Investors who seek passive income usually focus most of their attention in dividend stocks. With a current yield of 5.2%, Barclays (LSE:BARC) shares are great candidates. So, what dividends are analysts forecasting for this year and the next?

Profits to fly?

The recent turmoil in the banking sector has led to numerous drops among bank stocks. Barclays shares have been no exception, dropping more than 25% from their 2023 high. Nonetheless, the dip has resulted in a more lucrative dividend yield, and potentially a buying opportunity for me as well.

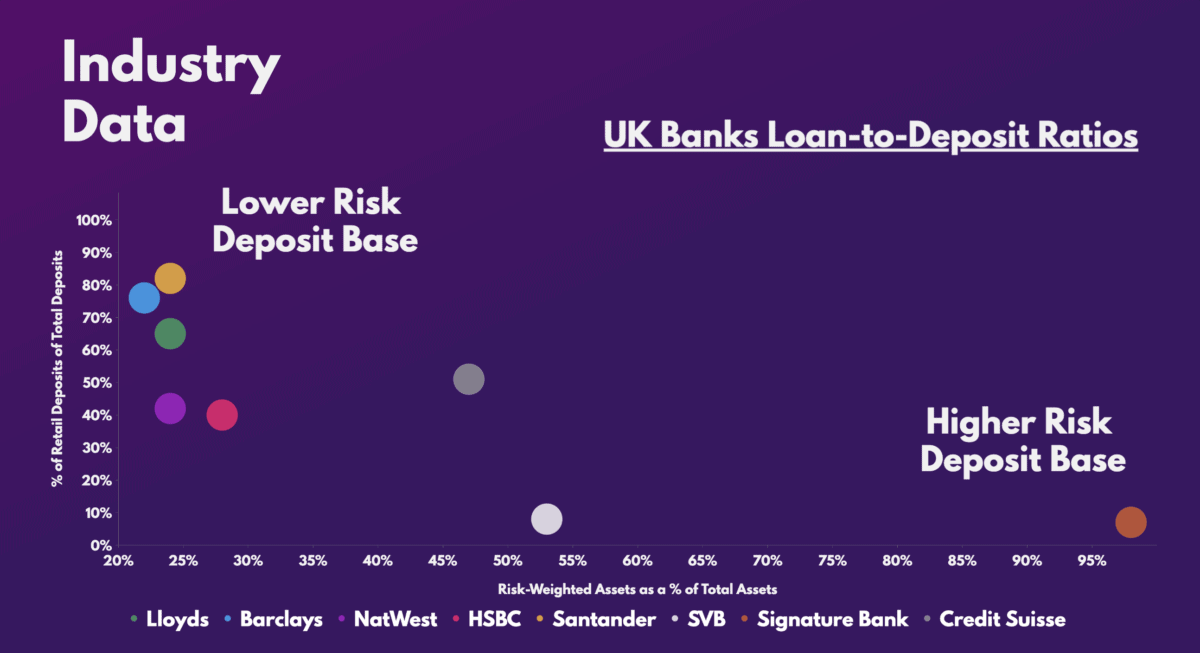

Although fears of a similar issue occurring in the UK can’t be ruled out, Barclays remains one of the better-equipped banks to protect itself from such a scenario. That’s because unlike many of its other peers, the Blue Eagle bank has a lower-risk deposit base.

Should you invest £1,000 in Barclays right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Barclays made the list?

This stems from a lower percentage of risk-weighted assets. More importantly, the bulk of its deposits are from retail customers, meaning that a high number of its funds are insured by the Financial Services Compensation Scheme. This makes Barclays less susceptible to a bank run.

I’d even argue that Barclays shares could be a hidden gem in the current crisis. After all, customers have been withdrawing funds from smaller banks and depositing them into larger institutions. In fact, Barclays reported an uptick in deposit inflows since SVB’s collapse.

More lucratively, the lender expects a positive year ahead. Management is guiding for net interest margins to continue expanding from 2.86% to at least 3.2%. Additionally, it’s also expecting a return on tangible equity (ROTE) of greater than 10%.

