Those who invested in IAG (LSE:IAG) stock in October would’ve seen their wealth grown by 65%. As the travel sector continues to strengthen, the company’s share price is expected to continue growing. With that in mind, IAG shares could be an excellent pick for building long-term wealth.

A turbulent reaction

IAG’s shares were already up 25% this year, so investors had high expectations for the full-year earnings. While the firm’s bottom line matched analysts estimates, its top line disappointed slightly. Consequently, investors reacted negatively, sending the IAG share price down by 6%.

| Metrics | Consensus | 2022 | 2019 | Growth |

|---|---|---|---|---|

| Revenue | €24.38bn | €23.07bn | €25.51bn | -10% |

| Operating income | €1.20bn | €1.26bn | €3.29bn | -62% |

| Basic earnings per share (EPS) | €0.09 | €0.09 | €0.78 | -88% |

Nonetheless, the stock’s dip shouldn’t take the limelight away from what was otherwise a great year for the group as it continues to recover towards pre-pandemic levels. Although the conglomerate failed to beat consensus for its top and bottom lines, IAG still shared very encouraging travel numbers.

Capacity, revenue passenger kilometres, passenger numbers, and load factors all saw healthy increases from last year. Most notably, IAG managed to meet its guidance for Q4 capacity, which came in at 87% of 2019 levels.

| Metrics | 2022 | 2019 | Growth |

|---|---|---|---|

| Capacity/Available seat kilometres (ASK) | 263.59bn | 337.75bn | -22% |

| Revenue passenger kilometres (RPK) | 215.75bn | 285.75bn | -24% |

| Passengers carried | 94.73m | 118.25m | -20% |

| Load factor | 81.8% | 84.6% | -2.8% |

Long way to cruising altitude

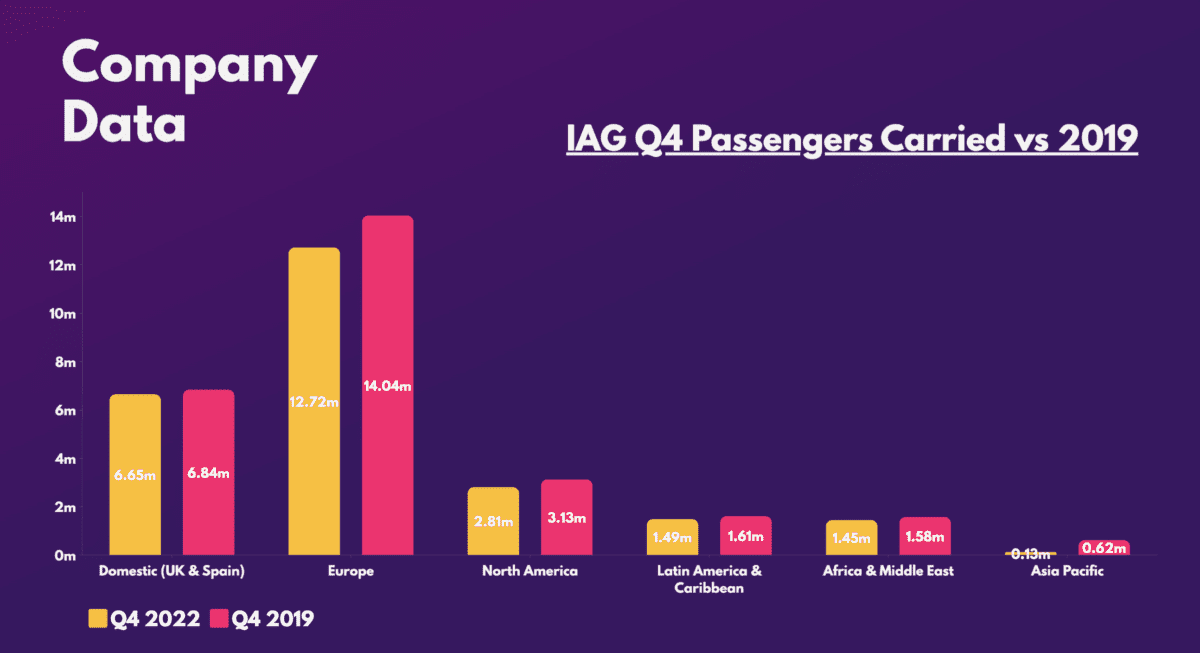

Having said that, there’s still more good news to come. Despite the sharp rebound in IAG’s share price in recent months, its upside potential remains tremendous with passenger numbers to all regions still having plenty of room to grow.

