Taylor Wimpey (LSE:TW) shares are set to go ex-dividend on Thursday. This is the date by which an investor must own a stock to receive its next dividend. This currently stands at 4.8p per share. So, with a massive dividend yield of 8%, should I buy the stock?

Paying dividends

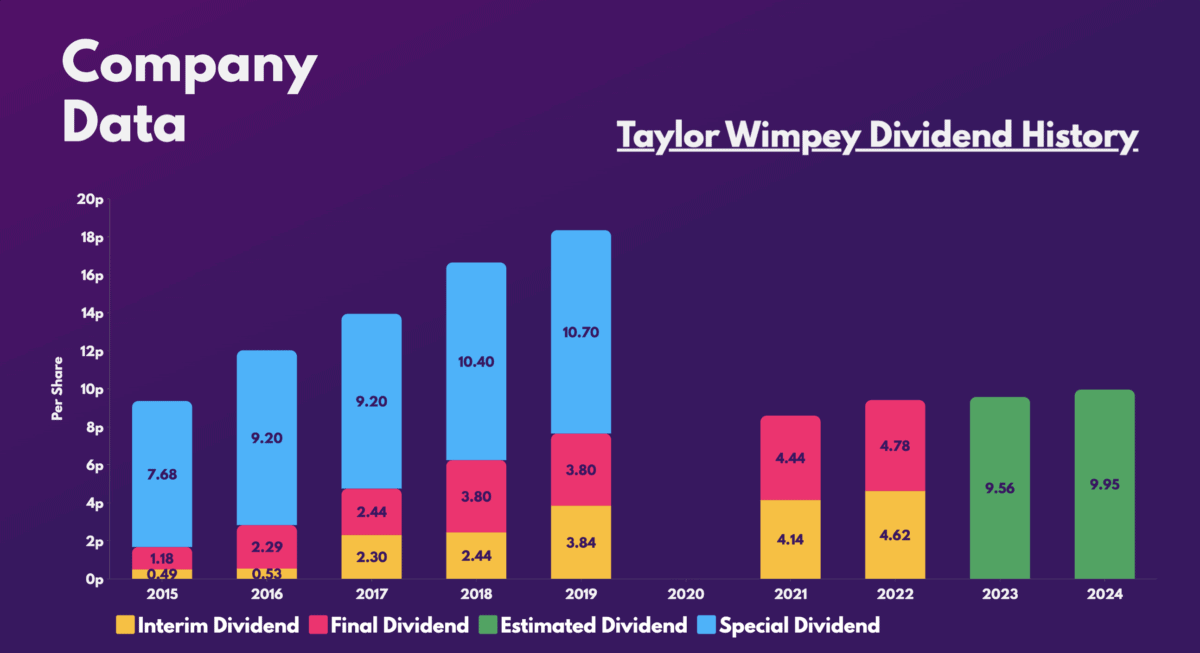

I think there’s a strong case to buy Taylor Wimpey shares for its upcoming dividend. For starters, the conglomerate has a rich history of paying lucrative yields, and its upcoming payout is evidence of that.

In fact, I feel Taylor Wimpey shares are one of better purchases for investors seeking passive income. That’s because the firm’s 8% dividend yield puts it in the top quartile of British dividend payers. It even trumps the industry average yield of 5.9%.

When considering the fact that peers Persimmon and Barratt are cutting their payouts, Taylor Wimpey’s strong yield is testament to its excellent dividend policy. And unlike its peers, the developer’s dividend policy is one that’s asset-based rather than earnings-based.

This allows the group to pay shareholders lucrative yields during both good and bad times. As a result of this, management has reiterated its intention to return either at least £250m, or 7.5% of the builder’s net assets, to shareholders annually.

Headwinds dissipating

Aside from the upcoming dividend, however, I see plenty of other reasons to buy Taylor Wimpey shares — mainly for their longer-term potential.

