The UK stock market’s lurch lower leaves many FTSE 100 shares looking too cheap to miss. Take Rolls-Royce (LSE:RR.), for example, whose share price has plunged 8% during the past week.

This means it currently trades on a forward price-to-earnings growth (PEG) ratio of 0.2. This is comfortably below the benchmark of 1 that suggests a stock is undervalued. It also indicates that Rolls could be one of the best value shares on the FTSE today.

So should I buy the business for my investment portfolio today?

Should you invest £1,000 in Lloyds Banking Group right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Lloyds Banking Group made the list?

Sustained earnings growth?

Rolls’ ultra-low PEG ratio reflects analyst predictions that earnings will soar in 2023. According to the City, the bottom line will increase by 136% year over year.

These forecasts are underpinned by the strong and sustained recovery of the travel industry. Higher traffic in the skies translates to greater demand for Rolls-Royce’s aftermarket services.

Brokers think annual earnings will leap an impressive 51% next year and 30% in 2025 as well.

On the up

Rolls-Royce’s revenues outlook has improved rapidly across the business. But the sunny outlook for its core civil aerospace division is the most encouraging for future profits. Demand for the firm’s engines and servicing packages is rising and could increase strongly over the longer term.

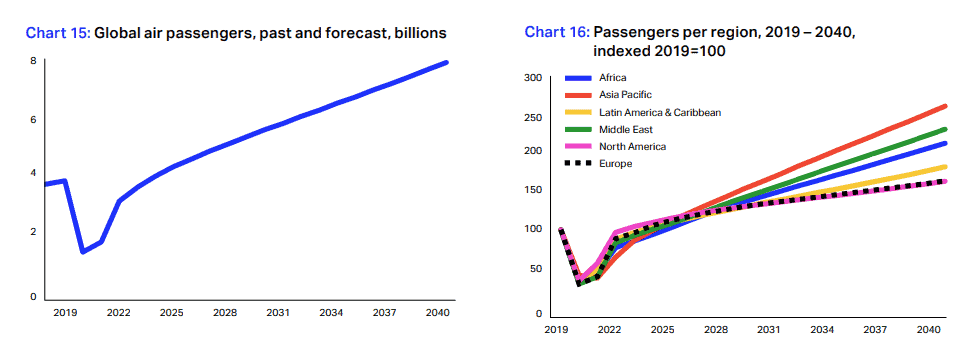

As the graphs below show, air passenger volumes are tipped to soar over the coming decade. As a result sales of aircraft-related hardware and services is also expected to boom.

The business has also received some good news concerning its nuclear reactor programme of late. In Tuesday’s Budget, the Treasury pledged heavy investment in small modular reactors (SMRs) as part of Britain’s green energy strategy.

The government selected Rolls in 2021 to build a fleet of SMRs. The news affirms lawmakers’ commitment to nuclear power, another potential earnings driver for the firm.

Still too risky?

As an investor there’s a lot I like about this recovering business. However, I still have reservations about spending my hard-earned cash on Rolls-Royce shares.

My chief concern over Rolls is its hefty £3.3bn net debt pile. As a possible investor I have to consider how this will affect the firm’s plans to start paying dividends again.

I’m also mindful that high debts could impact its ability to pursue capital-intensive growth programmes. The pressure to develop market-leading products in areas like green technology is huge. A slimmer R&D budget versus its rivals may severely compromise its ability to win contracts.

Finally, I’m concerned about the impact that high cost inflation and supply chain problems are having on Rolls’ profits. These look set to continue pressuring margins as the war in Ukraine rolls on and post-Covid bottlenecks persist.

The FTSE 100 is packed with top value stocks following recent market volatility. So right now I’m happy to ignore Rolls’ cheap share price and buy other shares.