Paying dividends

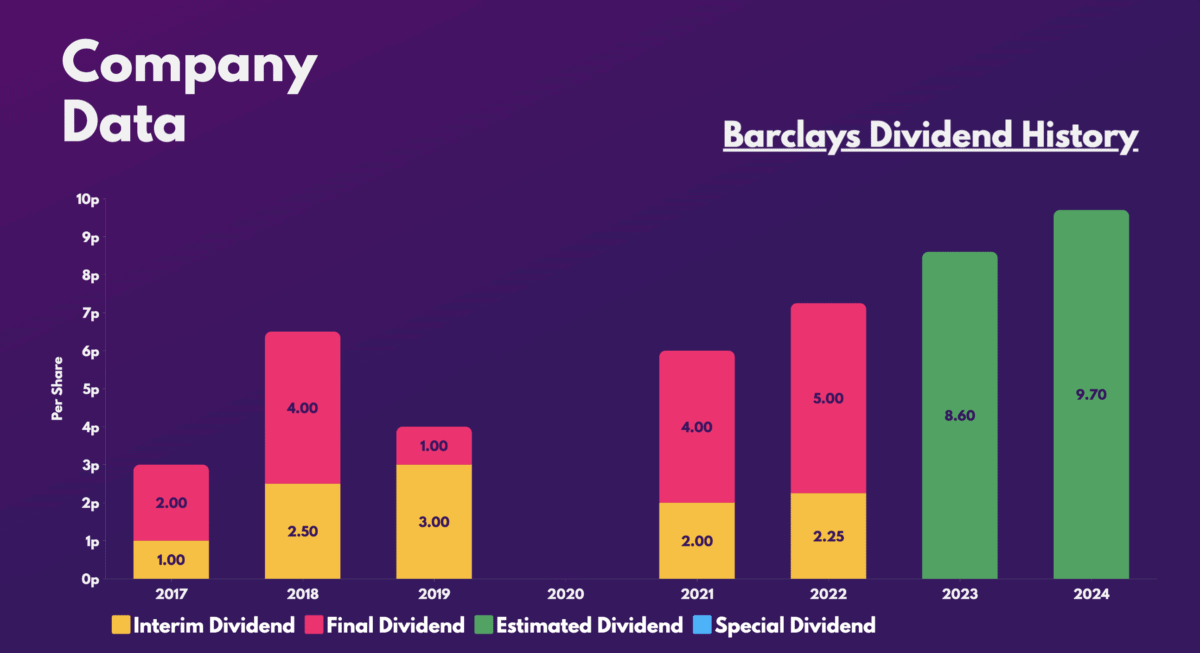

With more promising numbers than last year, Barclays’ basic earnings per share (EPS) should rise in 2023. As a matter of fact, analysts are currently pricing in a rise from 30.1p in 2022, to 32.2p in 2023, and then 35.4p in 2024.

Provided these projections are met, it’s likely that the FTSE 100 stalwart will increase its dividend payments. As such, analysts are forecasting the company to pay a dividend of 8.6p per share in 2023, and then 9.7p per share in 2024. This would amount to a forward yield of 6.1% and 6.9%, respectively.

Should I buy Barclays shares?

What’s more, Barclays stock currently has the lowest valuation multiples among its FTSE rivals. Thus, it’s no surprise to see brokers like JP Morgan, Citi, and UBS with a ‘buy’ rating. And with an average target price of £2.40, this presents a massive potential gain of 71% if I were to buy the shares today.

| Metrics | Barclays | Industry average |

|---|---|---|

| Price-to-book (P/B) ratio | 0.3 | 0.7 |

| Price-to-earnings (P/E) ratio | 4.3 | 9.0 |

| Forward price-to-earnings (FP/E) ratio | 4.5 | 5.6 |

That said, it should go without saying that there are several reasons why Barclays shares are trading so cheaply. These include its exposure to the US market, higher commercial real estate involvement, and numerous litigation cases — all of which could dampen profits substantially.

Nevertheless, I hold the view that the stock is oversold as it trades on multiples that are currently at decade lows. While the risks of bank runs, impairments, and litigation charges shouldn’t be discounted, neither should the bank’s long-term potential. Hence, I’ll be buying the stock in due course.