When it comes to investing, there’s no better mentor than Warren Buffett. That’s because the Oracle of Omaha has managed to outperform the stock market with his long-term investing philosophy. So, here are three stocks he’s invested in that I’m buying with a spare £1,000.

1. Apple

Apple (NASDAQ:AAPL) has been a mainstay in Warren Buffett’s portfolio for years. As of the latest filing, Buffett’s fund, Berkshire Hathaway, owns over 915m shares of Apple.

Although sometimes accused of being a ‘boring’ stock, Apple remains a leader in the smartphone industry, with an ever-growing user base. This not only boosts sales for devices, but also provides additional revenue when users adopt and buy the company’s services (Apple Music, iCloud, Apple TV).

Should you invest £1,000 in BP right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if BP made the list?

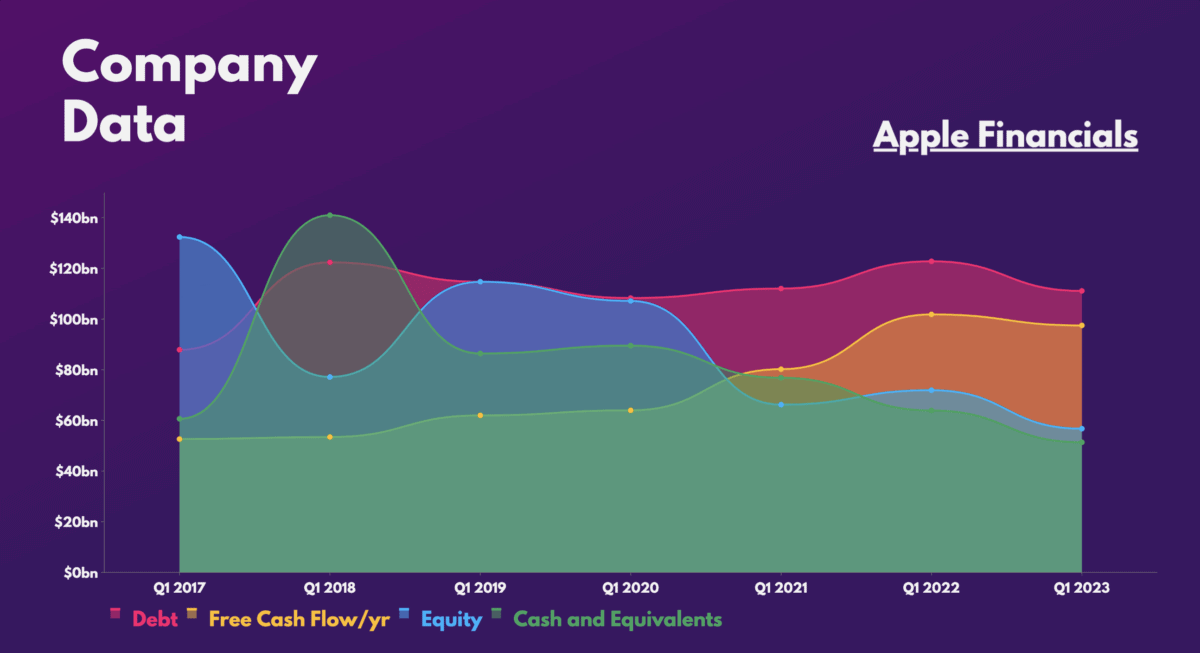

Additionally, Apple’s financials are impressive too. The firm generated a whopping $394bn in revenue in sales last year and is constantly growing its profit margins. Its cash pile is also massive, sitting at $24bn, giving it room to increase shareholder value through stock buybacks and dividends. Thus, it’s easy to see why Warren Buffett is such a big fan of the world’s most valuable company.

2. TSMC

Taiwan Semiconductor Manufacturing Company (NYSE:TSM) is the world’s largest semiconductor foundry. It’s responsible for producing chips for some of the biggest names in the tech industry. These include the likes of AMD, Qualcomm, and Apple.

