On the back of an aggressive rate-hiking cycle in 2022, Lloyds (LSE:LLOY) shares have jumped 35% from October lows. In fact, the bank stock is already up 15% this year. Nonetheless, its shares still remain cheap, which is why it may still be worth buying.

Interesting developments

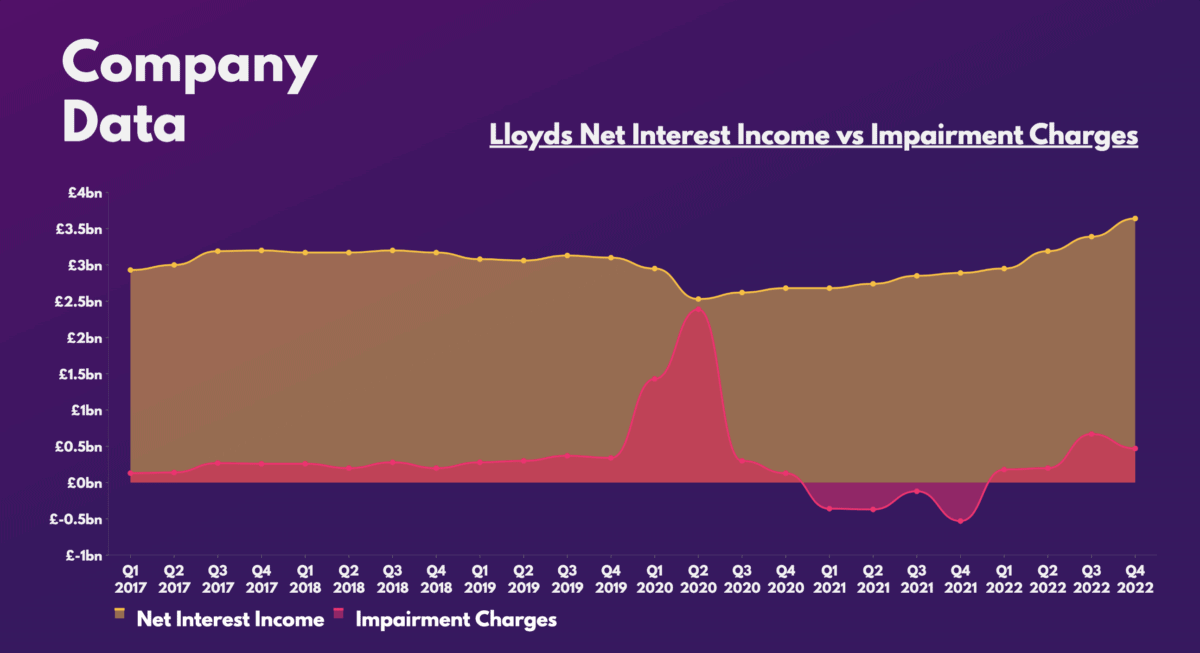

Lloyds reported its full-year results last month. Unfortunately, the numbers didn’t really impress. Net interest income (NII) saw a healthy improvement thanks to higher interest rates. This is a result of the company’s interest-bearing assets generating higher income than it has liabilities to pay. However, this was offset by higher impairment charges (bad debt). As a result, Lloyds shares’ trajectory towards 60p has lost some steam as net profit declined from a year before.

| Metrics | 2022 | 2021 | Growth |

|---|---|---|---|

| Net interest income (NII) | £13.17bn | £11.16bn | 18% |

| Net interest margin (NIM) | 2.94% | 2.54% | 0.4% |

| Impairment charges | £1.51bn | -£1.39bn | 209% |

| Net profit | £5.56bn | £5.89bn | -6% |

| Return on tangible equity (ROE) | 13.5% | 13.8% | -0.3% |

The outlook shared by Lloyds wasn’t great either. Compared to its other UK peers like Barclays and NatWest, the Black Horse Bank disappointed with its guidance. It’s forecasting a substandard net interest margin (NIM) for 2023, with interest rates expected to reach a peak very soon.

Should you invest £1,000 in Lloyds Banking Group right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Lloyds Banking Group made the list?

| Banks | 2022 NIM | 2023 NIM Outlook |

|---|---|---|

| Lloyds | 2.94% | >3.05% |

| Barclays | 3.54% | >3.20% |

| NatWest | 2.85% | >3.20% |

Nevertheless, the comparatively lower NIM forecasted is also exacerbated by a number of other factors. The main one is that Lloyds is having to share a bigger portion of its NII with its customers, or risk undermining its strong liquidity. Additionally, loan growth is most likely to slow due to the tougher macroeconomic environment. This isn’t helped by a declining housing market, as Britain’s largest mortgage lender anticipates seeing smaller loan income from lower house prices.

