Having jumped as high as 80% from their October lows, IAG (LSE:IAG) shares had been flying high. However, the stock lost some momentum recently, dropping 20% since early February. But given the bright prospects for the travel industry, could this dip be a buying opportunity for me?

A heavy transaction

The group’s latest earnings report would have put a smile on any investor’s face, I feel. Capacity continued to recover along with passenger numbers. Meanwhile, operating profits soared by €4.2bn from a year before. Nonetheless, despite the blowout numbers, IAG shares have been on a steady decline.

This can be attributed to the weakness of the FTSE 100 overall, but I imagine investors weren’t too happy with the elephant in the room either — the Air Europa deal, which has left many worried for several reasons.

IAG already has a 20% stake in the Spanish company. However, management is now opting to buy the remaining 80% and consolidate it for €400m. This would normally be good news given the huge earnings potential for IAG, but investors seem to think otherwise, dumping their shares instead.

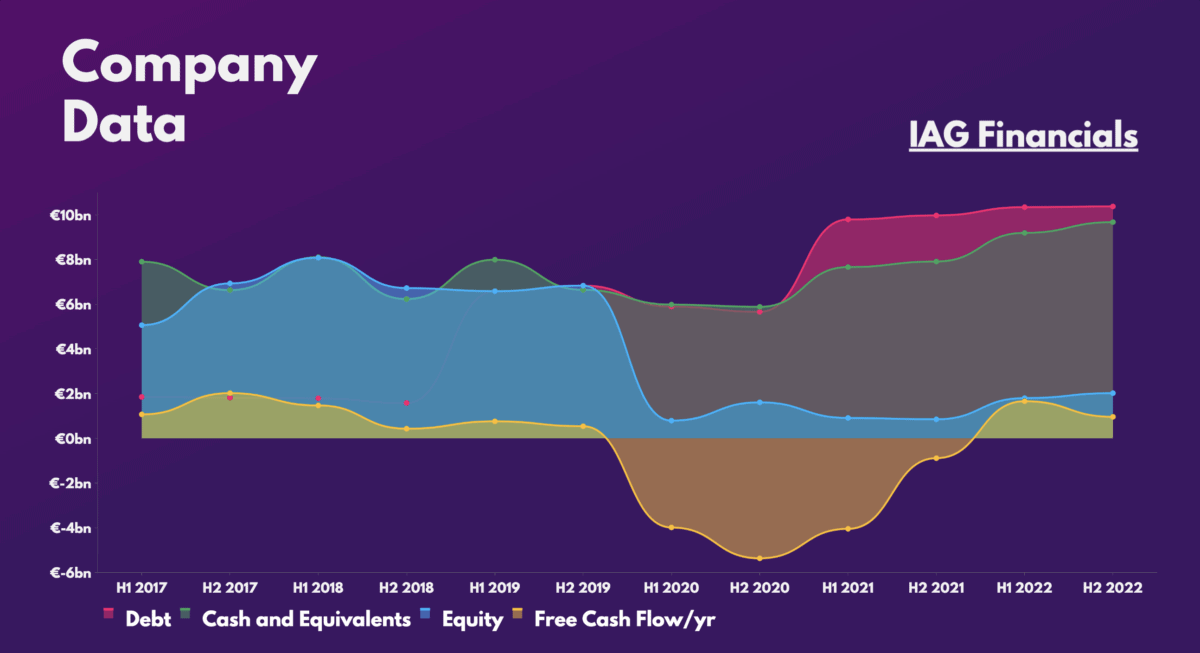

This is most probably due to the already fragile state of the conglomerate’s balance sheet. And with the deal pending regulatory approval, IAG may have to pay a penalty if it fails. Nevertheless, even if it goes through, the acquisition may further delay the firm’s return to dividend payments.

Strike turbulence

To further sour sentiment, IAG has said it expects to face some further short-term turbulence. Staff at Heathrow Airport are anticipated to strike during the busy Easter holidays, forcing IAG’s British Airways to cancel 32 flights a day.

