UK stocks are well represented in my portfolio, and Aston Martin (LSE:AML) is one of them. The luxury automotive company has seen the value of its shares shoot up in recent weeks after results impressed and Aston Martin F1 took third in Bahrain.

So, is this the start of a recovery?

Long-term performance

The Aston Martin flotation must be one of the worst in recent years. The value of the stock has fallen some 85% since its offering in late 2018, despite the recent rally.

Should you invest £1,000 in Aston Martin right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Aston Martin made the list?

At the time of writing, it’s trading at 300p a share. That’s down 5% over 12 months, but it’s only a fraction of where it was three years ago.

So, what’s behind this fall?

Well, the British sports car maker was worth £4.3bn when its shares were listed on the stock market in October 2018 at £19.

Many commentators at the time suggested this was a considerable overvaluation. The stock slumped on repeated losses as investors lost faith in the company’s ability to operate sustainably.

Is this a turnaround?

It’s important to note that the considerable share price gains over the past week don’t just stem from the results published on March 1.

Having said that, the results contained several positives.

Despite posting a £495m loss before tax, the Gaydon-based firm made a narrow operating profit of £6.6m in the final three months of the year. Investors had been waiting for some time to see this.

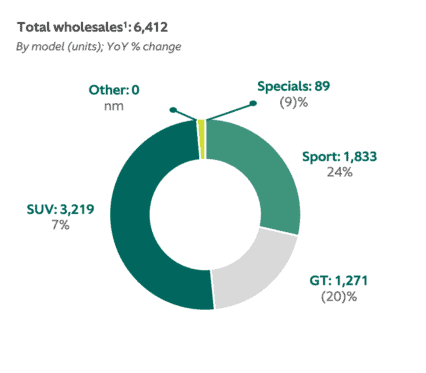

The company repeated that it will be able to hit its 2024/25 goals, including £2bn in revenues and £500m in adjusted EBITDA. And it will be able to achieve this by selling just 8,000 vehicles, less than the planned 10,000.

Margins are key to this. Management says the next generation of sports and limited edition luxury vehicles will have profit margins of 40%. The move last year to poach former Ferrari boss Amedeo Felisa as chief executive, appears to be paying off. Ferrari is revered for its margins.

The introduction of the DBX SUV has also been game-changing for volume and margins.

The Fernando Alonso effect

I’m one of those saddos that watch F1 practice on a Friday. And as Fernando Alonso was demonstrating that the Aston could be Red Bull’s main competitor this season, something strange happened. The share price jumped 10%.

And these gains continued when the market opened on Monday. In the race on Sunday, Alonso passed Hamilton’s Mercedes AMG and Sainz’s Ferrari to finish in third. Teammate, Lance Stroll — the son of Aston Martin chief executive Lawrence Stroll — finished sixth, despite a wrist injury.

That’s a huge improvement on last year, and as with the road cars, this success is partly built on poaching experts from its peers. In this case, Aston took several experts from Red Bull.

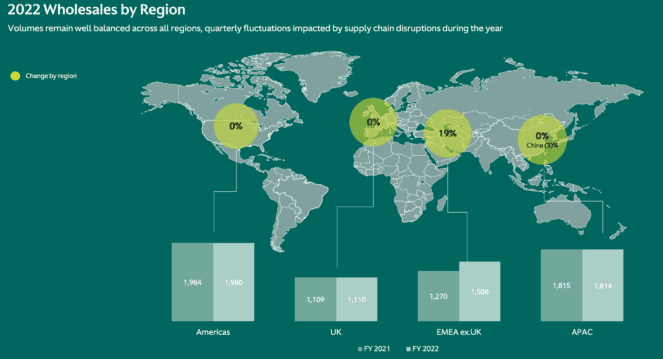

The F1 team is separate from the stock, but there’s a clear overlap. With the team performing well in an increasingly US-focused sport, the carmaker should benefit — the US is also among its largest markets.

Alonso’s podium finish saw the market cap rises as much as £250m.

I’ll buy more

I’m intending to buy more stock when I have the funds available. I’m aware that debt may weigh on profitability for some time, but Aston is easily a £5bn-company if it can hit its 2024/25 objectives. Maybe one day it’ll be a €50bn-company like Ferrari.