Despite being known for its stability, Tesco (LSE:TSCO) shares have barely moved over the past five years. In fact, the stock has even underperformed the wider stock market by quite some margin. So, can Tesco still be considered a good investment?

Putting loyalty to the test

Consumer staple businesses like Tesco are known to be great shares to buy during times of crisis due to their inelastic business model. As a result, the stock was able to pull an outstanding performance during the pandemic, and is even holding up decently in the current cost-of-living crisis.

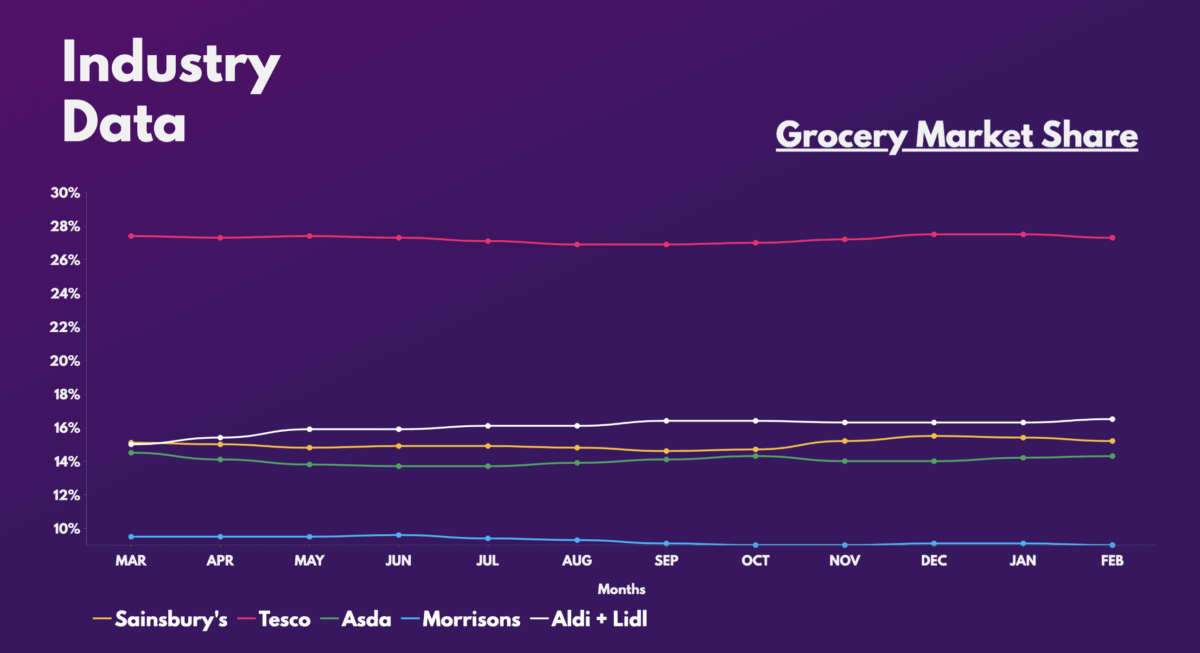

This is in part due to its dominant position as the UK’s biggest supermarket. The company has held its market share relatively steady throughout the past year, and this is testament to its renowned Clubcard scheme. In fact, Tesco is the only top grocer to have grown its market share from pre-pandemic levels.

Consequently, customers have expressed high satisfaction levels, leading to sales growth. After all, the firm reported strong Christmas numbers in its last trading update. Nonetheless, all this will be put to the test again as the FTSE 100 stalwart gears up for another round of challenges.

Food inflation continues to grow at an unprecedented rate. Therefore, Tesco will have to continue competing with Aldi and Lidl, as consumers flock to discounters for better deals. Additionally, the decrease in value of Clubcard points isn’t going to help it retain its cost-conscious customers either.

A special treat?

