The last few months have seen IAG (LSE: IAG) shares take off. I could’ve picked up a share for less than a pound in October, before a 48% climb to the present price of 140p. And recent news means the sky might just be the limit for the airline company.

A steep descent

The three-year anniversary of the first COVID lockdown passed this month, and the devastated travel industry still hasn’t really recovered.

I’m glad I didn’t hold shares in IAG as they nosedived from £4.57 down to 96p in the early days of the pandemic.

Should you invest £1,000 in IAG right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if IAG made the list?

And years later, despite a battered share price and boasting the flag carriers of three European nations in British Airways, Aer Lingus, and Iberia, it’s hard for me to see the stock as a must-buy.

Even with COVID out of the picture, problems like rising fuel costs and a cost-of-living crisis kept shares grounded below £1 late last year.

A first-class earnings call

In spite of these challenges, the tide began to turn for the company starting with a first-class earnings call in September that saw revenue and profits approach 2019 numbers.

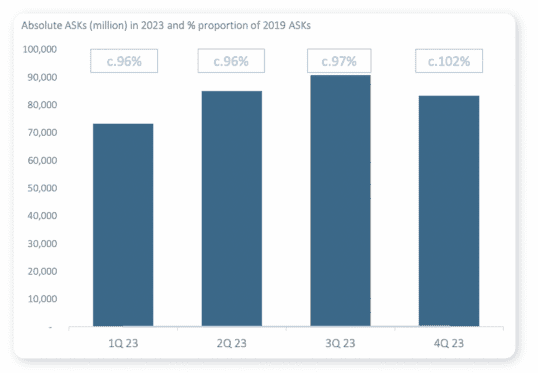

The good financials were driven by recovering passenger numbers. Full-year 2022 reached 78% of 2019 passenger numbers with Q4 reaching 87%. And the company’s own data shows ASKs (available seat kilometres) should surpass 2019 figures by the end of the upcoming year.

I wasn’t surprised to see the markets react positively to this news, and the IAG share price shot up 33% in the last six months.

And with the CEO optimistic about returning to “pre-COVID levels of profit” and a share price still 70% below its pre-pandemic high, I’m tempted to add some shares myself. There are reasons to be cautious, though.

Wider risks

Last week’s unexpected announcement that inflation remained high at 10.4% for February was a huge blow. I’m not sure those ‘back to normal’ travel figures are guaranteed if inflation continues to outpace wages.

And the airline group didn’t come through the pandemic unscathed. Like many firms, the company had to build up debt to keep the lights on. In IAG’s case, it jumped from €6bn in 2019 to around €11bn. That might hurt future profitability and returns I’d get from owning the stock, such as dividends.

Speaking of which, dividends are not being paid out at the moment and haven’t been since the COVID crisis. A lack of payouts means I’d have to hope the share price goes up for me to see any returns.

If I did decide to open a position, I could see it paying off well if headwinds like a potential recession or cost-of-living issues turn out to be less serious. But those risks make me think that IAG may have reached maximum altitude for the time being.