Rising bank rates mean that some Cash ISAs offer around 4% fixed for a year. But, given the long-term decline in rates over the last decade, I can’t be confident of that kind of return lasting. For long-term income building, I’d still plump for a Stocks and Shares ISA.

Build a portfolio first

Before I can draw a meaningful income I need to build my portfolio. At the moment I am paying as much as I can afford into my Stocks and Shares ISA and buying a mix of dividend and growth stocks. I am reinvesting any dividends I receive. When it is time to start taking an income, I will start withdrawing those dividends instead of reinvesting them. But, what kind of returns should I expect as I build my portfolio?

Well, according to IG Group, FTSE 100 total returns have averaged 7.75% per year since its inception. That includes the effect of dividend reinvestment.

I do need to be aware that historical performance is no guarantee of future performance. And, I need to plan for the long-term, if I am using a long-term average rate like this. Also, my portfolio should look something like the FTSE 100, if I am using a rate based on the performance of that index.

Dividend stock yields

Before I start working out how much I should regularly invest and for how long, I need a target. How big of a portfolio, and what kind of dividend yield will generate an income equivalent to £250 per month, or £3,000 per year?

Well, the average dividend yield of the FTSE 100 is around 3.5%. I would hope I could get that closer to 4% with some careful stock picking.

| Stocks and Shares ISA Value | Required annual yield to generate £250 monthly income |

| £150,000 | 2% |

| £100,000 | 3% |

| £75,000 | 4% |

| £60,000 | 5% |

| £50,000 | 6% |

| £42,500 | 7% |

| £37,500 | 8% |

| £33,333 | 9% |

| £30,000 | 10% |

A £75,000 portfolio yielding 4% will generate £3,000 a year in dividends, which will satisfy that £250 per month income requirement. But I am not done with the maths yet. Now I need to establish how much I would need to invest, and for how many years at that assumed 7.75% rate, to hit £75,000 or more.

Stocks and Shares ISA income

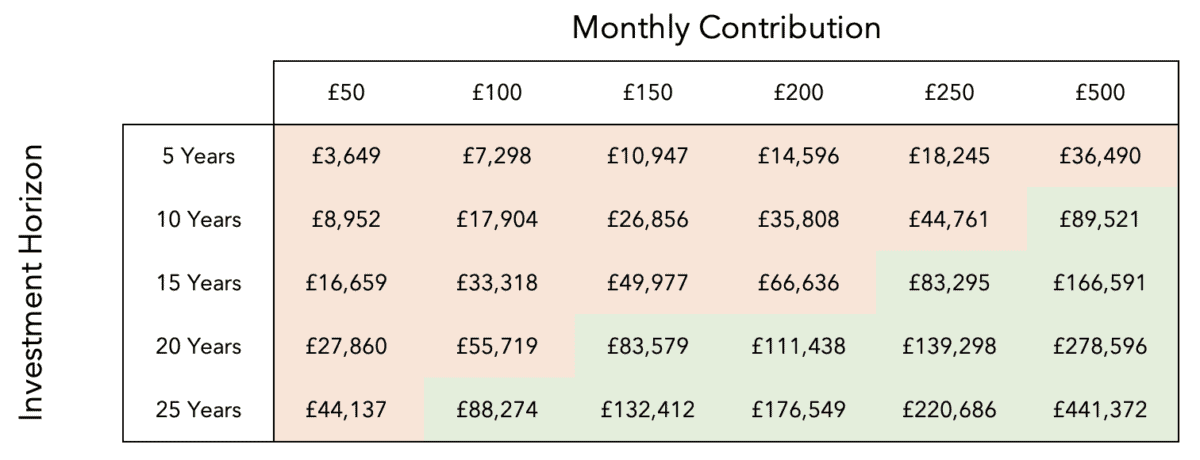

With the help of Excel’s future value function, I discovered that investing £50 a month for 25 years won’t do it. However, £100 a month for 25 years is predicted to build an £88,274 portfolio, which is more than enough to generate £250 in monthly dividend income assuming a 4% dividend yield.

Investing £150 a month for 20 years would also do the job. So, I have options. But now comes the hard part. I need to keep investing regularly in a basket of quality growth and dividend stocks for the long term and hopefully one day I can sit back and enjoy a steady stream of passive income from my Stocks and Shares ISA.