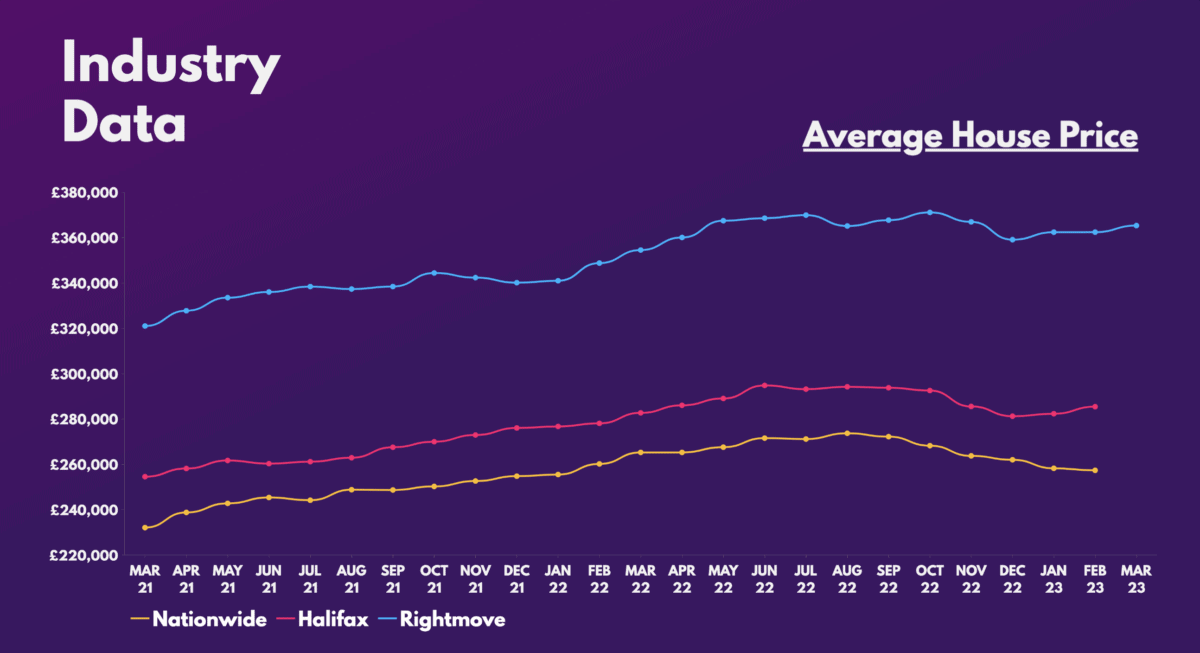

For one, house prices in the UK have a strong history of going up in value over time. This leaves plenty of room for earnings to expand, and consequently its dividends as well. After all, the FTSE 100 stalwart paid large special dividends before the pandemic hit.

As for the short term, house prices don’t seem to be falling as drastically as initially forecast. And with wage costs, build-cost inflation, and mortgage rates declining, Taylor Wimpey may be in for a pleasant surprise if house prices continue to remain sturdy.

Are the shares worth owning?

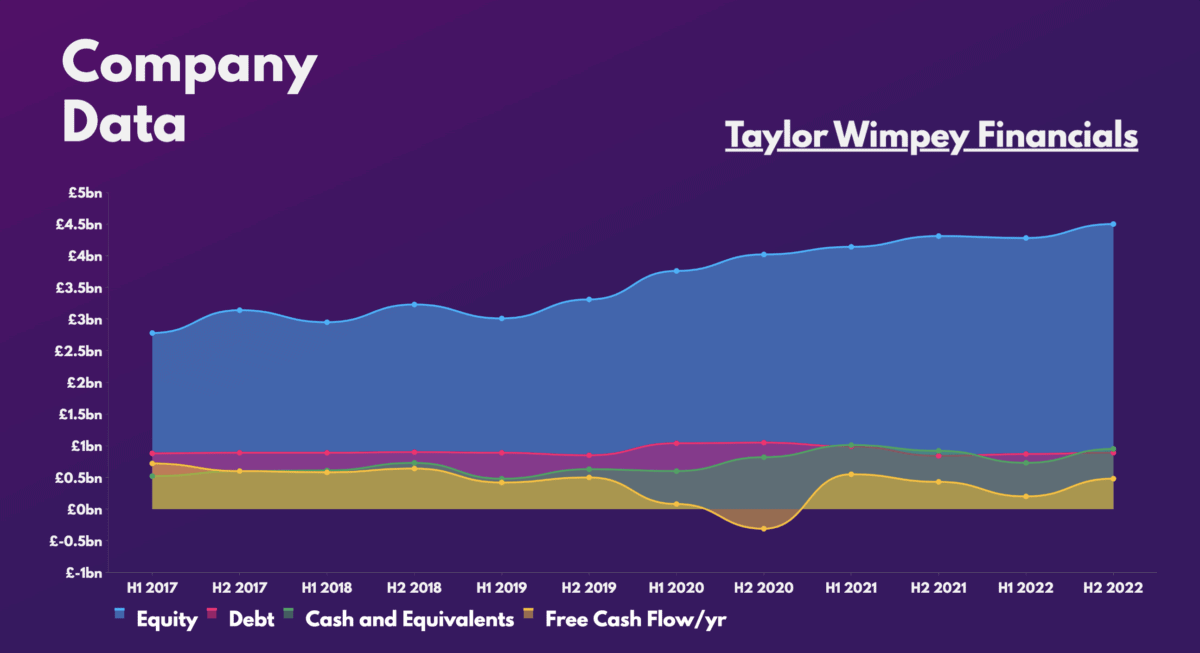

On that basis, is the stock a no-brainer buy? Well, all indications seem to point towards me saying yes. The housebuilder has an impeccable dividend policy that’s been stress-tested and an even better set of financials.

What’s more, the stock’s valuation multiples indicate superb value. Considering the long-term outlook, I’d argue that the current share price is a bargain.

| Metrics | Taylor Wimpey | Industry Average |

|---|---|---|

| Price-to-book (P/B) ratio | 0.9 | 0.9 |

| Price-to-sales (P/S) ratio | 0.9 | 0.8 |

| Price-to-earnings (P/E) ratio | 6.3 | 9.8 |

| Forward price-to-sales (FP/S) ratio | 1.2 | 1.2 |

| Forward price-to-earnings (FP/E) ratio | 12.8 | 10.4 |

And although several brokers such as Deutsche and Liberium only rate Taylor Wimpey shares a ‘hold’, I’m more incline to agree with Jefferies, which has a ‘buy’ rating, with a target price of £1.54. This would present me with a potential gain of approximately 34% if I were to add to my position today.

There’s certainly the risk that house prices plunge from here, but having analysed all the data for now, I don’t see an outright crash in the housing market. Thus, I don’t see why I shouldn’t continue building my stake in Taylor Wimpey, especially at these prices.