I’m searching for new dividend opportunities from the ranks of FTSE 100 stocks. Investing in companies that offer attractive yields is a great way to earn a second income from the stock market.

One Footsie share stands out to me thanks to its 7.03% dividend yield and highly cash-generative business model. I’m referring to tobacco giant Imperial Brands (LSE:IMB).

Here’s how I’d target £500 in passive income each year by investing in the company.

Passive income from dividends

The Imperial Brands share price has climbed 31% over the past year. Currently, the shares trade for £20.08 each.

At today’s price, I could buy 356 shares with £7,150. That would leave me with £1.52 as spare change. At present, a stake in Imperial Brands of this size would generate £502.54 each year in passive income. That’s more than I could expect from the vast majority of FTSE 100 shares, considering the index’s average yield is 3.59%.

The company is maintaining its progressive dividend policy as things stand, in addition to increasing shareholder value via a £1bn share buyback programme due to conclude in September. Last year, the business distributed a whopping £1.32bn in dividends.

Of course, no dividends are guaranteed. However, the firm’s cash position looks very robust, which suggests the bumper payouts are sustainable. The company delivered almost £2.6bn in free cash flow last year. This translates into an adjusted operating cash conversion of 102%, up from 83% in 2021.

Where next for Imperial Brands shares?

I view this stock as a useful hedge against sky-high inflation, due to the company’s strong pricing power. After all, cigarette consumers have become accustomed to price hikes far greater than inflation over the years because of ever-increasing tobacco taxes.

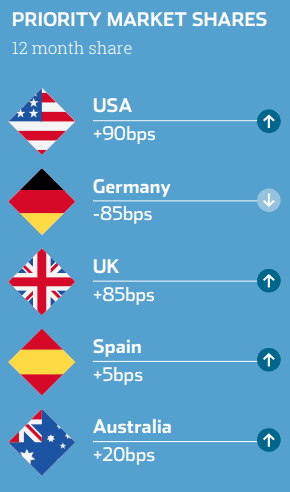

Imperial Brands enjoys a top-three position in terms of market share in its five largest markets. Collectively, they account for over 70% of the firm’s operating profit. Given their importance to the business, it’s encouraging to see the company delivered market share growth in four out of its five key countries.

A major challenge facing the business is the prospect of increasingly stringent legislation to limit the public health impact of smoking. To counter this threat, many tobacco companies are increasingly concentrating on their reduced-risk product ranges, which include vapes and non-combustible cigarettes.

In this regard, I think Imperial Brands needs to make further progress. It’s some way behind competitors like British American Tobacco. The rival firm has enjoyed greater success with its Vuse vapour products than Imperial Brands has managed with its comparable blu products. Granted, Imperial Brands has fared better with its oral nicotine Zone X range, but this remains a small market.

Why I’d buy this stock

Despite some challenges that cloud the outlook a little, if I had some spare cash I’d buy Imperial Brands shares now.

The company continues to make huge revenues from its core combustible tobacco business and the dividend yield is hard to beat.

With strong cash flow, a big share buyback programme, and a strengthening presence in its top five markets, I think this FTSE 100 stock looks like a solid investment for me today.