Apple (NASDAQ:AAPL) stock has been one of the best stocks to own for monumental gains over the years — and Warren Buffett would be glad to second that. So, can the blue-chip share still replicate its former success and give me the opportunity to grow my wealth exponentially for years to come?

Fruitful returns

With a return of almost 900%, Apple’s 10-year return easily trumps the S&P 500 by a huge margin. Hence, it’s no surprise to see Berkshire Hathaway having Apple stock as its biggest holding.

It’s no coincidence why either. The Cupertino-based company is renowned for many strong traits. These include a deep economic moat, strong pricing power, high margins, and good management — all of which have resulted in high returns on assets (27%), equity (54%), and capital employed (156%).

Should you invest £1,000 in Apple right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Apple made the list?

Making blockbuster moves

Nonetheless, this hasn’t stopped bears from expressing their concerns over Apple’s potential growth in the future. The company’s most recent earnings show that growth is starting to taper off, with critics pointing towards supply chain issues and a lack of innovation in its recent products.

All of these are valid concerns. Even so, it should go without saying that Apple stock still has plenty of potential to increase in value.

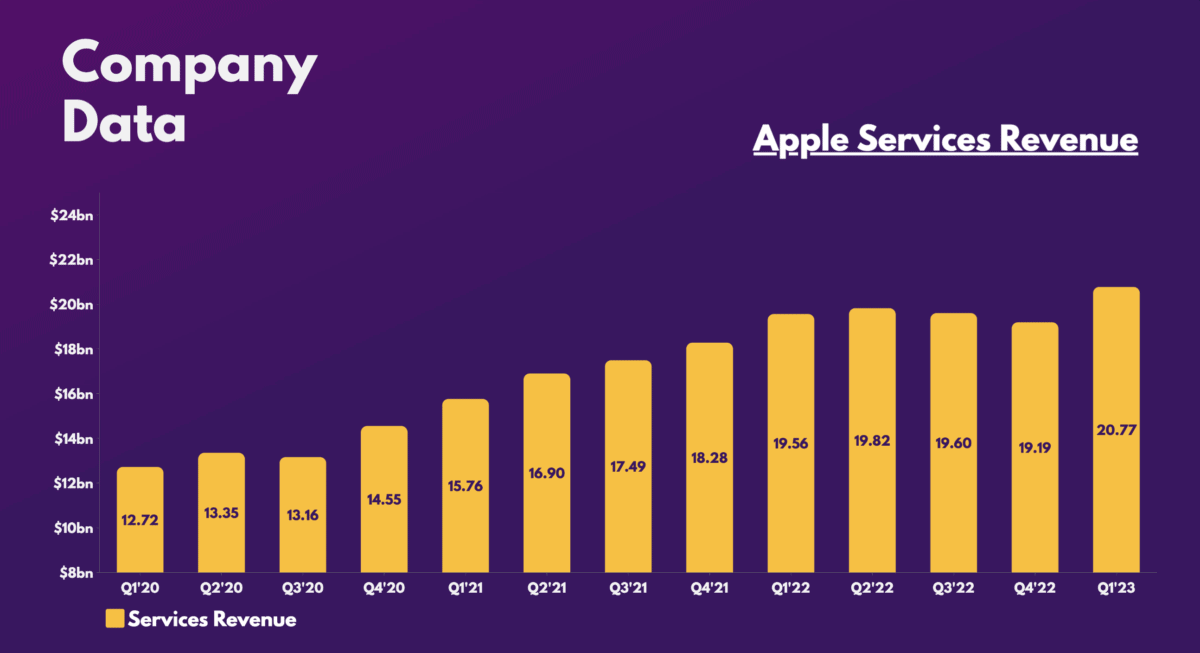

For one, services revenues are expected to continue growing despite the recent slump. This will be the tech giant’s most attractive source of income given its high margins (66%). And with over 2bn active devices and growing, recurring revenue should pick up when the economy improves.

Another huge catalyst for Apple stock would be its investments in entertainment. The group plans to invest $1bn into producing box office movies, and may even purchase streaming rights for the Premier League.

