Last year wasn’t a great year for tech companies. Meta (NASDAQ:META) was one of the hardest hit, as its shares fell by a staggering 65%. Nonetheless, CEO Mark Zuckerberg is determined to lead a rebound this year, promising “a year of efficiency”. Hence, now could be the best time to buy Meta stock.

Metaversal developments

Despite losing more than $13.7bn in its Reality Labs division so far, Zuckerberg is doubling down on Meta’s ambitions to become the market leader in virtual reality technology.

But to ensure that it doesn’t sink the company into unprofitability, the firm is planning to make another 11,000 workers redundant in the coming months, on top of the 10,000 it released last year. These moves are expected to prop up Meta’s earnings per share, and is why the stock has been performing so well.

Should you invest £1,000 in Inc.) right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Inc.) made the list?

More interestingly, the group is jumping on the AI bandwagon. It’s releasing its own Large Language Model in attempt to compete with ChatGPT and Google’s Bart. The goal is for it to be able to generate text, draw pictures, and even create media that resembles human output.

Although critics have labelled the move as a PR stunt, I beg to differ. I believe this could be extremely useful in boosting revenue steams from apps like WhatsApp, which have struggled to generate meaningful returns over the years. And if successful, this could spell huge upside for Meta stock.

Facing reality

As exciting as these developments are though, Meta still needs to spend its capital diligently. That’s because not many companies, if at all, have lost $13.7bn. And if Zuck’s bet is going to pay off, he’ll have to make sure that Meta’s main revenue driver can make up for Reality Labs’ hefty losses.

This is where the investment case for Meta stock starts to falter — user base saturation. The conglomerate earns the bulk of its revenue from Facebook. It’s certainly been successful in monetising the social media website over the past two decades. That said, user growth has been faltering.

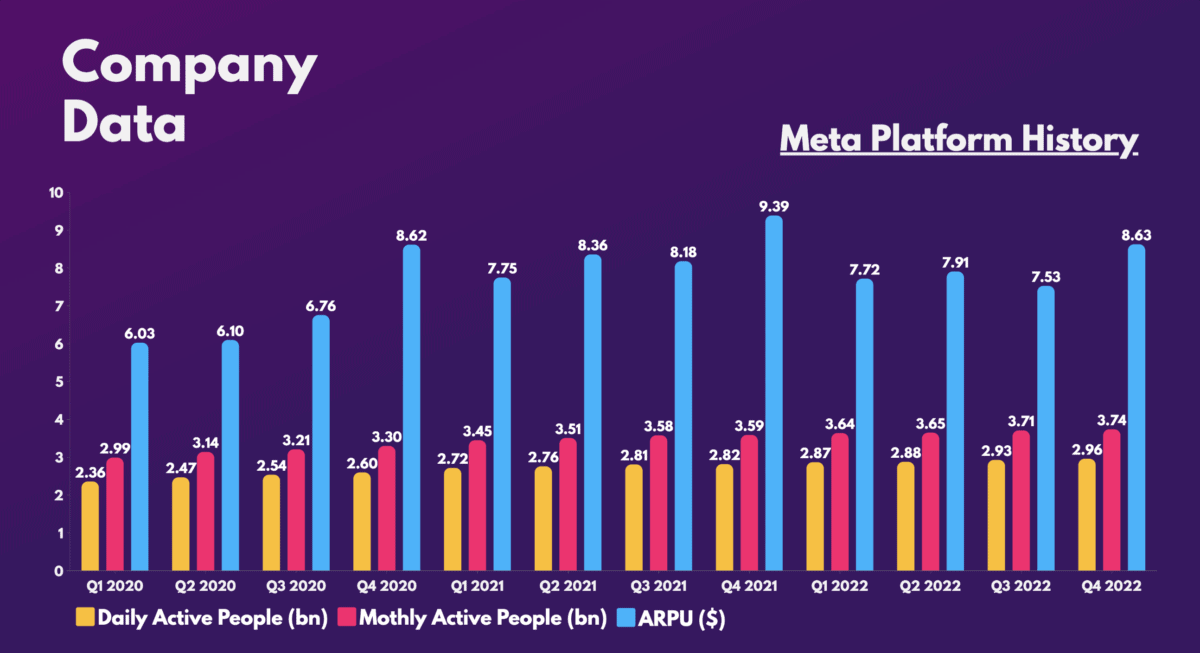

In terms of Meta’s overall user base, daily and monthly active users have only grown by a meagre 25% over the past three years. While this is expected given the sheer size of the corporation, the stall in average revenue per user (ARPU) is also worrying.

