House prices may be declining, but Taylor Wimpey (LSE:TW) continues to impress. The housebuilder’s stock is up 35% from its September bottom. And with a rewarding dividend yield of 7.8%, Taylor Wimpey shares remain top picks for passive income.

Building on strong results

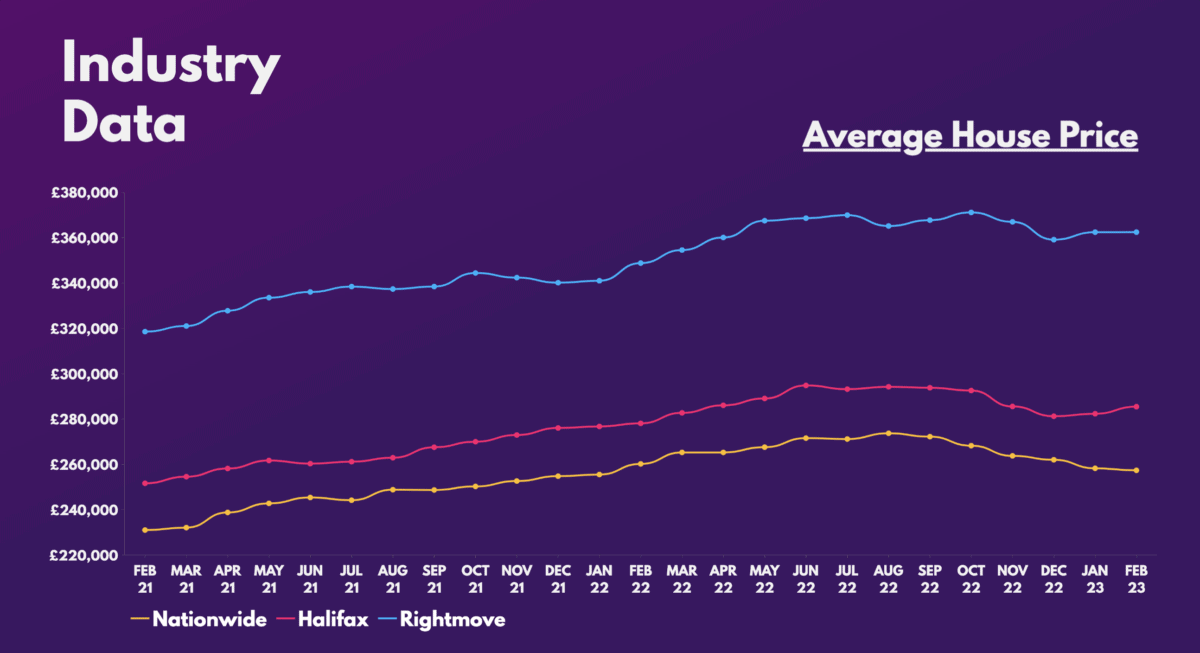

Despite the calamities of red-hot inflation, the mini-budget crisis, and sky-high mortgage rates, Taylor Wimpey managed to finish 2022 with some strong numbers. House completions may have fallen slightly, but this was offset by an increase in average selling price (ASP).