What’s more, it’s got an array of next-generational products that are waiting to be unveiled. These could be the next catalyst for a revenue explosion. Such products include its long-awaited VR headset, a foldable phone, and even an improved Apple Watch with non-intrusive diabetic tracking capabilities.

What’s next for Apple stock?

Having said that, it’s worth noting that Apple stock is already up 25% this year. For that reason, I think the shares will float around its current levels until macroeconomic conditions start to improve. Nevertheless, the conglomerate still has plenty of bright, long-term prospects.

As dominant Apple is, it’s easy to forget that it only commands 24% of the smartphone market. This means that there’s still plenty of room for it to continue capturing market share. As such, Apple remains a great investment in my books and certainly has the potential to grow my wealth massively.

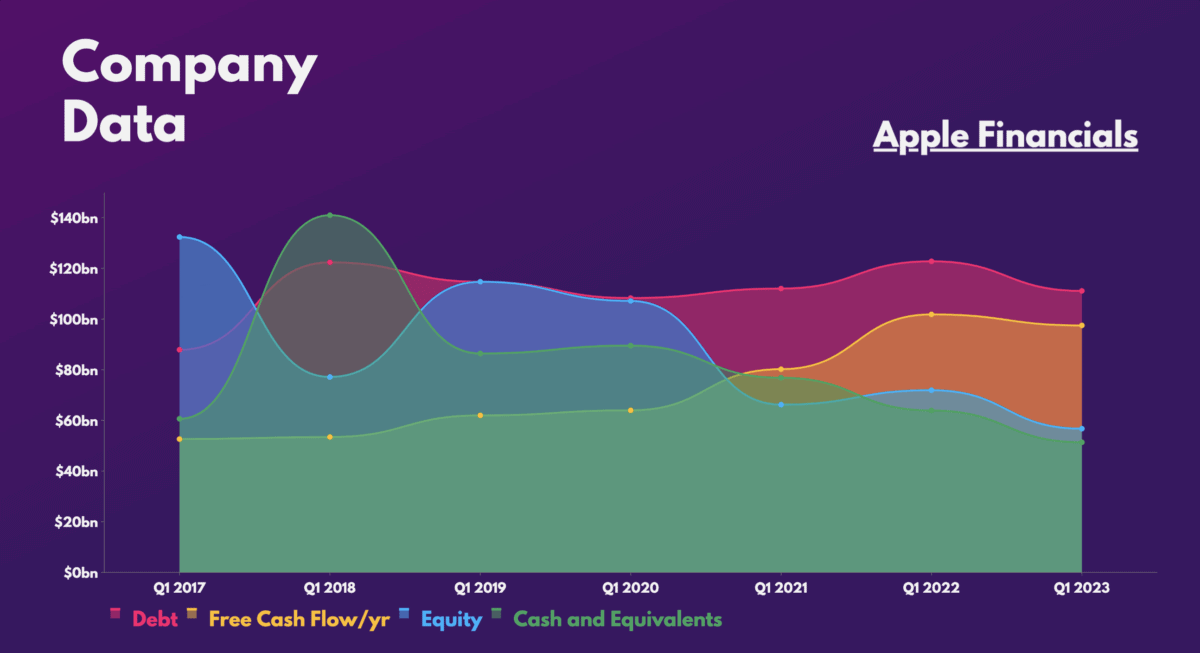

Its balance sheet may look poor with debt running above cash levels. However, the corporation’s strong free cash flow gives management the leeway to take on debt without too much worry.

That said, Apple stock isn’t cheap, as its valuation multiples are currently above the industry and index average. After all, Warren Buffett is known for buying the stock when it trades at 20 times earnings, and sells part of his stake when it reaches above 25.

| Metrics | Apple | Industry average |

|---|---|---|

| Price-to-earnings (P/E) ratio | 26.3 | 15.1 |

| Forward price-to-earnings (FP/E) ratio | 25.7 | 33.4 |

Brokers like Goldman Sachs, Morgan Stanley, and JP Morgan may have ‘buy’ ratings for the share, but given its average target price of $168, there isn’t much room for growth in the short term. Therefore, I’ll be holding onto my positions for now.