Scottish Mortgage Investment Trust (LSE: SMT) shares have gone out of fashion recently amid the sell-off in global growth stocks. The fund’s share price slumped 22% in the past year as investors sought safety in more defensive areas of the market.

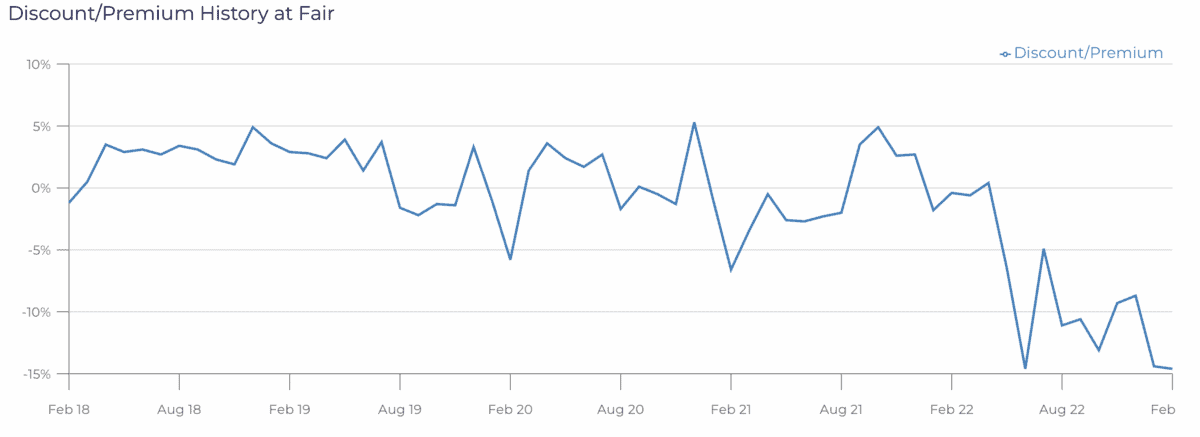

However, I believe now could be a golden opportunity to invest in this FTSE 100 investment trust. At 675p, it’s currently trading at a 16.6% discount relative to the net asset value (NAV) of its portfolio and I might not have to wait too long for the shares to re-establish themselves as providers of market-beating returns.

Here’s why I think investing in Scottish Mortgage shares today could be a very rare chance for me to build wealth.

Shares on sale

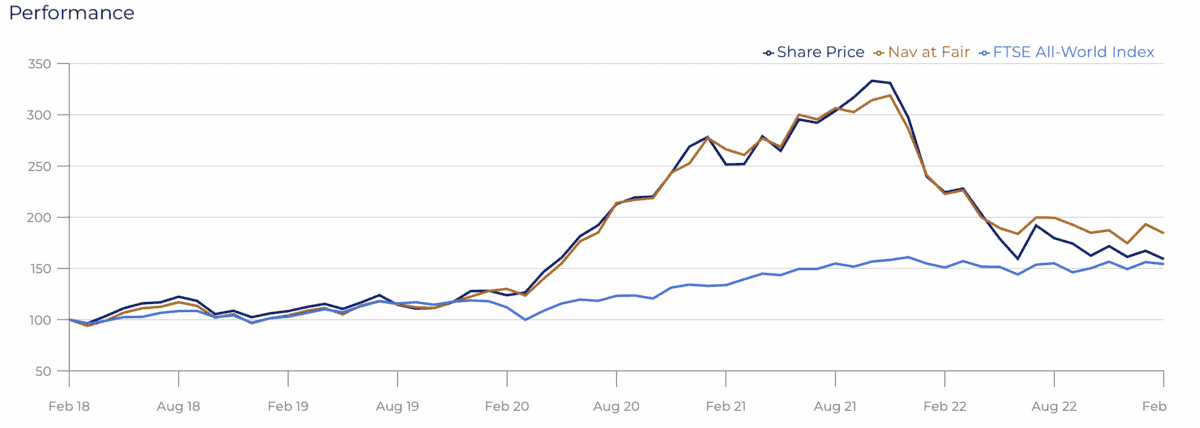

Scottish Mortgage uses the FTSE All-World Index as its benchmark. For almost the entirety of the past half-decade, the fund’s share price has outperformed this index.

Today, the five-year return of the two has almost reached parity, although Scottish Mortgage remains slightly ahead. That looks like a rare buying opportunity to me.

The fund’s also still marginally ahead of the S&P 500 and considerably outperforming the FTSE 100 over the same timeframe. This is testament to the strength of its returns over five years, considering how brutal the sell-off in the past 18 months has been.

Perhaps the most compelling buy signal for me is the wide discount that has emerged between the share price and the NAV. This is currently at a five-year low, and I don’t expect that will remain the case for much longer.

Growth stock investing

Over 20% of Scottish Mortgage’s investments are concentrated in just three stocks: Moderna (7.9%), ASML (7.4%), and Tesla (5.2%). As the chart below shows, the first two are essentially trading where they were a year ago, but Tesla has fallen 31%.

This serves as a reminder that not all of the fund’s holdings are responsible for the 12-month share price decline. I expect each individual company will take a different route to recovery.

In addition, Scottish Mortgage invests heavily in private companies, which make up 28% of the portfolio. Currently, I think this is a little too close to the fund’s 30% limit and it creates additional risk due to the challenge of accurately valuing these businesses.

Nonetheless, I’m a firm believer that the investment trust’s big bet on growth opportunities can pay off. Although value stocks are in vogue at present, this won’t last forever. I think patient Scottish Mortgage shareholders like me will stand to benefit when a ‘risk on’ environment returns.

How rare is this opportunity?

I’m a big fan of the fund’s investment philosophy. I think it offers me a great chance to beat the market.

In my opinion, there are a number of indicators that suggest Scottish Mortgage shares are unusually cheap at present. That said, I view the company as a long-term investment. I wouldn’t be surprised if there’s plenty more volatility to come this year.

Whether this is a once-in-a-lifetime chance to scoop up shares at bargain prices is debatable. There may be further such opportunities in the future, but in my view they don’t come that often. I’ll be adding to my position at these price levels.