Since the mini-budget crisis last October, Rolls-Royce shares (LSE:RR) have jumped by a whopping 125%. But with full-year statutory profitability yet to be achieved, I question whether the stock deserves its current elevated price. Do the charts agree with me?

Why is the stock up?

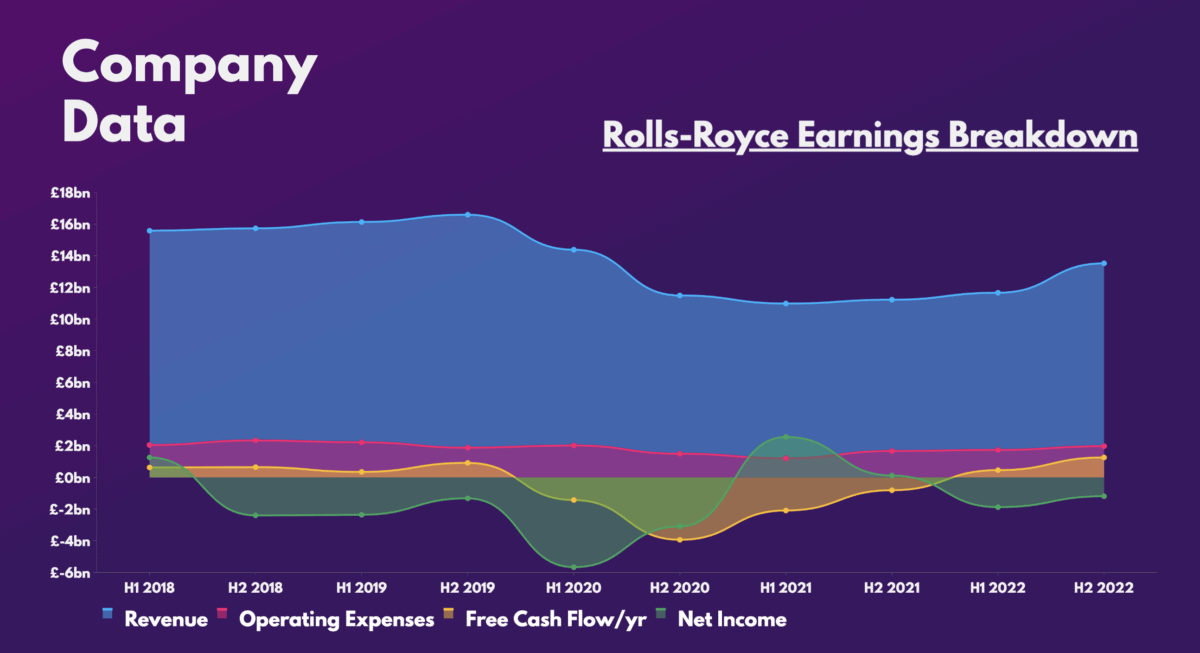

The recent jump in the share price can be attributed to its latest full-year results. The company reported better-than-expected numbers that resonated well with investors. Revenue continues to recover. But more importantly, the firm finally turned a profit on an underlying basis.

Pair the above with upgrades from an array of brokers and investment banks, and it’s easy to understand why sentiment surrounding the stock has turned positive. Having said that, it’s worth assessing whether Rolls-Royce shares are too pricey after the recent rally.

Are Rolls-Royce shares still cheap?