More importantly, business travel (B2B), which is known for its higher ticket yields, is still recovering steadily. This growth should continue to provide some uplift to IAG’s bottom line given its higher margins.

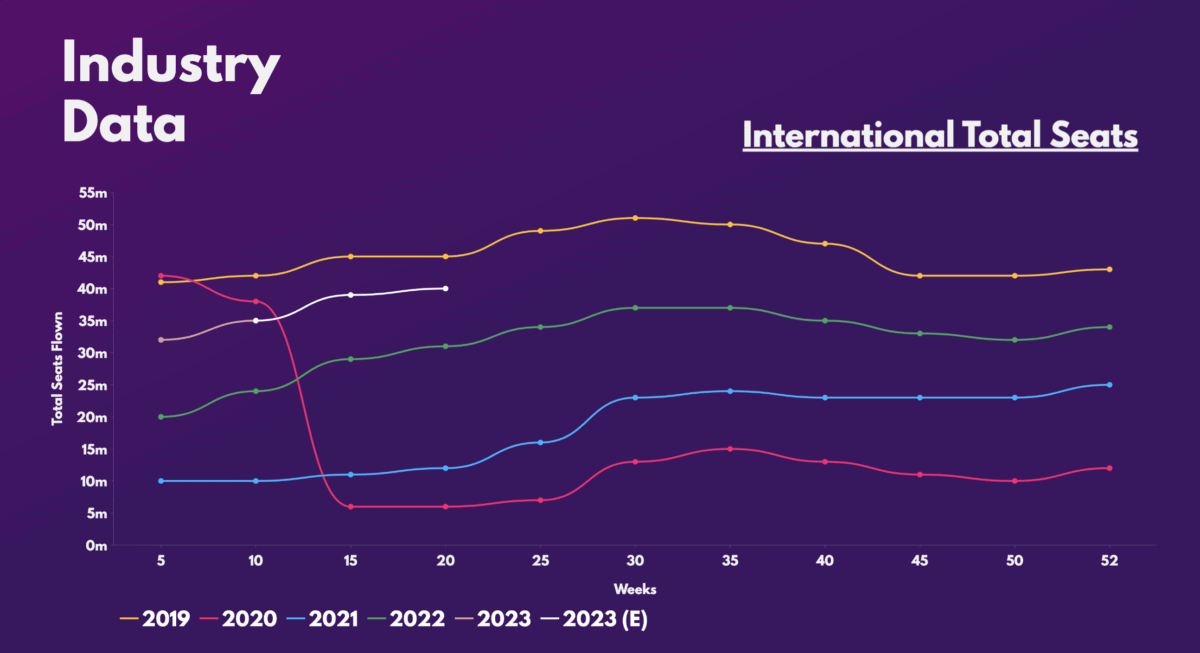

Therefore, CEO Luis Gallego upgraded the FTSE 100 stalwart’s outlook for the year ahead. He now expects Q1 capacity to be at 96% of 2019 levels, and for full-year capacity to come in at 98%. What’s more, the airline is forecasting operating profit before exceptional items to be in the range of €1.8bn to €2.3bn.

Are IAG shares worth it?

