CRISPR Therapeutics (NASDAQ:CRSP) is possibly the most speculative growth stock I’m buying for my portfolio. It’s not traditionally something that would interest me, but the more I read, the more interested I became.

So, at $50, can CRISPR Therapeutics make me rich?

Gene therapy prospects

CRISPR Therapeutics is a speculative pick as governments and regulators round the world have been hesitant to back gene therapy treatments.

CRISPR, an acronym for ‘clustered regularly interspaced short palindromic repeats’, refers to a gene-editing technology utilised by the firm.

Despite initial hesitancy, this is a highly promising therapy that is increasingly demonstrating its efficacy, and CRISPR Therapeutics is not the only company validating the promise of this technology.

Attitudes to the tech are seemingly changing, and even over the last year, we’ve seen increasing confidence that these treatments, dependent on efficacy, will receive regulatory approval.

But there is of course risk here. CRISPR treatments are not proven over the long run yet.

Near-term wins

The market has struggled to value CRISPR Therapeutics, despite progress on the firm’s sickle cell disease (SCD) approval. The treatment could be approved this year.

The stock traded for over $190 a share back in January 2021 after the company had just received a $900m upfront payment from its partner Vertex.

But conversely, as CRISPR Therapeutics gets closer to monetising the treatment, the stock trades for just $50.

Other gene-editing firms are also developing SCD treatments, but CRISPR Therapeutics’ Exa-Cel treatment appears to have a very strong chance of being the first-ever approved CRISPR-based therapy.

This would be a blockbuster moment for the firm. In trials, Exa-Cel demonstrated impressive efficacy. Of 44 patients, 42 were “functionally cured” of their disease. However, it is worth noting that long-term durability has not been established — only time will tell.

Being the first CRISPR treatment on the market could generate billions in revenue. Calculations suggest the treatment could cost $1m per patient during their lives — less than existing treatments — and that 32,000 people would be eligible at first. This creates a $32bn market opportunity.

The product could be launched this year. It is worth noting that Vertex would receive more than half the revenue generated.

Strong pipeline

Biotech can be a volatile part of the market. CRISPR Therapeutics is currently trading near its three-year low, but just one piece of positive trial data could send the share price soaring.

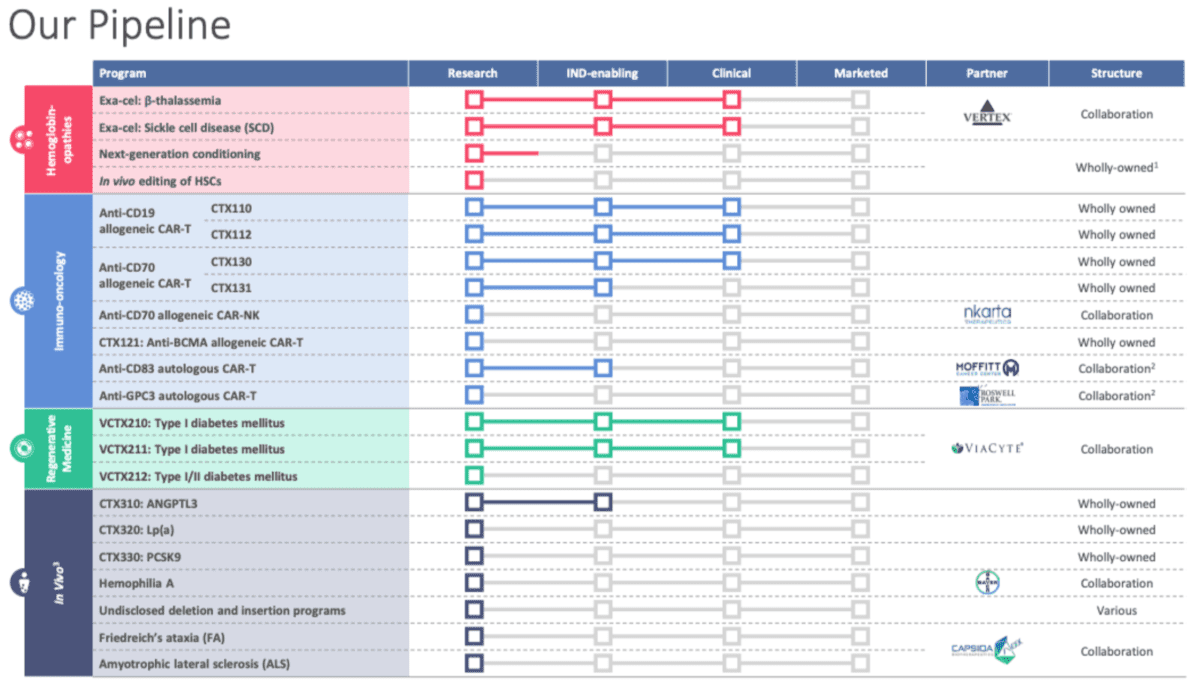

Overall, the firm’s pipeline includes 25 programmes. With initial data suggesting CRISPR therapies have a wide range of applications, this a reason to get excited about the long-term prospects of this stock. CRISPR Therapeutics also has $2bn in cash to aid development.

The firm also has two additional oncology therapies that could become marketed products in the next couple of years.

CTX-110 targets a protein — CD19 — present in B-cell malignancies such as large B-cell lymphoma. Meanwhile, CTX130 targets a protein called CD70 in the treatment of T-cell lymphomas, including certain solid tumours.

There’s no guarantee these treatments will receive regulatory approval. However, it is a highly promising part of the market and one that could deliver millions of positive health outcomes in the future. That’s why I’m adding this stock to my portfolio.

Can it make me rich if I put $5,000 in at $50? Well, I certainly hope so. Considering the pure size of the SCD opportunity, I think it could be undervalued on this alone.