While this shouldn’t impact the airline’s bottom line too drastically, it’s the potential for future industrial action that has shareholders worried. And as long as inflation remains elevated, disruptions are more likely than not to linger.

Then there’s the concern surrounding fuel costs. Jet fuel prices have come down substantially from their highs. Even so, they’re still high and will continue to eat into IAG’s profits. After all, United Airlines recently downgraded its outlook for Q1 due to such higher costs.

Can IAG shares soar again?

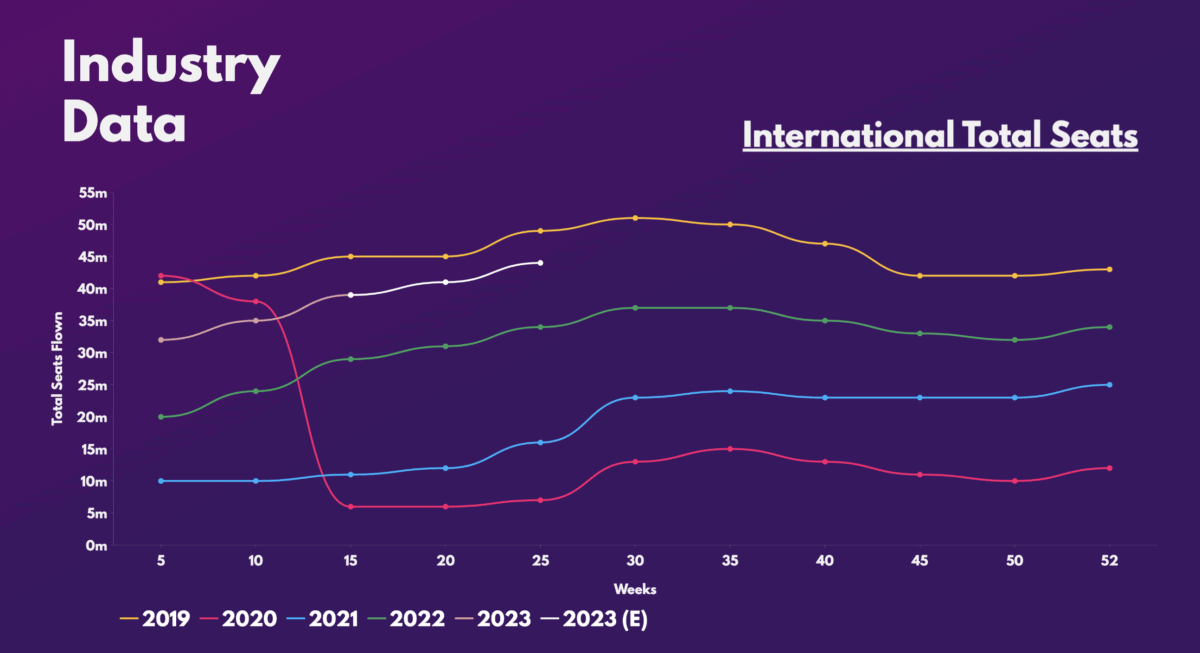

Although the recent drop in the IAG share price may look like travel demand is starting to cool off, industry data indicates otherwise.

International seats flown continue to recover towards pre-pandemic levels, and are projected to keep growing. This sentiment is backed by Booking CEO Glenn Fogel, who said that the short-term outlook for the travel sector looks bright.

Therefore, I’m confident that IAG shares will eventually pick back up and rise again. That said, although its valuation multiples look cheap, they’re still above the industry average on most fronts, especially when comparing them to their budget and US counterparts.

| Metrics | IAG | Industry Average |

|---|---|---|

| Price-to-sales (P/S) ratio | 0.3 | 0.8 |

| Price-to-earnings (P/E) ratio | 18.3 | 15.0 |

| Forward price-to-sales (FP/S) ratio | 0.3 | 0.3 |

| Forward price-to-earnings (FP/E) ratio | 8.7 | 7.0 |

And despite brokers UBS, Deutsche, and Liberium rating the stock a ‘buy’ with an average target price of £1.68, there are other cheaper airline stocks with better financials and higher price targets that I’d rather invest in. As such, I won’t be buying IAG shares today.