Investors who bank on income from dividend stocks can be left disappointed. That’s because some left-field event can suddenly interrupt a company’s otherwise reliable earnings — even for Dividend Aristocrats.

That said, some stocks have an excellent track record of payouts. Here’s two I reckon I can hang my hat on for income.

Renewable energy

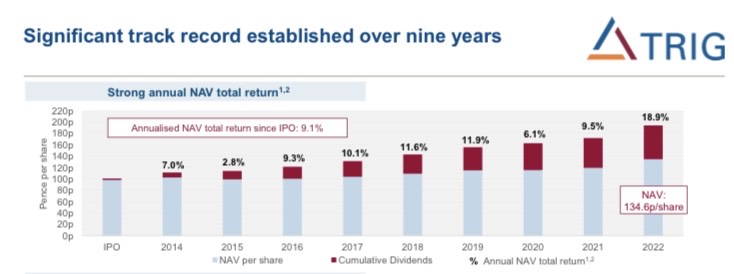

The Renewables Infrastructure Group (LSE: TRIG) is an investment trust with locations generating electricity from renewable sources. Founded in 2013, it has some £3.3bn in assets across six European countries.

Should you invest £1,000 in Diageo right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Diageo made the list?

Its portfolio is predominantly made up of onshore and offshore wind and solar farms. And the trust says these generated enough clean energy last year to power 1.6m homes!

Relying on these technologies can present problems if adverse weather (no wind, for example) affects energy production. However, I like that its assets are geographically diversified, as wind is unlikely to stop blowing across six different countries.

Just this week, the trust, referred to as TRIG, signed its first corporate power purchase agreement (PPA) with BT Group for a new wind farm in Scotland. A PPA is a long-term contract (10 years in this case) between an electricity generator and a customer, set at a pre-negotiated price.

This deal provides TRIG with long-term price security, while also delivering BT a supply of renewable power at an agreed price. It’s a win-win for both companies, as well as the environment.

For this year, TRIG is targeting a payout of 7.18p per share. That equates to a dividend yield of 5.7%, which comfortably beats the market average.

Also, the shares are down 6% over the last year. So I reckon now could be an excellent entry point for new investors.

I started a position in TRIG two months ago and I intend to hold the shares for years.

Gaining market share

McDonald’s (NYSE: MCD) stock ‘only’ has a dividend yield of 2.2%. While that may not sound as tasty as some ultra-high-yield dividend shares, the global fast-food franchise has raised its payout for 46 years in a row. So I’m going for consistency here rather than yield.

Plus, the share price return of 175% over the last decade isn’t too shabby!

The stock has gained 12.7% over the last year, while the S&P 500 has declined 13%. That’s an almost total inversion to the flagging index.

A major reason for this might be because of the 39 brokers covering McDonald’s, 18 have the shares as a buy while 10 rate them as a ‘strong buy’. None rate them as a sell.

I think the secret sauce here is the almost defensive quality the shares possess. Unlike many other consumer cyclical stocks, McDonald’s tends to thrive even during tougher economic times.

That’s because consumers suddenly prioritise value and affordability. That was in evidence last year, as it gained market share among low-income consumers, even after raising menu prices by 10%.

That said, its ability to raise prices isn’t unlimited. And if the global economy tanks, then foot traffic and profits could fall.

However, as things stand, the company continues to generate healthy free cash flow ($5.5bn in its latest financial year). And I reckon that will grow, supporting further dividend increases. So I remain a happy shareholder.