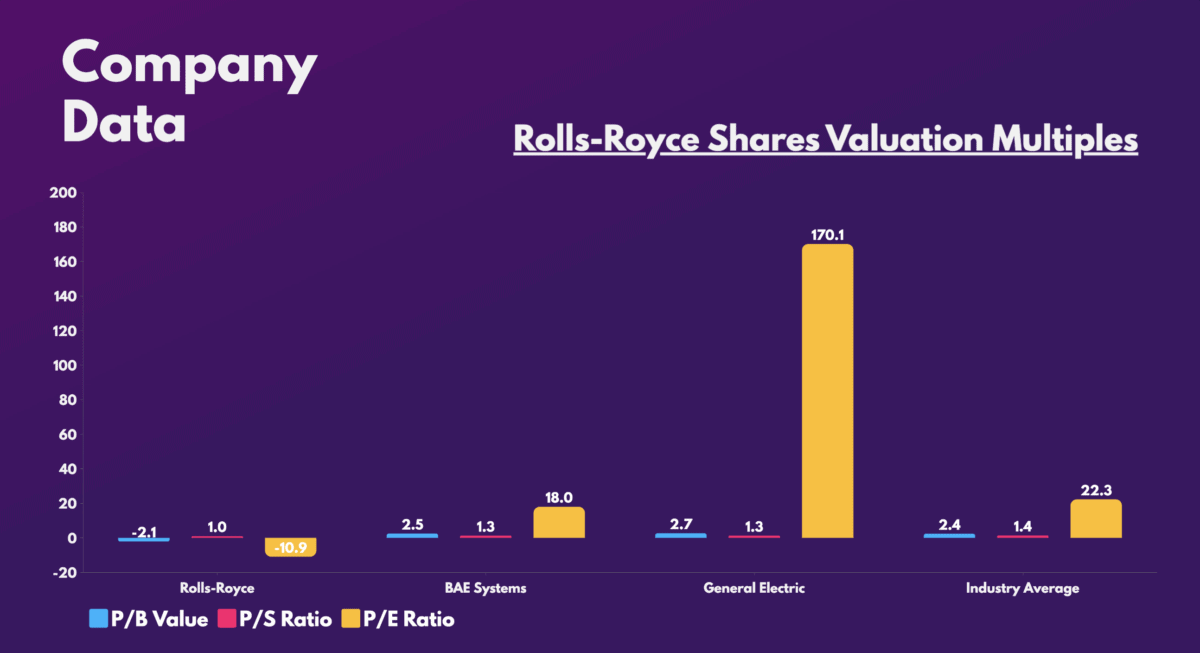

The Derby-based engineer isn’t profitable on a statutory basis. Therefore, its stock doesn’t have a price-to-earnings (P/E) ratio. As such, other valuation multiples such as price-to-sales (P/S) and price-to-book (P/B) value have to be used to determine whether the shares are fairly valued.

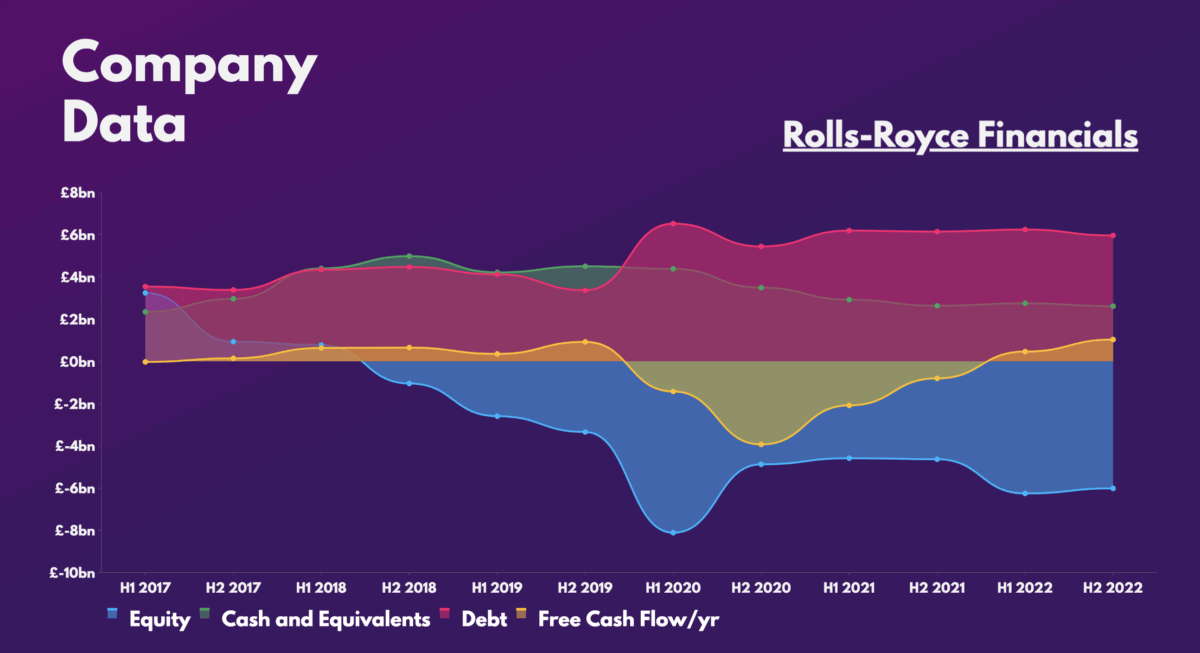

At a P/S ratio of 1, it’s fair to say the manufacturer’s stock is fairly valued based on sales. That said, it’s worth noting that Rolls doesn’t have a P/B value. This is because the group’s balance sheet is in tatters with negative shareholder equity.