| Metrics | 2022 | 2021 | Change |

|---|---|---|---|

| Total completions | 14,154 | 14,302 | -1% |

| Average selling price (ASP) | £313,000 | £300,000 | 4% |

| Net sales rate | 0.68 | 0.91 | -25% |

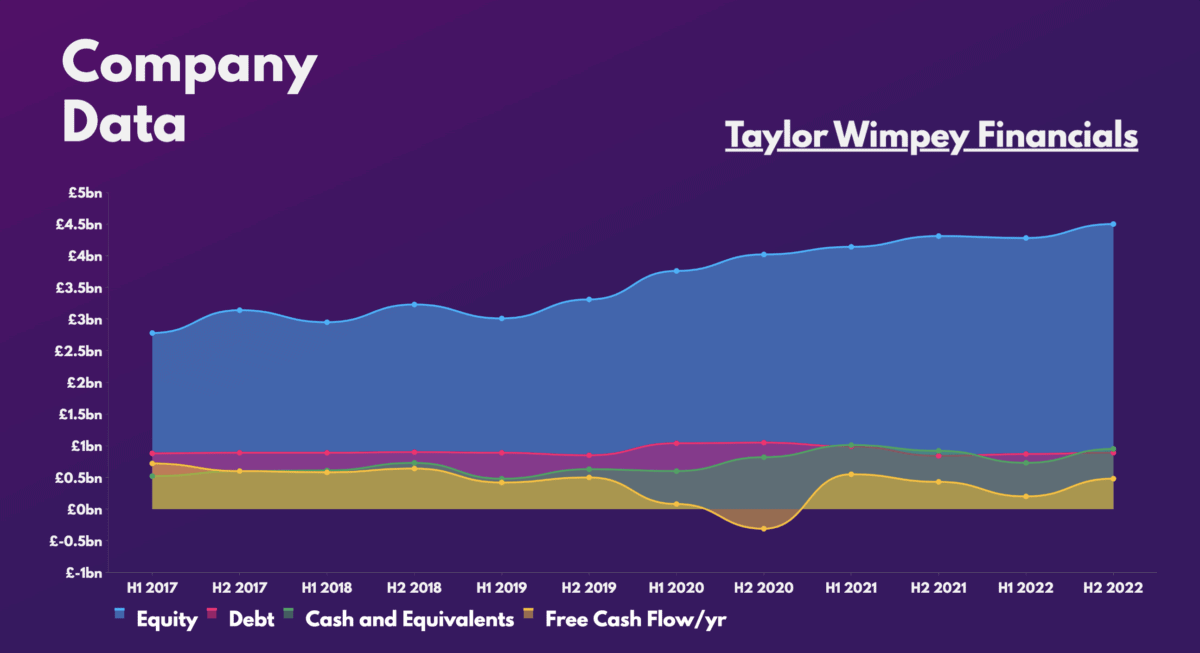

As a result, the shares didn’t suffer the carnage Persimmon‘s did, with Taylor Wimpey reporting record figures. This outperformance was helped in part by house price inflation outstripping build cost inflation. But more importantly, the firm moved quickly to reduce spending on land purchases while imposing tight cost controls on projects after the mini-budget in September. This allowed it to finish the year in a much stronger financial position than its peers.

Should you invest £1,000 in HSBC right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if HSBC made the list?

