Bank stocks have wiped out their gains from earlier this year. This stems from the collapse of one of the largest US banks, Silicon Valley Bank (SVB). This sparked contagion fears about other banks and whether they’re actually safe investments. So, have I made a mistake investing in bank shares?

Losing credibility

Due to the inherently different business model of banks, compared to other companies, investing in them can be rather risky. That’s because they operate on leverage. In other words, banks use their customers’ deposits to finance their assets, such as loans and investments, and earn profits from them.

This is risky because in the event that those assets lose their value, and customers come asking for their money, the bank may have to sell those assets at a loss. And if enough of those assets are liquidated, the bank may collapse, as was the case with SVB and Signature Bank earlier this month.

As such, banking as an industry is only as strong as the customers’ confidence. Once that’s lost, banks can very quickly and easily plunge, no matter how strong their fundamentals are.

Thus, it’s no surprise to see the recent sell-off in bank shares. Investors fear that the dominos won’t stop falling, with bigger banks to come next — and Credit Suisse‘s recent demise has only worsened the sentiment.

High risk, low reward?

There is a notion that taking high risks has the potential to produce high rewards. However, that’s not always the case, and banks are a prime example of this. Even the FTSE 100‘s best-performing bank stock (Lloyds) comes nowhere close to replicating the success of the S&P 500 over the past five years.

This is because bank shares tend to be cyclical in nature, meaning they only perform well when certain economic and trading conditions are right.

Lenders tend to do better in a thriving economy and when interest rates are higher. But with a slow-growing economy and interest rates staying at almost zero over the past decade, it’s no wonder Lloyds shares have stayed flat.

Therefore, if rates remain in the goldilocks zone (2%-3%) over the medium to long term, bank shares could start riding upwards. This is when interest rates are high enough to generate interest income, and low enough to spur economic growth.

Are bank shares worth a buy?

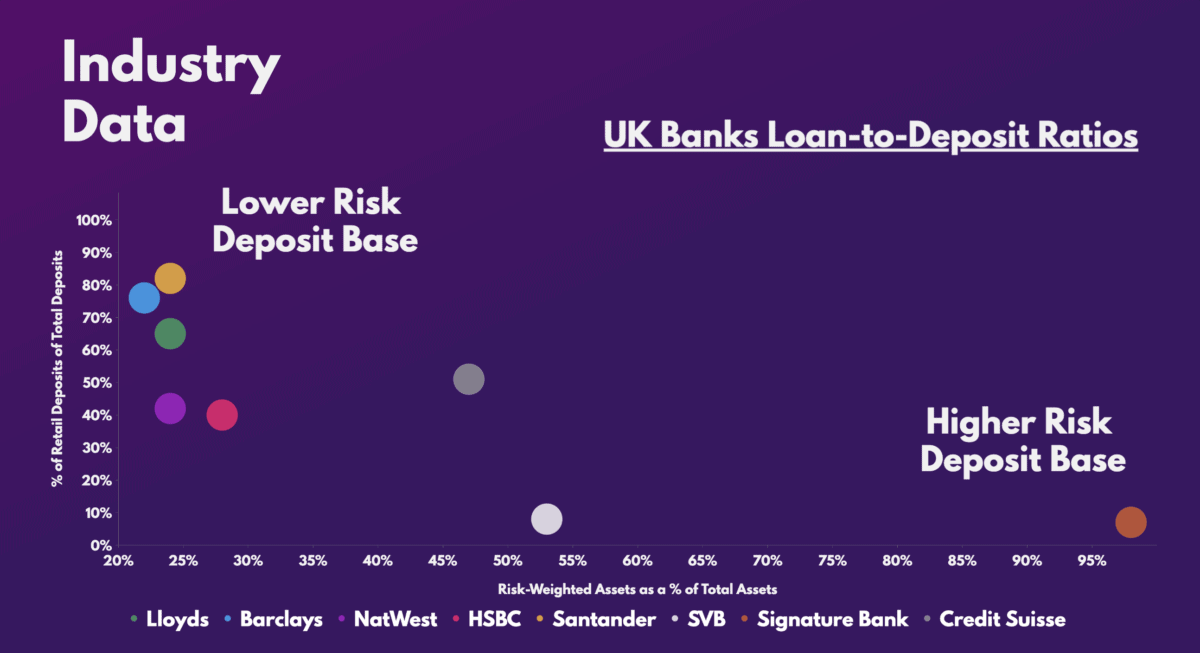

That said, it doesn’t change the fact that banks are still risky investments. Their financials are complex, and their balance sheets may have many unrealised losses that aren’t disclosed. For that reason, it’s important to invest in banks with strong liquidity and low-risk deposit bases, such as the ones in the UK.

This is due to the fact that UK banks are more strictly regulated. They hold a significantly lower number of risk-weighted assets, and a larger chunk of customers’ deposits are insured, by the Financial Services Compensation Scheme. This means a bank run is less likely to occur.

Although bank shares haven’t always been my cup of tea, I think the recent sell-off has presented buying opportunities I can’t ignore.

Most of their valuation multiples are at decade lows, and given the margin of safety, the risk-reward proposition is certainly attractive. Hence, I don’t think investing in bank shares have been a mistake — at least not yet — and is why I’ll be looking to add more to my Lloyds position and buy names like Barclays.

| Metrics | Lloyds | Barclays | NatWest | HSBC | Santander | Industry average |

|---|---|---|---|---|---|---|

| Price-to-book (P/B) ratio | 0.6 | 0.3 | 0.7 | 0.7 | 0.6 | 0.7 |

| Price-to-earnings (P/E) ratio | 6.1 | 4.3 | 7.0 | 8.9 | 6.0 | 9.0 |

| Forward price-to-earnings (FP/E) ratio | 6.5 | 4.5 | 6.0 | 5.4 | 5.7 | 5.6 |