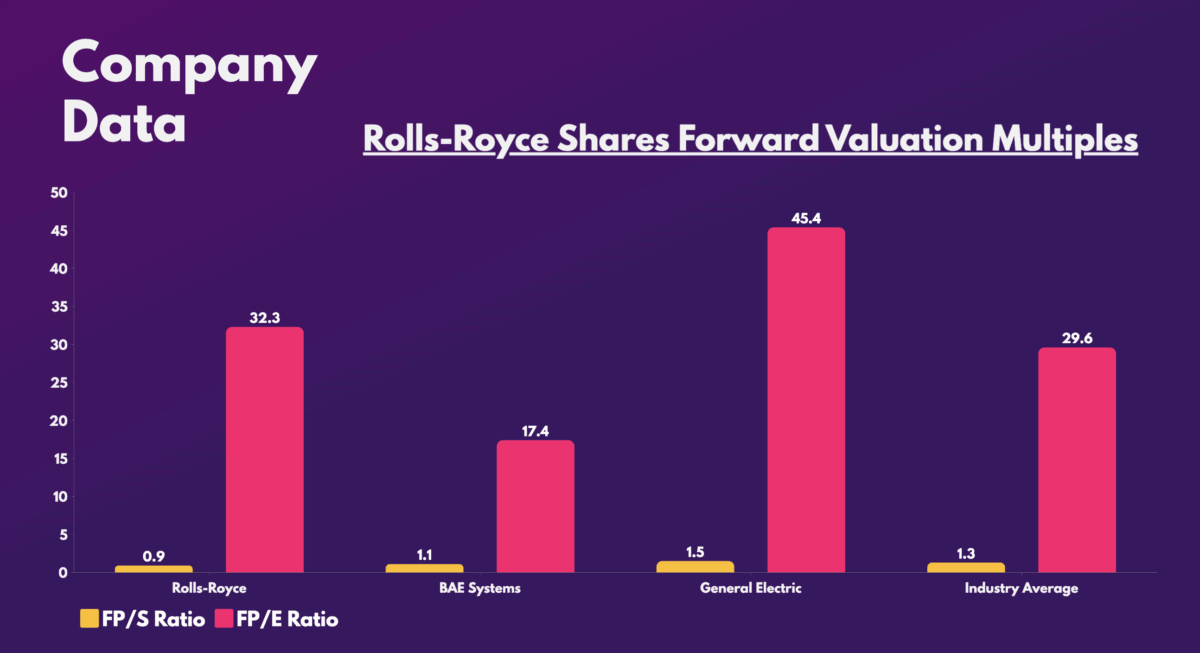

Nonetheless, given its status as a growth share, it’s more important to view its forward-looking indicators. These include multiples such as forward price-to-earnings (FP/E) and forward price-to-sales (FP/S) ratios. These multiples give a rough idea of how the stock’s value today relates to its projected future earnings.

Considering its FP/S ratio, the share price now isn’t too expensive. However, shareholders may find its above average FP/E ratio a little bit concerning. This is because it’s above the industry’s average.

Rolls is still quite some way off its pre-pandemic revenues. And with plenty of room to continue growing earnings, I feel an FP/E ratio of 32.3 isn’t unreasonable for its potential growth. Thus, it wouldn’t be premature to label Rolls-Royce shares as fairly valued today.

Is it a good business to invest in?

Nevertheless, Warren Buffett once famously said: “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” And when diving deeper into the corporation’s fundamentals, it’s clear to see that it’s severely lacking in many areas.

With negative shareholder equity, I think it’s safe to say Rolls-Royce is the latter in Buffett’s statement. Management may be making strides in slowly paying its debt off, but it doesn’t change the fact that its financials are in the gutter.

Despite that, things are starting to look up for the engine producer. Flying hours are creeping back up, which should boost long term recurring revenue and earnings. Additionally, its Power Systems segment continues to show strength with a record order book.

Buying Rolls-Royce shares is no doubt risky. But given new CEO Tufan Erginbilgic’s reputation of being a value driver, there’s a glimmer of hope that the conglomerate can turn things around. And given the stock’s reasonable price, I’m not averse to adding to my small position for the exciting upside potential.