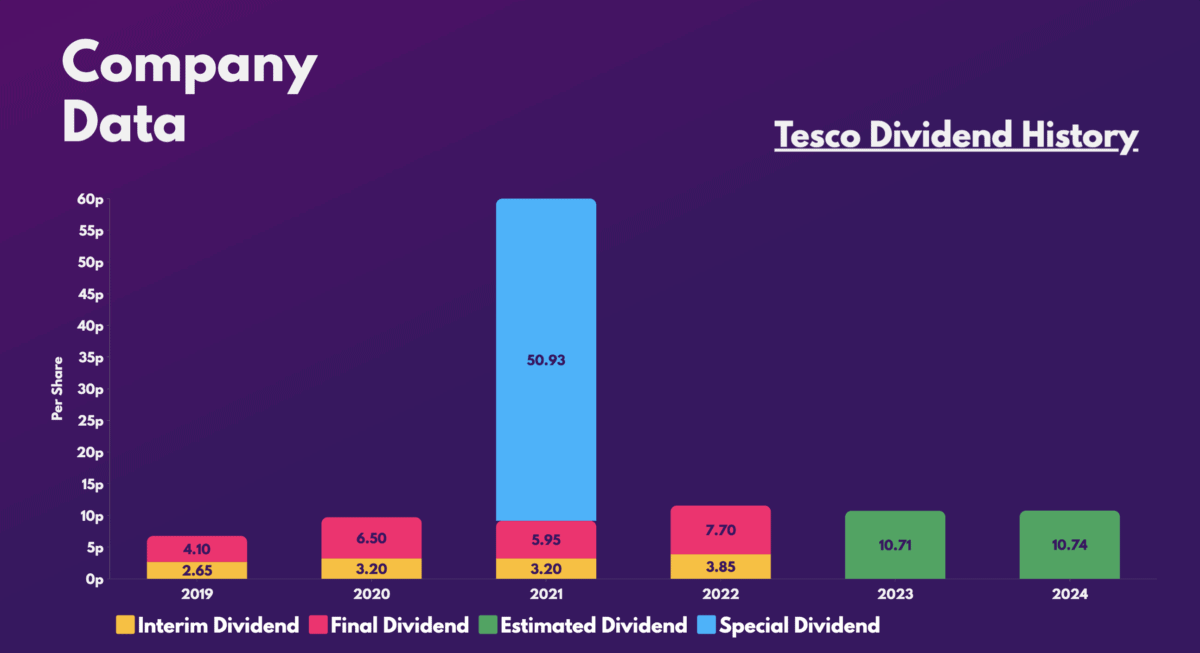

Having said that, where Tesco disappoint in gains, it makes up for it in dividends. The blue-chip stock has a rich history of paying lucrative dividends, especially during times of good performance. Its payouts during the pandemic are evidence of this. Hence, this could be a reason for investors to buy Tesco shares.

With energy prices declining too, the grocer’s bottom line could see some improvement over the course of the year, which could boost its dividend yield. Moreover, the group is rumoured to be exploring the sale of its banking arm. Such a deal could see the retailer paying another special dividend in the near future.

Are Tesco shares worth adding to my basket?

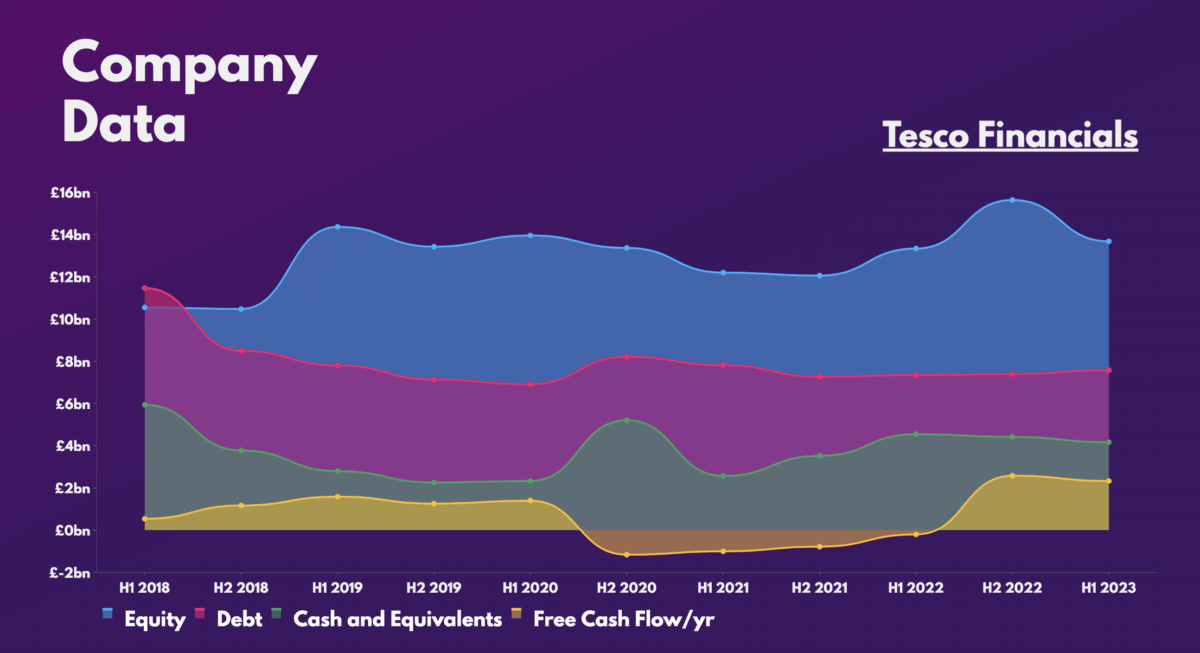

That said, as lucrative as those dividends may potentially be, it doesn’t shy away from the fact that Tesco seems to me to have a substandard balance sheet. Its short-term assets can’t cover its total debt, though that’s to be expected for a retailer.

Even so, its flat returns on assets (2%), equity (6%), and capital employed (7%) over the past decade don’t help its investment case. What’s more, its valuation multiples aren’t cheap either, with most of them comfortably above the industry average.

| Metrics | Tesco | Industry Average |

|---|---|---|

| Price-to-book (P/B) ratio | 1.4 | 1.4 |

| Price-to-sales (P/S) ratio | 0.3 | 0.3 |

| Price-to-earnings (P/E) ratio | 19.6 | 13.4 |

| Forward price-to-sales (FP/S) ratio | 0.3 | 0.4 |

| Forward price-to-earnings (FP/E) ratio | 12.7 | 12.4 |

Nevertheless, numerous brokers remain bullish on Tesco shares. Jefferies, JP Morgan, and Shore Capital all have ‘buy ‘ratings. The stock even has an average price target of £3.08, which is approximately 19% higher than its current levels.

Ultimately, there’s no doubt that Tesco could be a safe stock to buy for those investors seeking stability while benefitting from some handsome dividends. However, it’s by no means exceptional as there are other UK shares boasting higher returns in share price performance and dividends. Thus, I won’t be buying today.