Lloyds (LSE:LLOY) shares started the year on a very positive note, rising over 14% by mid-February. However, the black horse bank has since given up the bulk of those gains. Why?

The primary reason behind the share price fall is turmoil that started in the US with the collapse of Silicon Valley Bank. Soon after, attention quickly turned to Switzerland when Credit Suisse also reached a crisis point. Now the focus is on Germany as concerns intensify regarding Deutsche Bank‘s involvement in the credit-default swaps market.

So, will FTSE 100 constituent Lloyds be next if contagion fears spread to the UK? Or is the sell-off in Lloyds shares short-sighted, making today a good buying opportunity? Here’s my take.

Solid fundamentals

Despite a gloomy backdrop, I think Lloyds’ recent results reveal plenty of reasons to be confident in the banking group’s prospects. The pro forma CET1 ratio, which measures a bank’s capital against its risk-weighted assets, is a healthy 14.1%.

Although lower than 2021’s figure of 16.3%, the ratio is still well above the bank’s 12.5% target. In my view, it’s sufficiently robust to ensure Lloyds’ ability to withstand financial distress.

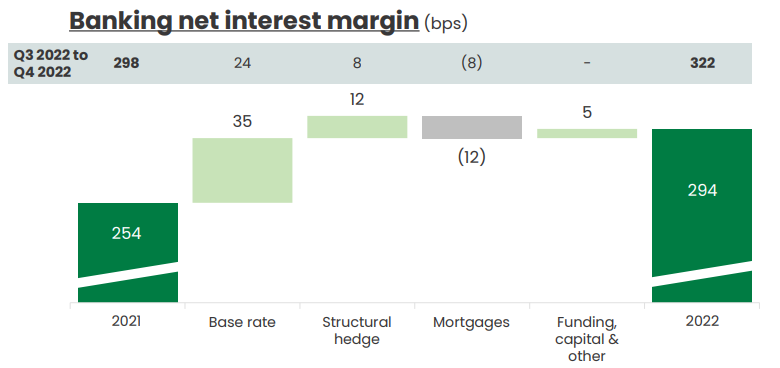

What’s more, the group’s net income rose 14% in FY22 to hit £18bn. Underlying profit before impairment charges also increased by 46%. In addition, the net interest margin continues to expand, aided by tightening monetary policy.

I’m also encouraged by CEO Charlie Nunn’s focus on attracting affluent customers — essentially anyone earning more than £75,000 or with the same amount to invest. Increasing the number of customers with this kind of financial profile has the potential to add significant shareholder value.

With ambitions for an expanded offering spanning tiered savings, flexible lending options, and bespoke benefits, I’m excited to see whether the group can successfully achieve its aim over the coming years.

Macro risks

In my view, the biggest risks facing the Lloyds share price are broad macro risks rather than company-specific concerns. After all, the stock market is renowned for its emotional investing cycles and there’s a chance that Lloyds could be caught up in big sell-offs affecting the entire banking sector.

Although Bank of England governor Andrew Bailey sought to calm nerves by saying the current situation is “very different” to the 2007-08 financial crisis, he did concede the regulator was in a period of “very heightened tension and alertness”. This suggests we’re not out of the woods yet.

I believe Lloyds is a better-run bank than the various casualties of the crisis so far. After all, the group’s liquidity coverage and asset portfolio both look healthy. Nonetheless, the possibility of further market panic is a very real one, especially if more big lenders go under.

A cheap stock to buy?

I already own Lloyds shares. My average traded price is not dissimilar to where the shares are today. Due to a 5% dividend yield and encouraging financial results on top, I’ll be holding my position.

However, heightened macro risks make me reluctant to buy more at this stage. I don’t think the share price is sufficiently cheap today to justify adding to my position. Instead, I’ll sit tight and see how this rapidly evolving situation develops.