Lloyds (LSE:LLOY) shares have had a mixed reaction after the company reported its full-year results on Wednesday. Like the rest of its FTSE peers, the bank offered a rather uncertain outlook for the year ahead. Nonetheless, I think it’s still a solid stock to hold for passive income.

Interesting results

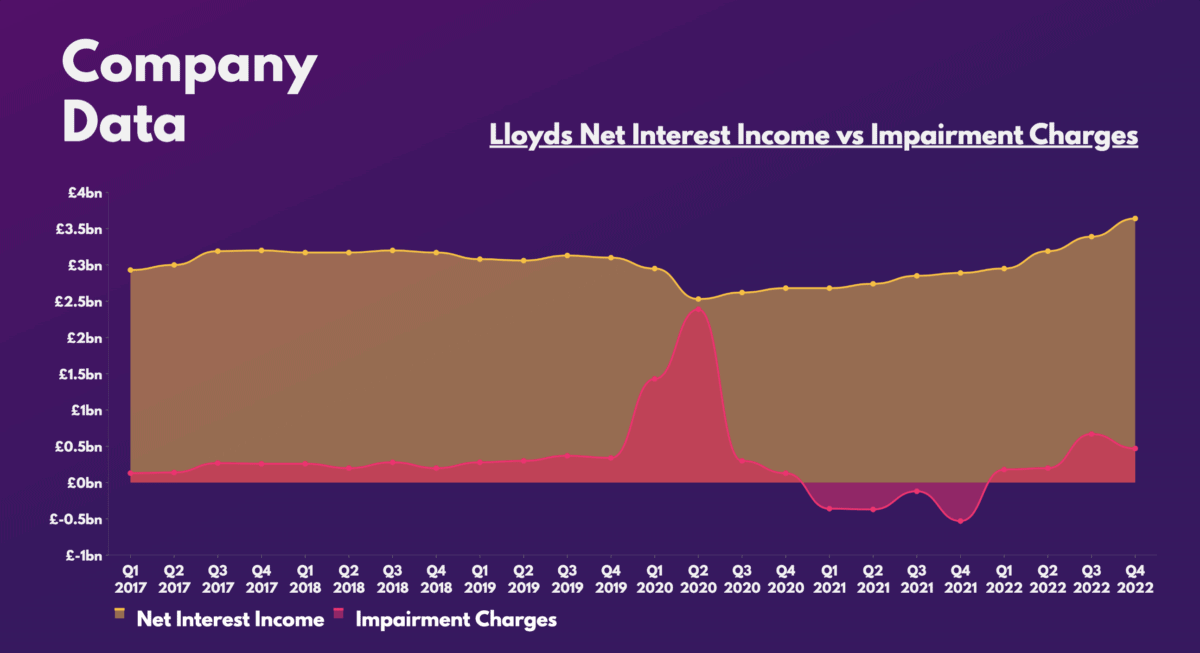

We got a bit of a mixed bag when Lloyds shared its full-year figures. Q4 looked rather impressive as the bank beat analysts expectations on almost all fronts. Unfortunately though, Q4’s higher-than-expected impairment charges were a sore point.

| Metrics | Consensus | Q4 2022 | Q4 2021 | Growth |

|---|---|---|---|---|

| Net interest income (NII) | £3.55bn | £3.64bn | £2.89bn | 26% |

| Net interest margin | 3.16% | 3.22% | 2.57% | 0.65% |

| Impairment charges | £380m | £465m | -£532m | 187% |

| Net profit | £1.21bn | £1.52bn | £0.42bn | 262% |

| Return on tangible equity (ROE) | 12.5% | 16.3% | 2.9% | 13.4% |

What’s more, the outlook for the year ahead wasn’t great. The firm predicted the net interest margin to be no greater than 3.05%, below the 3.2% that peers Barclays and NatWest are expecting. This means that profit margins could be lower in 2023.

Should you invest £1,000 in BT right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if BT made the list?

Additionally, both underlying profit and profit after tax were weaker compared to the prior year. This was disappointing given its earnings potential in a high-interest environment. This was due to 2022’s impairments being much higher than last year’s credit release. As such, even though NII (the interest the bank generates on financial assets, minus the interest it pays on its liabilities) improved substantially, it was offset by its increase in bad debt.

