Two years ago, Chinese electric vehicles manufacturer NIO (NYSE: NIO) saw its shares surge above $60 before a shocking fall to just above $8. The share price is still under $9 as I write, a massive discount of 85% on the previous price.

With battery-powered vehicles guaranteed to disrupt the $1.7trn automobile industry, should I buy in today?

The buzz around electric vehicles

In recent years, it’s been easy for me to point to Elon Musk’s Tesla as the biggest jolt to the markets regarding electric-powered cars. But Chinese firm NIO has been on a similarly wild ride.

Should you invest £1,000 in Rolls-Royce right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Rolls-Royce made the list?

If I’d invested £1,000 in NIO at the start of 2020, it would have shot up to an electrifying £15,175 in only a few years, before falling to £1,420 at today’s price.

To compare, if I owned a £1,000 stake in Tesla at the start of 2020, it would have increased to £12,795 at its peak then fallen to £5,691 today.

I reckon those high points were probably somewhat inflated. NIO, in particular, had an astonishing $100bn valuation despite full-year revenue of only $2.5bn and running at a net loss.

But the reason for the excitement was obvious to me. Several countries have already passed legislation to phase out internal combustion vehicle engines by the 2030s, so electric vehicles seem set to take over the massive $1.7trn automobile industry. And no doubt, there’ll be some big winners.

How is NIO standing out?

With trillions of dollars at stake, I’m hardly surprised to see that NIO has an army of competitors including Tesla, Rivian, Chinese counterparts like BYD and XiPeng, and a whole host of legacy car manufacturers.

So what makes NIO stand out from the crowd? Well, in 2021 the firm announced its ET5 saloon, which has a 620-mile range, beating the industry leader (the Tesla Model 3, which offers 420 miles) by some distance.

Another piece of tech I like the look of comes in the way of the company’s battery replacement service. Rather than wait at least 30 minutes at a charging station, a customer can replace the depleted battery with a fully-charged one in just a few minutes.

Am I buying?

Any positive signs must be balanced by an awareness of the risks, and NIO’s biggest question mark is that it’s not yet profitable.

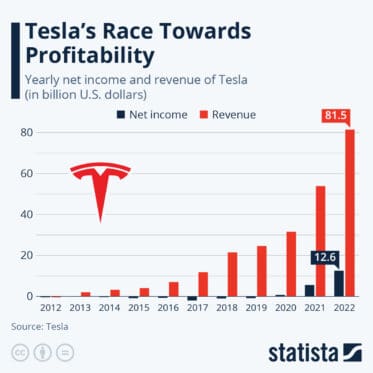

That’s not totally out of the ordinary for a growth stock. In fact, Tesla wasn’t profitable for years but made $12bn in 2022. This graph from Statista shows the progression nicely.

Could the same thing happen with NIO? The Chinese firm’s growth year on year has rivalled Tesla’s meteoric rise, with car sales growing from 8,101 in 2018 to 91,429 in 2021.

Perhaps my biggest concern is regarding the wider stage. Tensions between China and the West are rising and I wouldn’t like to have much of my portfolio in Chinese companies if, say, some kind of conflict over Taiwan happened.

As it is, I’ll think I’ll keep NIO on my watchlist for now.