The FTSE and its constituents are renowned for some surprisingly cheap valuations. And given the recent drops in the stock market, certain shares have become even cheaper. So, here are three cheap stocks with valuations currently trading near decade lows that I’m buying in April.

1. Taylor Wimpey

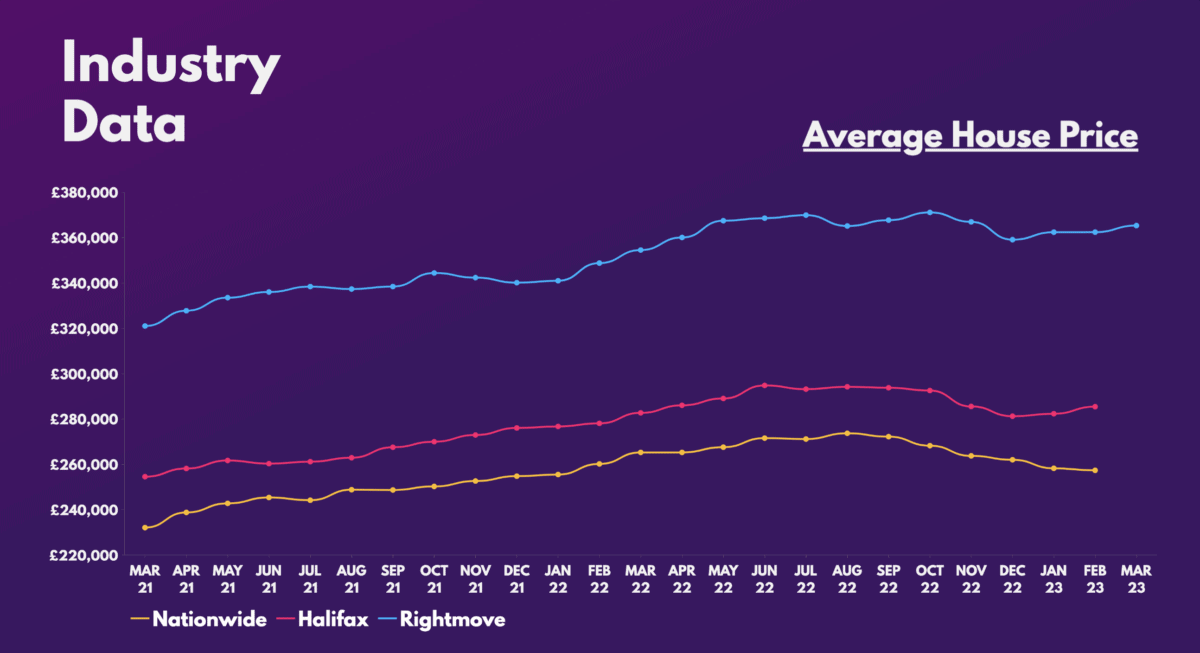

Sky-high inflation, the mini-budget crisis, and soaring mortgage rates have caused the housing market to cool significantly over the past year. Consequently, housebuilder stocks have suffered, and Taylor Wimpey (LSE:TW) shares have been no exception.

That said, the stock has made a remarkable recover from its September lows, jumping 35%. Even so, the shares remain reasonably cheap as the builder’s valuation multiples are below historical averages.

| Metrics | Taylor Wimpey | Industry Average |

|---|---|---|

| Price-to-book (P/B) ratio | 0.9 | 0.9 |

| Price-to-sales (P/S) ratio | 0.9 | 0.8 |

| Price-to-earnings (P/E) ratio | 6.3 | 9.8 |

| Forward price-to-sales (FP/S) ratio | 1.2 | 1.2 |

| Forward price-to-earnings (FP/E) ratio | 12.8 | 10.4 |

With headwinds in the housing market starting to slow down too, now could be a good time to build my position. What’s more, house prices aren’t declining as much as initially anticipated. Provided this trend continues, the developer may even see an earnings surprise.

Additionally, Taylor Wimpey has an immaculate balance sheet, boasting a sublime debt-to-equity ratio of 2%. Pair that with its asset-based dividend policy and an 8% dividend yield, and I don’t see why I shouldn’t buy more shares at these cheap prices.

2. Barclays

Next up is Barclays (LSE:BARC). The hybrid retail and investment bank has been caught up in the recent banking crisis. Therefore, the bank has seen its initial rally earlier this year go into reverse in the past couple of months.