Nonetheless, there were still plenty of positives to take away from the report. Impairments seem to be stabilising while NII continues to grow. So, provided the Bank of England continues to leave interest rates elevated throughout 2023, profit margins have the potential to creep back up. This would be a positive for Lloyds shares and its passive income potential.

Stable income?

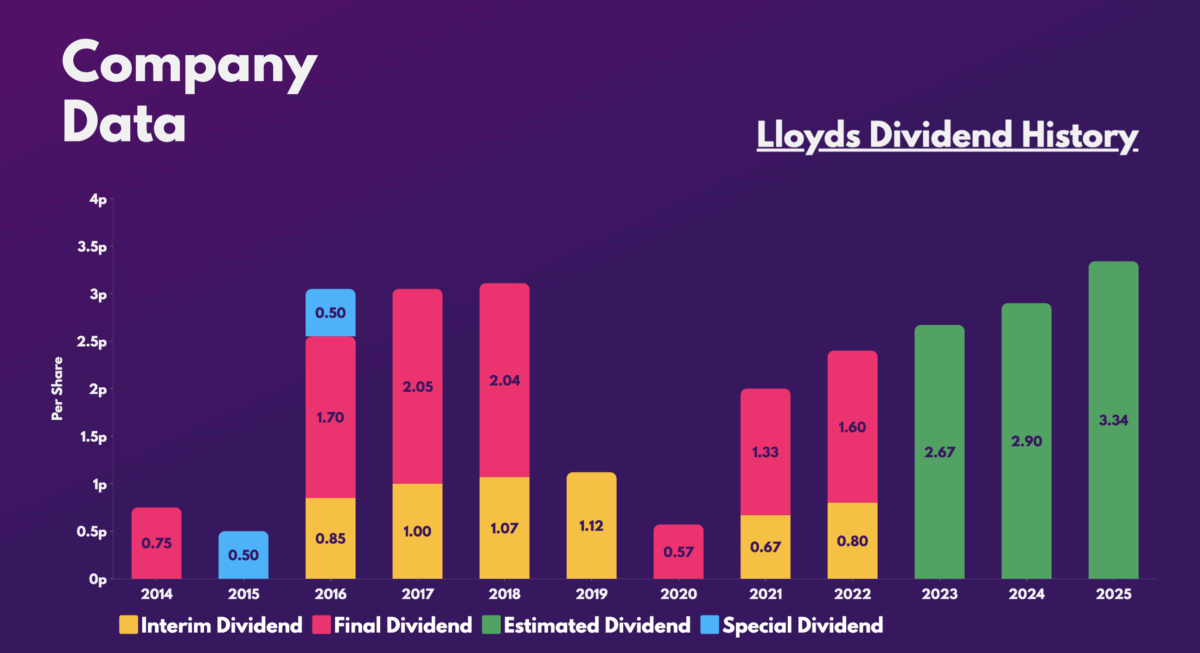

Most importantly though, the lender reported a final dividend of 1.6p per share. This brings the group’s dividend yield to 4.6% in 2022. Although not stellar compared to the likes of commodity giants and housebuilders, it’s still a respectable yield to earn some passive income.

What could leave investors excited, however, may be the forward yields. The Black Horse bank’s CET1 ratio (which compares a bank’s capital against its assets) is currently above its 12.5% target at 14.1%. And it plans to return the excess value to shareholders by 2024, starting with a £2bn stock buyback programme.

Ultimately, Lloyds shares at this stage may prove to be a bargain if the economy and the housing market don’t continue to sink from here. Impairments could start to taper off, releasing some credit reserves, and improving returns. And with economic data being less gloomy than had been imagined, investors could see higher payouts moving forward.

A balancing act

Lloyds has a reputation of overpromising and underdelivering. Hence, I believe the board has done well to lower expectations for the year ahead. With the latest economic data showing some promise, I still rate Lloyds, and see it being a potential winner in 2023 in terms of share price growth and returns to shareholders.

After all, the stock’s valuation multiples and average price target (65p) mean it could be a lucrative investment. In fact, Jefferies, Citi, and Barclays still rate the stock a ‘buy’. Thus, I’ll be loading up on more shares for my portfolio to capitalise on the potential to earn more passive income.

| Metrics | Lloyds | Industry average |

|---|---|---|

| Price-to-book (P/B) ratio | 0.7 | 0.7 |

| Price-to-earnings (P/E) ratio | 6.8 | 9.8 |

| Forward price-to-earnings (FP/E) ratio | 7.1 | 6.8 |