With increasing hours of daylight and — theoretically — better weather, Brits’ thoughts inevitably turn to holidays. And there are a host of travel stocks listed in the UK that could benefit from holidaymakers’ dreams and desires!

So we asked two Fools to name their favourite shares in the sector right now, and why. As ever, note that returns are not guaranteed and past performance is not a reliable indicator of future results.

easyJet has more room to climb

By John Choong: One of the FTSE’s biggest winners so far this year has been easyJet (LSE:EZJ). The shares have risen by an impressive 50% and are up 75% from their October lows. And while the consensus is to buy low and sell high, easyJet shares are still nowhere near their pre-pandemic highs. In fact, they’re still down by 60% — which is why I still see its current share price as a buying opportunity.

Should you invest £1,000 in Serica Energy Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Serica Energy Plc made the list?

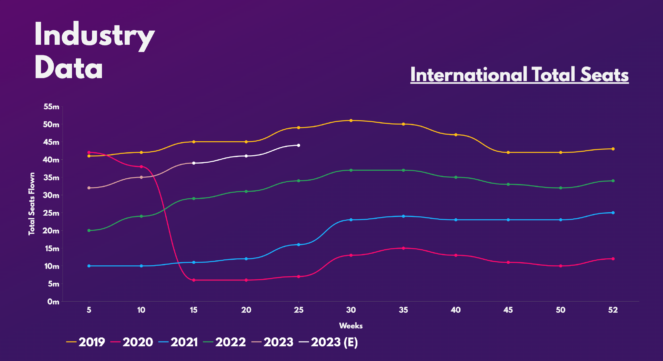

The hot momentum that fuelled the steep climb for travel stocks earlier this year may have dissipated. However, investors shouldn’t take this as a sign of waning demand. In easyJet’s latest trading update, CEO Johan Lundgren cited strong bookings momentum going into the summer, and expects the budget airline’s capacity to continue growing throughout 2023, with a return to pre-Covid levels by September.

More excitingly, the company’s up and coming Holidays segment (where customers can book packages), is proving to be a huge driver for revenue growth and should help expand the firm’s margins. And with fuel costs also expected to decline this year, this should help easyJet’s earnings, which are forecast to come in at 27.9p per share, an increase of almost 250%. That said, there’s always the risk that fuel prices climb back up or a deeper-than-anticipated recession hits, which could dampen forward bookings, and push the stock back down.

And despite its shares having risen drastically this year, the stock’s valuation multiples remain cheap and comfortably below the industry’s average.

| Metrics | easyJet | Industry Average |

| P/B value | 1.5 | 1.8 |

| P/S ratio | 0.6 | 0.8 |

| FP/S ratio | 0.5 | 0.7 |

| FP/E ratio | 20.1 | 29.1 |

What’s more, the group has robust financials, which is a tough find for travel stocks, especially after the pandemic. Its balance sheet boasts strong liquidity (£3.64bn) that sufficiently covers debt (£3.20bn) and has positive free cash flow (£246m). Thus, I see easyJet shares as the best FTSE travel stock out there.

John Choong owns shares in easyJet.

Cheap, stable and global: Marriott bounces back

By Mark Tovey. When it comes to travel stocks, I think buying Marriott International (NASDAQ: MAR) is like booking the presidential suite.

The hotel industry provides more consistent revenue streams than the airline industry. Fuel price spikes, cut-throat competition and even volcanic eruptions can leave airline operators’ profits up in the air.

By contrast, Marriott’s globally diversified business has unflappable foundations. The hotelier operates nearly 8,300 properties under 30 brands spanning 138 countries and territories.

With a price-to-earnings (P/E) ratio of 20, I think Marriott looks cheap considering it is exposed to high-growth markets in the developing world. In 2022, the company added more than 65,000 rooms globally, and its worldwide development pipeline totalled over 3,000 properties and more than 496,000 rooms.

Moreover, Marriott has bounced back from pandemic-era shutdowns. Fourth quarter revenue per available room increased 4.6% worldwide in 2022 compared with the 2019 fourth quarter – and that’s after adjusting for inflation.

My main concern about investing in Marriott is that interest-rate rises around the world are weighing on real estate prices. That’s because, like any asset, hotels are valued in terms of the rents they generate over time. With higher interest rates, the opportunity cost of buying a hotel – and not for example a government bond – increases. Therefore, the hotel’s price must fall to restore equilibrium.

However, taking a longer-term view, higher interest rates also make obtaining loans for capital-intensive projects less possible. That would in turn suggest fewer hotels being built, and less competition for Marriott.

I plan to buy shares in Marriott when I next have some spare cash.

Mark Tovey does not have a position in Marriott International.