Rolls-Royce (LSE:RR) shares have plateaued in recent weeks. For now, the bull run, which started in September, has come to an end.

But it’s worth noting that two investment banks have set considerable share price targets for the engineering giant in recent weeks. So why is that and are they warranted?

Price targets

A price target is a price at which an analyst believes a stock to be fairly valued, relative to its performance. When banks raise or lower their price targets, it can have a profound impact on share prices.

Naturally, banks raise these targets when they expect the share price to move up… and down when they see downward pressure on the stock.

So let’s have a look at the only two target prices set for this FTSE 100 stock in March.

To start, UBS nearly doubled the price target to 200p from 105p as it said the shares were “abnormally cheap“, despite China reopening.

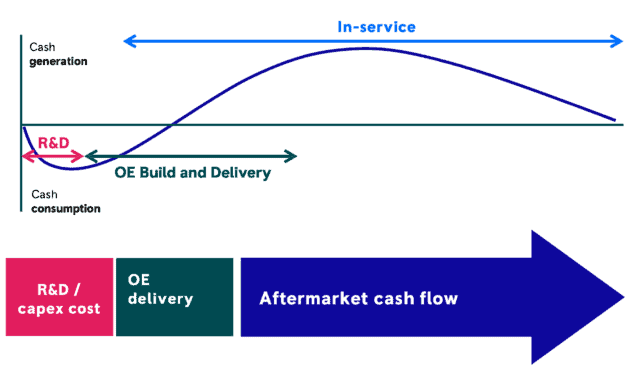

Then Citi lifted its price target on Rolls-Royce to 255p as it cited “a clear route to much better cash flow“.

These two price targets are considerable when we look at the current share price, 147p, and earlier price targets, most of which were under 100p.

In more good news, Standard and Poor’s raised its rating for Rolls-Royce long-term debt to BB with a positive outlook, meaning the firm’s debt could return so-called investment grade over the next 12-18 months.

What’s so great about Rolls?

So are these price targets warranted? And what’s behind the jump in price targets?

Well, Rolls surprised to the upside in late February. It posted a statutory operating profit of £837m for 2022, considerably up on £513m a year earlier. Meanwhile, revenue grew to £13.5bn from £11.2bn.

For many analysts this was something of a turning point.

All parts of the business are now experiencing growth. Defence is moving steadily forward amid a challenging geopolitical environment and the firm noted an impressive growth in orders for power systems, up 29% to £4.3bn.

But most importantly, the civil aviation segment — the company’s largest revenue generation — is recovering from the pandemic. Large Engine Flying Hours were around 65% of 2019 levels towards the end of 2022. That’s a huge improvement on 2021.

For 2023, Rolls is expecting this metric to hit 80-90% of 2019 levels. A good proportion of these additional flying hours could come from China where wide-body jets with Rolls engines, are used on domestic flights. We may even see total revenues exceed pre-pandemic levels in 2023.

Of course, there are still some concerns. Debt is down to £3.3bn — substantially smaller than this time last year — but it will remain a drag on profitability.

However, I’m still bullish on Rolls. I definitely believe the stock could push forward and hit its pre-pandemic heights this decade.