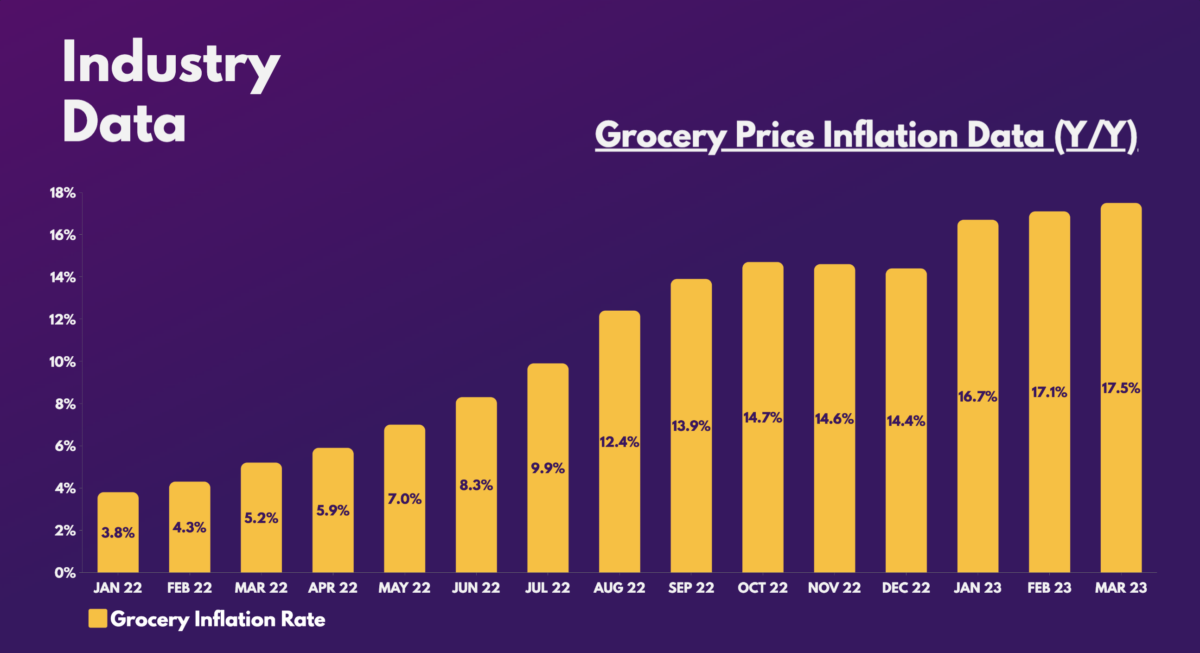

So, is it time to cash out on Tesco shares? Well, there’s certainly a case to be made as things aren’t getting better either. Food inflation continues to rip higher, and prices are expected to continue climbing in the coming months as sugar prices rise.

That said, it would be foolish to rule out Tesco so soon as customers are fickle when it comes to groceries. The latest Kantar data states that customers visit three or more grocers on average per month. And given Tesco’s massive appeal, its ability to attract customers shouldn’t be discounted.

More importantly, food inflation is forecast to peak in the second half of the year as the declines in wholesale food and energy prices flow through to groceries. When this does happen, Tesco could see its market share tick up again, as customers return to their favourite labels.

Should I buy Tesco shares?

There’s no doubt that Tesco is one of the most stable blue-chip shares to invest in. It’s a market leader and even pays a healthy dividend yield of 4.4%. Nonetheless, with no real long-term catalyst to grow its earnings exponentially, I don’t think its elevated valuation multiples, like its P/E ratio are justifiable.

| Metrics | Tesco | Industry Average |

|---|---|---|

| Price-to-book (P/B) ratio | 1.4 | 1.4 |

| Price-to-sales (P/S) ratio | 0.3 | 0.3 |

| Price-to-earnings (P/E) ratio | 20.2 | 12.7 |

| Forward price-to-sales (FP/S) ratio | 0.3 | 0.4 |

| Forward price-to-earnings (FP/E) ratio | 14.0 | 13.0 |

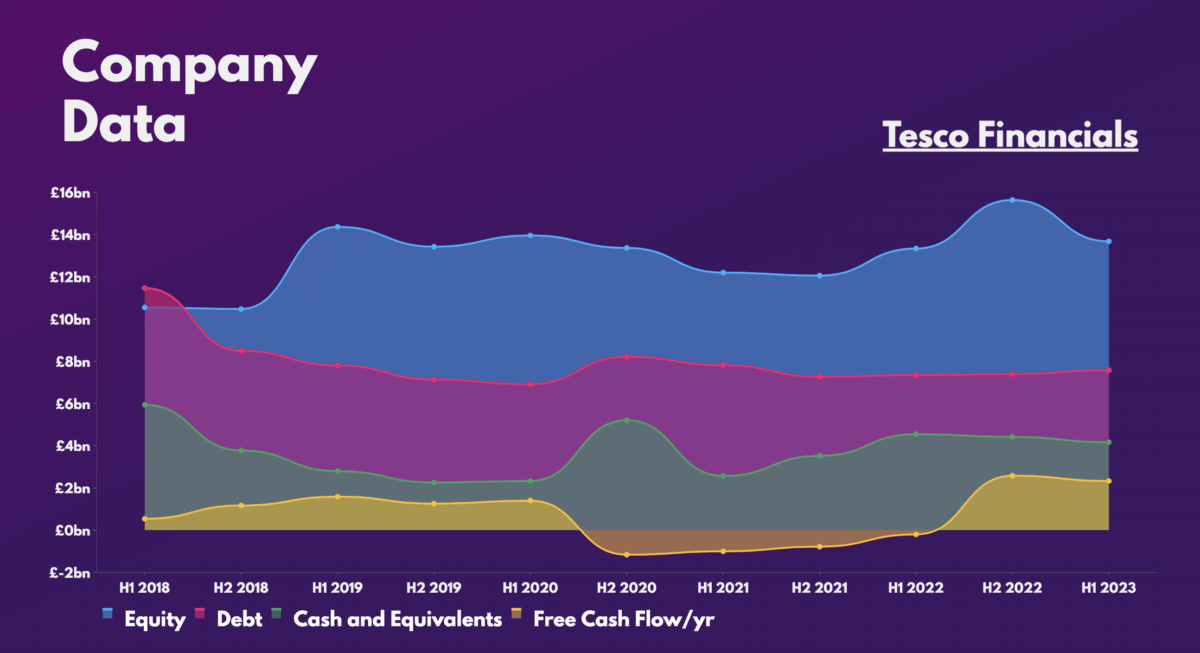

Additionally, the group’s balance sheet isn’t the best either. Although high levels of debt are expected for retailers, the low free cash low and insufficient cash to cover debt isn’t ideal.

Ultimately, although the recent Clubcard changes may affect customer footfall in the short term, I believe the scheme’s appeal remains strong. That’s because, lucrative discounts are the card’s unique selling point, and is yet to be rivalled by other supermarkets on a similar scale.

As such, I feel that Tesco to retain its dominance and for its share price to rise in the long term. After all, Shore Capital, Jefferies, and Morgan Stanley all have ‘buy’ ratings on the stock, with an average target price of £3.08. This presents a potential growth rate of 17% from current levels.

Nevertheless, there are other retailers with better growth prospects, more robust financials, and trading on cheaper valuations that I’d rather invest in. Thus, I won’t be buying Tesco stock today.