But as Warren Buffett once said, “be greedy when others are fearful”. And given Barclays’ cheap valuation, I think the risk-reward proposition is certainly appealing.

| Metrics | Barclays | Industry average |

|---|---|---|

| Price-to-book (P/B) ratio | 0.3 | 0.7 |

| Price-to-earnings (P/E) ratio | 4.3 | 9.0 |

| Forward price-to-earnings (FP/E) ratio | 4.5 | 5.6 |

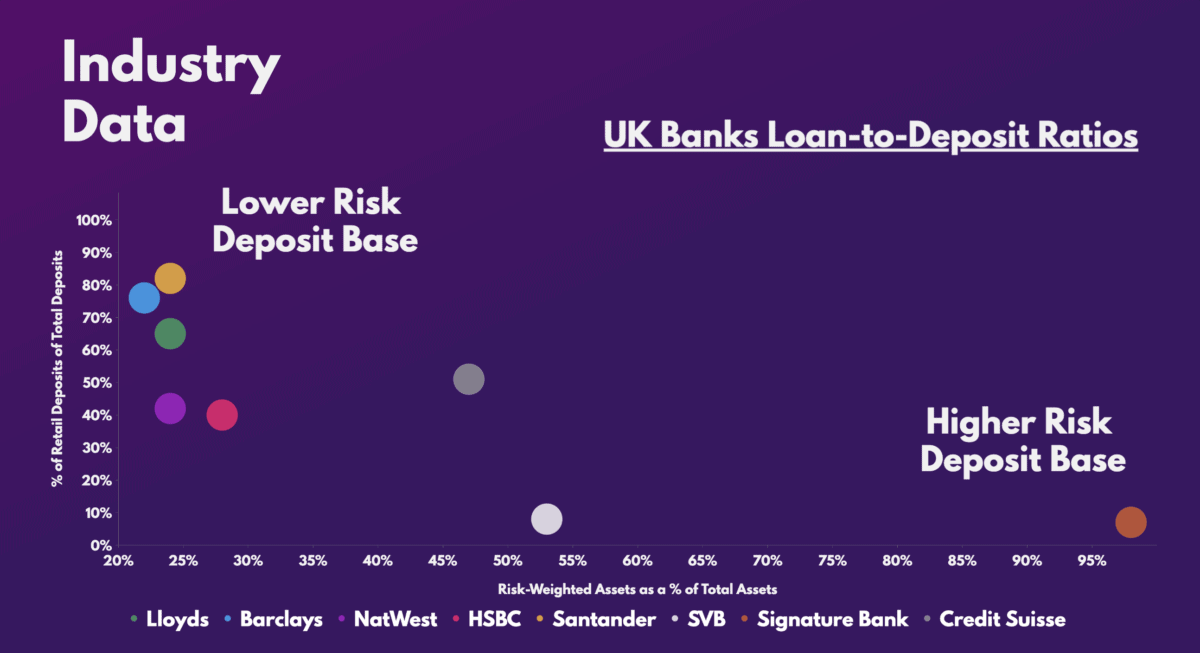

Having said that, investing in banks can be a risky affair given their business model. Nonetheless, the Blue Eagle bank’s lower-risk deposit base puts it in a firm position to protect itself from the turmoil. That’s because a large amount of its deposits are insured, making a bank run less likely.

Therefore, I believe Barclays shares are very cheap at these prices. This can be backed by its average target price of £2.40, meaning that buying the stock today could present me with a potential gain of over 70% — and the last time I checked, Barclays isn’t a growth stock.

3. Marks and Spencer

Finally, a personal favourite of mine, Marks and Spencer (LSE:MKS). Although analysts were quick to write off the stock as inflation started to rear its head, the retailer has stayed resilient throughout.

As such, those who listened to the ‘sell’ calls from brokers may be regretting their decision, as M&S stock has gone on to rally almost 75% from its October lows.

Despite the sharp increase, the shares are still surprisingly cheap as all of its multiples remain comfortably below the industry average. And when considering the tremendous growth prospects lined up for the FTSE 250 stalwart, it’s a screaming buy for me.

| Metrics | Marks and Spencer | Industry average |

|---|---|---|

| Price-to-book (P/B) ratio | 1.0 | 1.4 |

| Price-to-sales (P/S) ratio | 0.3 | 0.3 |

| Price-to-earnings (P/E) ratio | 10.0 | 13.6 |

| Forward price-to-sales (FP/S) ratio | 0.3 | 0.5 |

| Forward price-to-earnings (FP/E) ratio | 10.5 | 12.9 |

A combination of sleeker stores, a tremendously improved clothing line, upgraded omnichannel experience, strong financials, and a potential return to dividends has me beyond excited. After all, these improvements have started to show up in the firm’s latest Christmas update which boasted record sales.

With footfall ticking up, a growing market share in food and clothing, and shopping frequencies increasing despite the cost-of-living crisis, I believe adding Marks and Spencer shares to my basket in April is one of the better investing decisions I can make.