Warren Buffett recently sold almost all of his stake in TSMC, which alarmed many investors. However, I’m still bullish on the manufacturer as it remains the industry leader, creating the world’s most advanced chips.

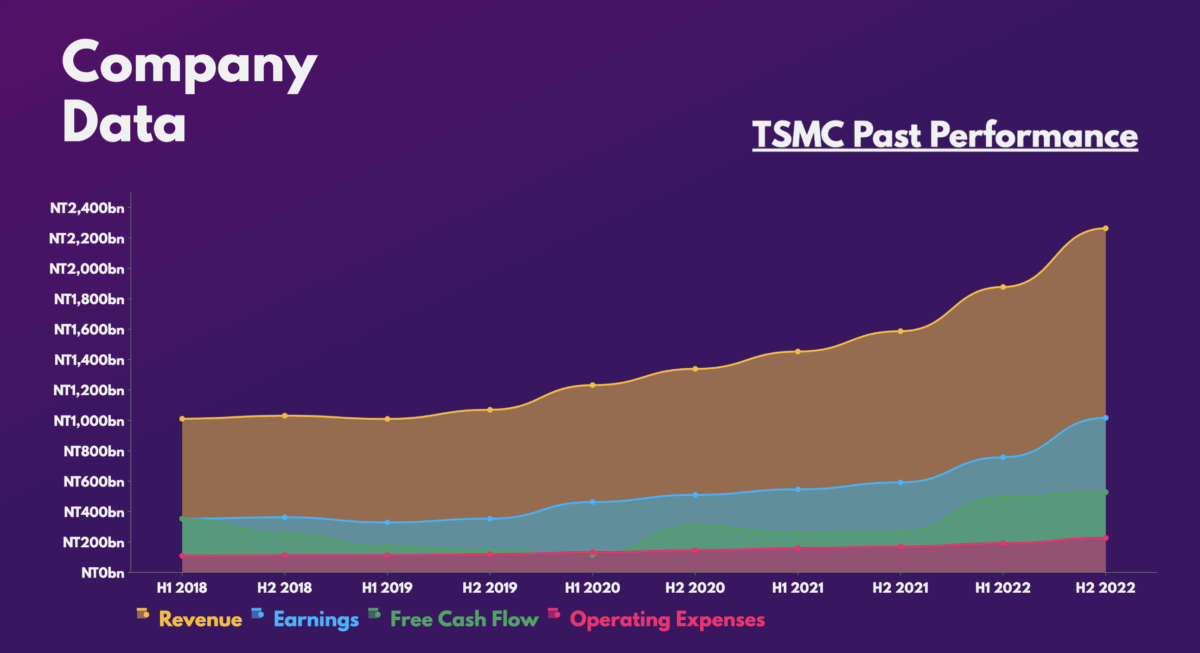

More importantly, TSMC’s financials are extremely impressive. The group is effectively a money spinner as it’s been able to grow revenues while expanding profit margins seamlessly. This is due to the growing demand for semiconductors, as the world becomes increasingly digitalised with more and more devices requiring chips.

The recent downturn in demand may have dented TSMC’s share price. But a rebound will eventually kick in, and a rally could get underway. After all, its current price-to-earnings (P/E) ratio of 13 is ludicrously cheap for a growth stock.

3. Diageo

Warren Buffett only owns a tiny position in spirit-maker Diageo (LSE:DGE). Nonetheless, I reckon it’s a great stock to own, especially during the current cost-of-living crisis.

The drinks company has reported solid numbers over the course of 2022, showing its resilience despite high inflation. That’s because the business has a strong market position and is well-positioned to benefit from the growing demand for premium alcoholic beverages.

The FTSE 100 stalwart is also lining up acquisitions to expand its portfolio. As such, the potential for the Johnnie Walker-owner to continue growing its profits is certainly there. Therefore, its forward P/E of 20 could indicate that the stock is reasonably valued.