Thankfully for Meta, it has a growth driver in the form of Instagram to help prop its stock up. The platform is beginning to find its feet in bringing in meaningful revenue. Still, it faces headwinds and increasing competition from TikTok, Snap, Pinterest, and YouTube Shorts.

Is Meta stock a buy?

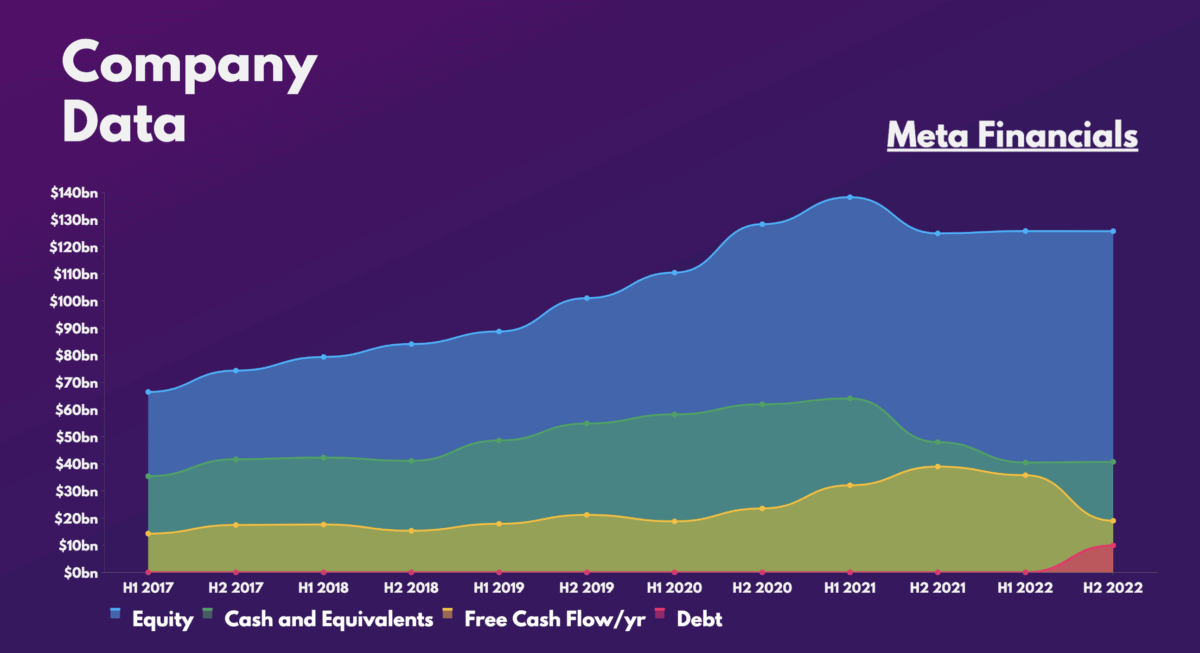

Nevertheless, the business still has plenty of runway thanks to its strong financials. Having said that, shareholders should keep an eye on the balance sheet as the uncapped spending from Reality Labs has seen cash levels and free cash flow deteriorate.

So, is Meta stock worth a buy then? Well, its valuation multiples have come back up from their bottom. Even so, the likes of Citi, Goldman Sachs, Deutsche, and many more are still bullish on the shares, reiterating their ‘buy’ ratings.

| Metrics | Meta | Industry average |

|---|---|---|

| Price-to-sales (P/B) ratio | 4.4 | 5.3 |

| Price-to-earnings (P/E) ratio | 22.1 | 24.3 |

| Forward price-to-earnings (FP/E) ratio | 20.4 | 32.5 |

However, it’s worth noting that the stock only has an average price target of $209. This roughly presents a mere 4% upside from current levels. Thus, I’m not overly keen on investing in Meta stock.