Marginal improvements?

Having said that, there are a few catalysts that could help boost the Lloyds share price upwards. The first would be the continued drop in impairments. Secondly, JP Morgan is now forecasting for the UK to narrowly avoid a recession. This could boost the lender’s bottom line from credit releases in 2023. And if house prices don’t come crashing down, Lloyds will be poised to benefit from any upside in the housing market in the medium term.

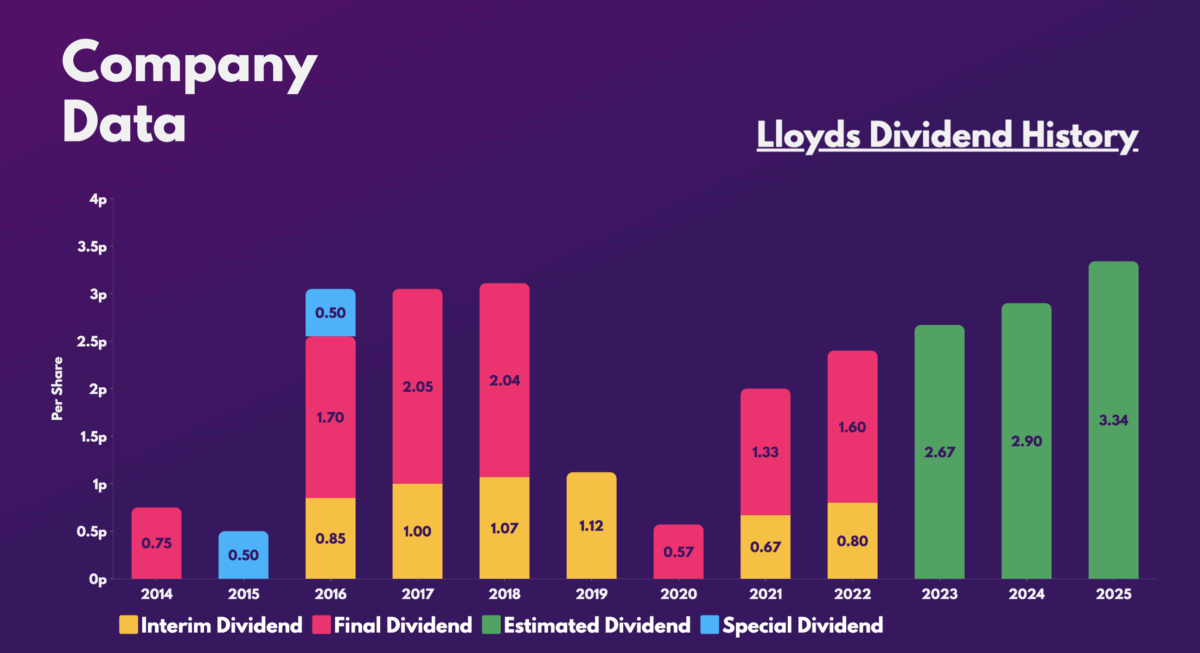

All of the following would not only result in a higher share price for Lloyds, but also a potentially higher dividend. That’s because the group’s CET1 ratio (which compares a bank’s capital against its assets) is currently at 14.1%. This is comfortably above its 12.5% target. Therefore, Lloyds plans to return the excess capital to shareholders via share buybacks and dividends, starting with a £2bn buyback. As such, analysts are projecting an increase in dividends over the next three years.

Are Lloyds shares a bargain?

So, are Lloyds shares worth a buy on that basis then? Well, there are a number of things that suggest so. For one, its strong balance sheet and liquidity insulates the FTSE 100 stalwart from any economic downturns. Moreover, the conglomerate is guiding for a better return on tangible equity (ROTE) as well as tangible net assets per share over the coming years.

| Metrics | 2023 | 2024 | 2025 |

|---|---|---|---|

| Return on tangible equity (ROTE) | 13.5% | 14.1% | 14.9% |

| Tangible net assets per share | 52.7p | 58.0p | 60.1p |

More lucratively, Lloyds shares are trading at relatively cheap current and future valuation multiples. Thus, it’s no surprise to see an array of investment banks, such as Barclays, UBS, and Deutsche rating the stock a ‘buy’, with an average price target of 70p. This presents a 37% upside from current levels. For those reasons, I’ll be looking to add to my current stake in Lloyds.

| Metrics | Lloyds | Industry average |

|---|---|---|

| Price-to-book (P/B) ratio | 0.7 | 0.7 |

| Price-to-earnings (P/E) ratio | 6.9 | 10.0 |

| Forward price-to-earnings (FP/E) ratio | 7.6 | 8.6 |