| Metrics | 2022 | 2021 | Change |

|---|---|---|---|

| Revenue | £4.42bn | £4.28bn | 3% |

| Operating profit | £923m | £829m | 11% |

| Profit before tax (PBT) | £828m | £680m | 22% |

| Diluted earnings per share (EPS) | 18.0p | 15.2p | 18% |

| Dividend per share (DPS) | 9.40p | 8.60p | 9% |

Cementing its dividend

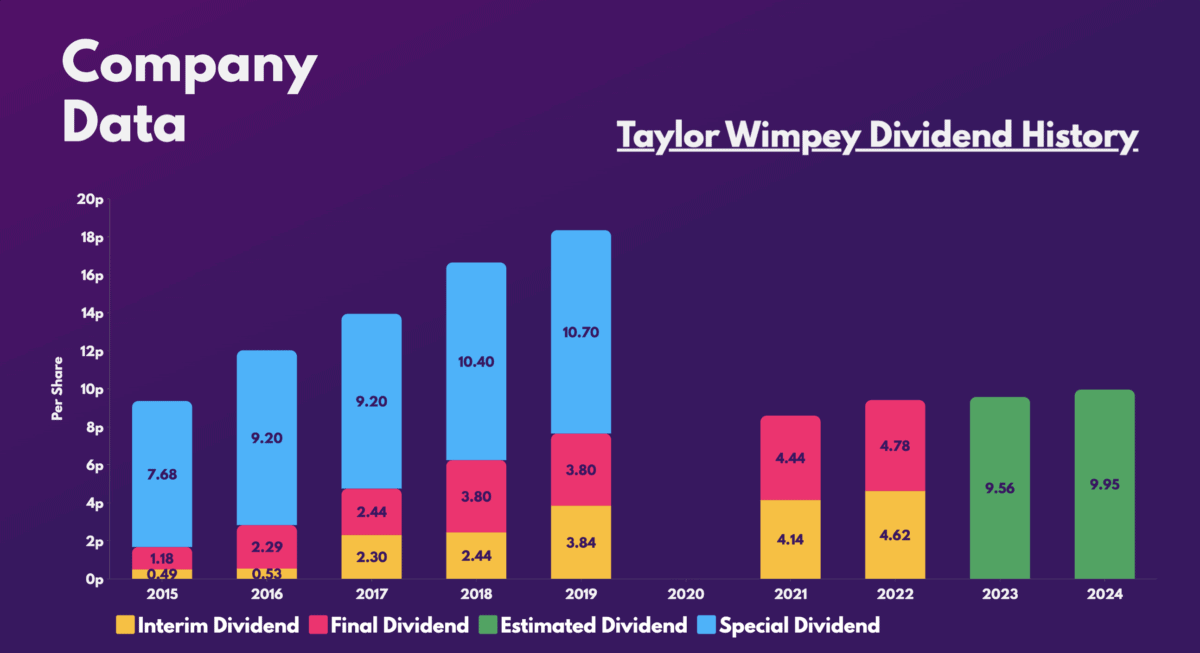

For those reasons, it’s able to share its success with its shareholders in the form of dividends. The group announced a final dividend of 4.78p per share, beating analysts’ estimates. Additionally, management is guiding for a higher-than-forecast dividend for the year ahead. The company anticipates paying a dividend of 9.56p per share, above analysts’ consensus of 8.73p. This gives the stock a lucrative forward yield of 8%.

It’s no surprise to see CEO Jennie Daly reiterate the developer’s dividend policy. The FTSE 100 stalwart maintains that it’ll return at least £250m, or 7.5% of its net assets, in dividends. This is possible because unlike several of its competitors, Taylor Wimpey’s dividend policy isn’t heavily reliant on earnings. Rather, it’s based on net asset value and its healthy balance sheet.

In other words, shareholders can still expect a reliable dividend yield of 5.9% even in the event of a market downturn. This means that in an earnings contraction, as long as the business’s balance sheet remains robust, it can afford to pay a decent dividend, thus bringing some security for passive income investors.

Are Taylor Wimpey shares good value?

So, are Taylor WImpey shares a buy for me on that basis? Yes, with caveats. The path ahead isn’t going to be an easy one. While the short-term outlook isn’t as bad as initially feared, it still isn’t the brightest.

| Metrics | 2023 (Outlook) | 2022 |

|---|---|---|

| Total completions | 9,000 to 10,500 | 14,154 |

| Private sales rate | 0.5 to 0.7 | 0.68 |

| Ordinary dividends | £338m | £324m |

| Effective tax rate | 27.3% | 22.0% |

That said, things are starting to turn around. Sales rates, cancellation rates, and house prices are all picking back up. Moreover, mortgage rates are stabilising with build cost inflation forecast to drop later this year.

What’s more, Taylor Wimpey shares have reasonable current and forward valuation multiples. As such, Jefferies and Barclays both have ‘buy’ ratings on the stock, with the latter having a price target of £1.42. This presents an 18% upside from current levels. And with insider buying activity picking up as well, it’s reasonable to say that sentiment surrounding the organisation is turning positive.

| Metrics | Taylor Wimpey | Industry Average |

|---|---|---|

| Price-to-book (P/B) ratio | 0.9 | 0.9 |

| Price-to-sales (P/S) ratio | 1.0 | 0.8 |

| Price-to-earnings (P/E) ratio | 6.6 | 11.4 |

| Forward price-to-sales (FP/S) ratio | 1.2 | 1.1 |

| Forward price-to-earnings (FP/E) ratio | 11.9 | 10.2 |

Ultimately, I believe the stock presents a great value proposition with tremendous long-term potential. Furthermore, it offers an opportunity to earn steady passive income with its mega dividend yields. Who’s to say no to that? Certainly not me, which is why I’ll be adding to my current position in due course.