At $101, Tesla (NASDAQ:TSLA) shares looked like a good buy. And I missed this opportunity, because a ‘fill-or-kill order’ didn’t go through. The stock is up 80% since then.

So I’m not a Tesla shareholder.

But let’s take a closer look at this electric vehicle (EV) firm’s recent performance and explore whether I should add this stock to my portfolio now.

Should you invest £1,000 in Tesla right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Tesla made the list?

2 volatile years

Over two years, Tesla shares are down around 8%. The stock has demonstrated extreme volatility within that time. Soaring above $400 in 2021 as tech stocks boomed and falling as low as $101 in recent months when the bubble burst.

So if I invested £1,000 in Tesla shares two years ago, today I’d have £920? Wrong!

The pound has actually depreciated around 15% over the two-year period. Today, I’d actually have more money than I started with. My original investment would be worth £1,081.

As the stock doesn’t pay a dividend, I can see that my total returns would have been around 4% a year. That’s not bad, but it’s not world-beating. The depreciation of the pound would have essentially saved the investment.

Continuing to perform

I’ve been expecting newcomers to start eating into Tesla’s market share. But that’s not really happened yet. In the US, the competition just isn’t there and highly promising Chinese firms, including NIO and Li Auto, were seemingly set back by Covid restrictions.

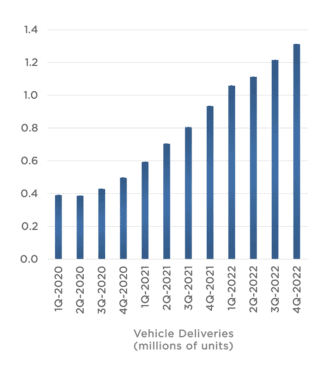

Tesla’s growth has continued unabated, despite a challenging macroeconomic backdrop.

And the Elon Musk company’s growth is forecast to continue as the US government boosts the domestic market with support. Bloomberg analysts predict that more than half of all vehicles sold in the US by 2030 will be electric.

Margins

Tesla’s margins are exceptional. NIO margins fell from 17.2% a year ago to just 3.9% in the most recent quarter. There were reasons for this, including selling older stock at incentivised prices.

However, Tesla’s gross margins have remained strong despite inflation and sales incentives. In Q4, Tesla’s automotive gross margin was 26.9%, down 4.6% year-on-year, but still very strong.

These margins and positive cash flow gives Tesla the ability to reprice its models in order to increase sales, and possibly make life harder for competition. Musk has repeatedly said the business would focus on bringing prices down to drive demand — Tesla recently cut prices on the Model S and Model X.

Valuation concerns

Eventually, I’m anticipating there to be more competition from other EV manufacturers and traditional car manufacturers. And, in turn, we’ll see growth moderate. But, broadly speaking, Tesla is still a company with impressive growth prospects.

However, Tesla isn’t cheap. It trades at a price-to-earnings multiple of 51. That’s considerably above the S&P 500 average around 19. Relative valuations aren’t favourable too. NIO trades with a price-to-sales of 2.1, versus Tesla’s seven.

I appreciate that Tesla is well-positioned to dominate the sector, but I’d rather invest in competitors, like NIO, that trade with considerably lower multiples.