Whenever a company has spare cash on hand, it usually has three options — pay off debt, reinvest it, or return it to shareholders through stock buybacks or dividends. Every once in a while, a special dividend is paid, and Tesco (LSE:TSCO) shares could come with one of those this year.

Banking on a sale

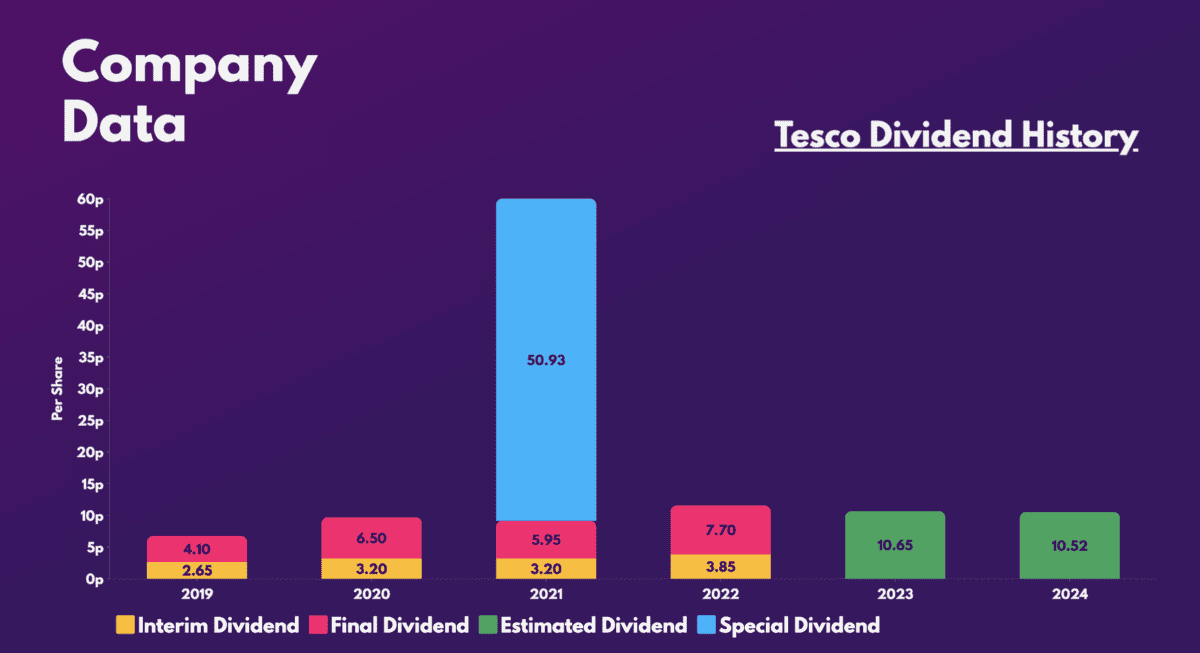

Back in 2020, Tesco sold its Malaysian and Thailand businesses for £8.2bn. Subsequently, the firm used the proceeds to repay shareholders through the largest ever special dividend issued by a British company. The payout was worth £5bn, or 50.93p per share. This meant that the shares yielded a mind-boggling 20%.

As such, there has been plenty of excitement over the latest rumours surrounding the potential sale of Tesco’s banking division. Although selling its financial arm wouldn’t generate nearly as much cash as its South East Asian businesses did, a valuation of £1bn is still something to get excited about.

Should you invest £1,000 in Abrdn right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Abrdn made the list?

No payday?

Having said that, a special dividend isn’t guaranteed by any means. Tesco may not necessarily want to share the spare cash with its shareholders. That’s because there’s an array of other options for which the FTSE 100 group may want to use the cash.