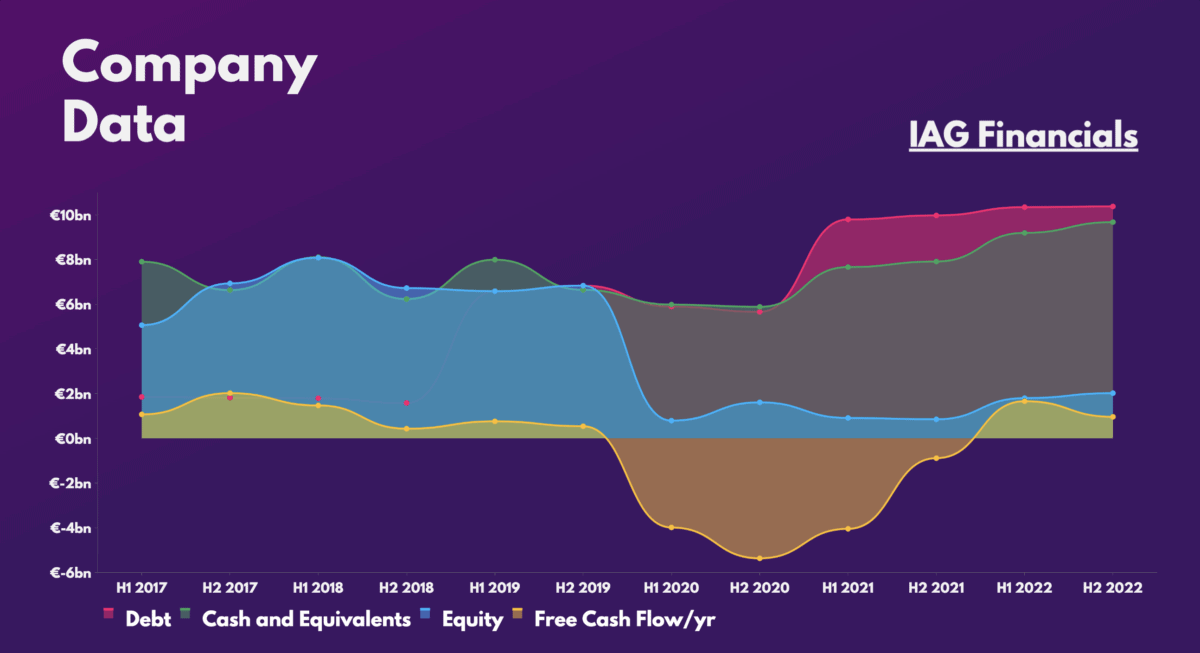

On that basis, are IAG shares worth a buy then? Well, its balance sheet remains in tatters. The fact that the board expects to retain net debt at €10.4bn in 2023 makes it all the more worrying. After all, the British Airways owner had already fished out €291m to cover interest on its floating rate debt last year. And with interest rates anticipated to remain higher for longer, its large debt pile isn’t going to help its bottom line.

Nevertheless, the stock’s valuation multiples can’t be ignored. Its current and forward multiples are trading at a much cheaper valuation than the industry average. Hence, it’s no surprise to see broker Liberium reiterating its ‘buy’ rating on IAG shares with a price target of £2.20. This presents a 40% upside from current levels.

| Metrics | IAG | easyJet | Industry average |

|---|---|---|---|

| Price-to-sales (P/S) ratio | 0.4 | 0.6 | 0.8 |

| Price-to-earnings (P/E) ratio | 20.1 | N/A | 15.9 |

| Forward price-to-sales (FP/S) ratio | 0.3 | 0.5 | 0.7 |

| Forward price-to-earnings (FP/E) ratio | 10.7 | 19.4 | 27.8 |

Additionally, the travel giant is looking to complete its acquisition of Air Europa by mid-2024. This should bring additional fleet capacity for the consortium to capture the growing international travel demand, while presenting lucrative growth opportunities in Latin America, the Caribbean, and Asia.

It’s safe to say that buying IAG shares could provide an opportunity to grow my wealth, and its current valuation makes an investment all the more enticing. However, I can’t get over its unhealthy debt pile, which is why I’d rather stay away. I’d rather invest in other travel-related stocks such as easyJet, which has as much upside potential as IAG, with healthier financials.