Penny stocks are often high-growth, high-risk investments. They’re not for the faint-hearted, as they can experience higher share price volatility than more established stocks.

That said, I am looking to add some smaller companies to my portfolio, albeit with modest stakes. In particular, I’m looking to take positions in firms that have market capitalisations below £100m and share prices under 100p.

One that fits the bill is AIM-listed lifestyle and concierge business Ten Lifestyle Group (LSE:TENG), which has a market cap just shy of £76m and a share price below 92p as I write. Here’s why I’d invest in this penny stock today.

Should you invest £1,000 in Ten Lifestyle Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Ten Lifestyle Group Plc made the list?

A unique growth engine

Ten Lifestyle Group harnesses technology to provide services for wealthy customers. Its offering spans the lifestyle, travel, dining, entertainment, and retail sectors. The business model has a solid track record, with the company boasting a 25-year trading history.

The group has strategic partnerships with major banks including HSBC, Morgan Stanley, and Royal Bank of Canada. It generates revenue from service fees contained in multi-year contracts with these corporate clients.

Speaking of revenue, the latest numbers are encouraging. In 2022, the company delivered record net revenue of £46.8m — that’s a 35% increase on the 2021 figure, and ahead of the firm’s pre-Covid levels. In addition, adjusted EBITDA also climbed 11% to hit £4.9m.

Ten Lifestyle Group continues to make strides with regard to creating a competitive advantage over its rivals. Investment in technology, content, and communications rose 18% to £13.6m. The firm’s digital platform now supports 18 languages and 39 currencies. It’s available to members in over 100 countries.

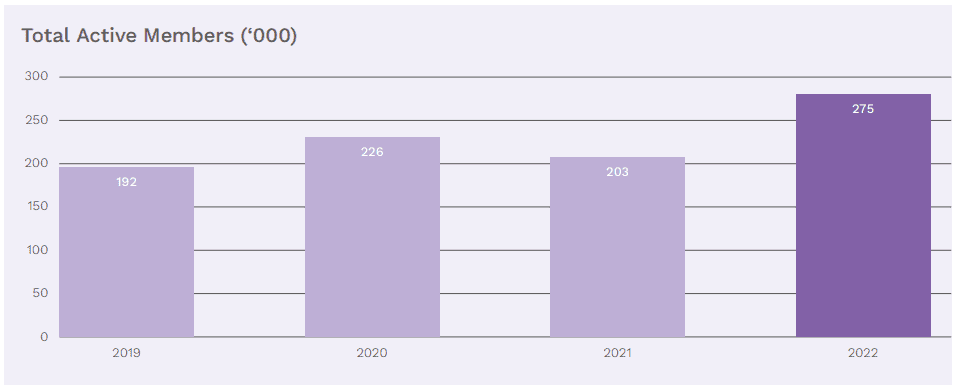

Perhaps the most promising development is evidence that the company is successfully capitalising on pent-up demand for global travel and lifestyle services as the world emerges from the pandemic. Active members (defined as members who have used the company’s service at least once in the past 12 months) are now at a record high, after increasing 36% in the last financial year.

Challenges

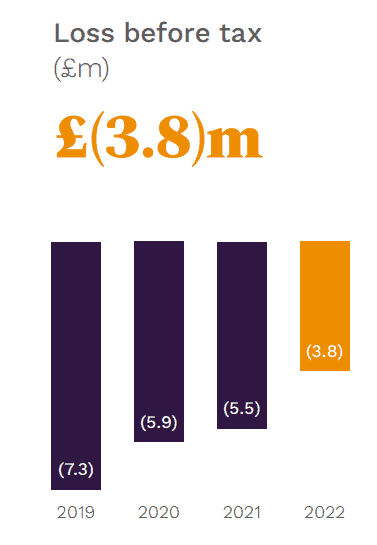

Despite some positive numbers, investing in this penny stock isn’t risk-free. Although its losses have diminished in size, the firm has failed to make a profit over the last four financial years. While the trajectory is promising, I’d like to see the company become profitable sooner rather than later.

In addition, Ten Lifestyle Group has faced difficulties arising from the war in Ukraine. The company was forced to close its Moscow office in March 2022, leading to a loss of business and one-off disposal costs of £519k. Further geopolitical tension and the elevated possibility of sanctions on other countries remains a concern.

Finally, given the group’s reliance on corporate client income, it is indirectly exposed to the performance of its key customers. In light of the current crisis engulfing many banking stocks, client expenditure on lifestyle, travel, and entertainment services may come under greater scrutiny when the time comes for contract renewals.

Why I’d buy this stock

Although there are risks, this penny stock looks like an attractive investment to me.

It’s a market leader in a sector that has significant growth potential, and the company’s digital strength makes the offering highly scalable.

If I had some spare cash, I’d invest in Ten Lifestyle Group shares today.