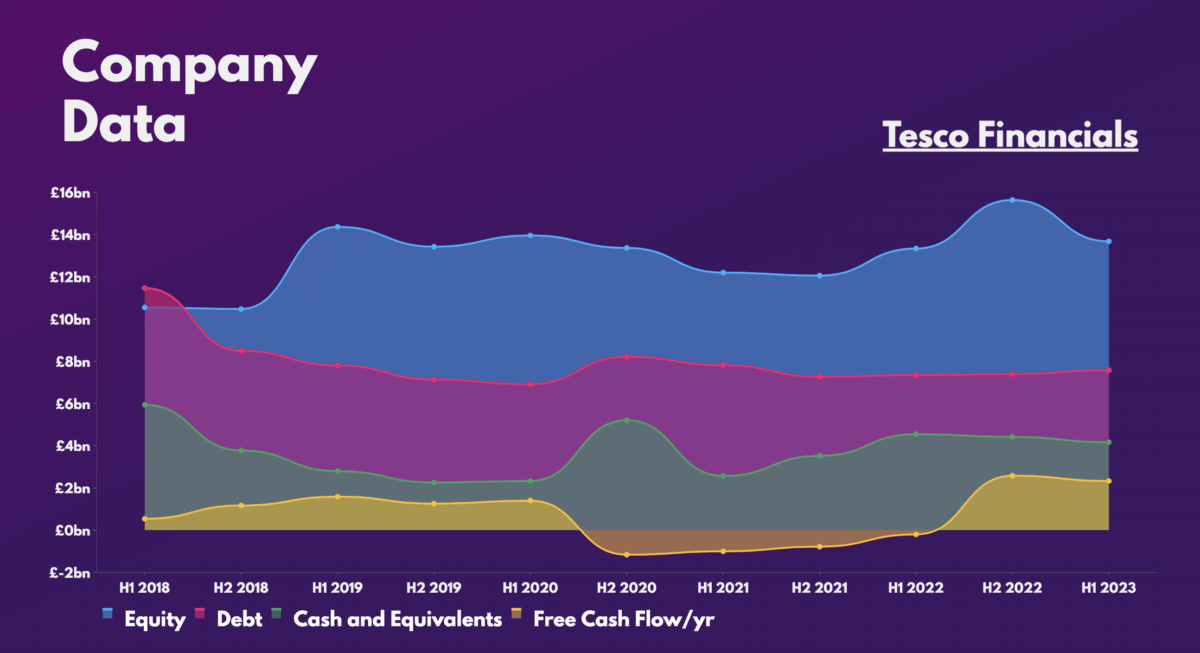

One instance would be to acquire smaller businesses as it has done in the past — it recently bought Paperchase, for instance. Alternatively, management may choose to use the cash to improve the state of its financials. While Tesco’s balance sheet isn’t the worst, it certainly has room for improvement, and its short-term debt isn’t sufficiently covered by its cash levels. Nonetheless, it’s worth noting that this is generally acceptable for retailers given their ability to generate revenue quickly from inventory.

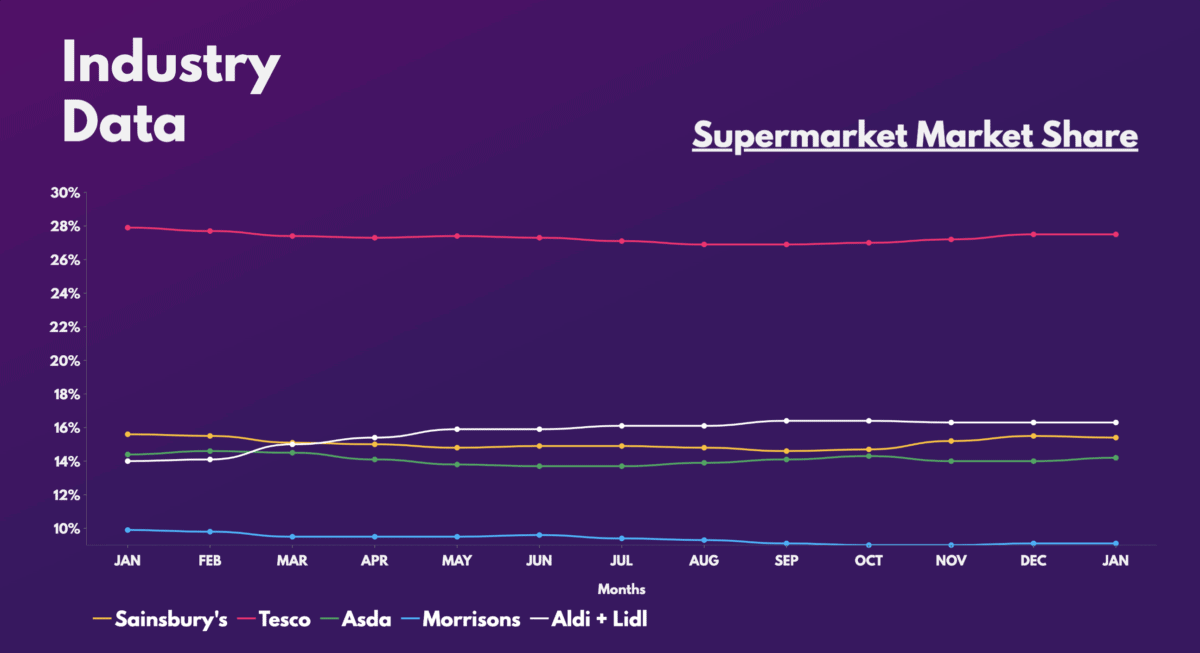

On the other hand, the board may choose to use the capital to further expand the supermarket’s footprint. This could also boost the value of Tesco shares through potential future growth. After all, the grocer is facing increasing competition from budget chains Aldi and Lidl. The former recently announced its intention to continue expanding its operations throughout the UK and could snatch some of Tesco’s massive market share.

Are Tesco shares worth it?

Are Tesco shares worth me buying on the basis of a potential mega dividend then? Well, the opportunity to benefit from a bumper payout is certainly appealing. However, buying a stock based on a chance of a one-off event doesn’t necessarily make a good investment. And besides, there are many factors that have to align in order for the sale to go through.

News outlets aren’t ruling out a partial sale or even a joint venture with high street banks either. What’s more, CEO Ken Murphy has been publicly supportive of the conglomerate’s banking presence, which could make a sale difficult.

Additionally, the stock’s current and future valuation multiples don’t exactly scream a bargain. It has an average price target of £2.98, roughly 19% higher than the current price. But the company’s lack of growth avenues, razor-thin profit margins, and uncertain dividend aren’t ideal. Hence, it’s no surprise to see Shore Capital rate the shares a ‘hold’.

| Metrics | Tesco | Industry Average |

|---|---|---|

| Price-to-book (P/B) ratio | 1.3 | 1.4 |

| Price-to-sales (P/S) ratio | 0.3 | 0.3 |

| Price-to-earnings (P/E) ratio | 19.2 | 14.1 |

| Forward price-to-sales (FP/S) ratio | 0.3 | 0.4 |

| Forward price-to-earnings (FP/E) ratio | 12.7 | 12.5 |

Ultimately, if dividends are truly the be-all and end-all of a potential investment, there are other FTSE names out there with better financials, larger margins, better growth prospects, and most importantly, larger and steadier dividend yields. Thus, I won’t be buying Tesco shares today.