Lloyds (LSE:LLOY) shares make up an important portion of my passive income portfolio. I’m planning on buying more this year, as climbing interest rates continue to support the banking group’s net interest margin.

With enough spare cash, here’s how I’d invest £5,000 in Lloyds to target £200 in annual dividend payouts.

A top dividend stock

The Lloyds share price has gone nowhere over the past 12 months. But when dividends are included shareholders have secured a positive return. What’s more, the share price has started 2023 on a positive note, rocketing 9% since the beginning of January.

At present, the bank yields 4.16%, which is above the average for FTSE 100 shares at 3.6%.

If I had £5,000 to invest, I could buy 9,758 shares at today’s price of 51.24p. Unfortunately I don’t have enough spare cash to invest that amount in one go. Nonetheless, I already own some Lloyds shares and I reinvest the dividends I receive to work towards this target.

At today’s yield, a £5,000 investment would yield £208 in annual passive income. City analysts forecast the dividend yield could rise as high as 5.9% this year, which might mean a £5,000 stake in the bank at today’s share price could deliver an even greater amount in dividend income.

That being said, dividends aren’t guaranteed. I’ll keep a close eye out for any guidance on shareholder payouts in the Q4 results due to be released next week.

The outlook for Lloyds shares

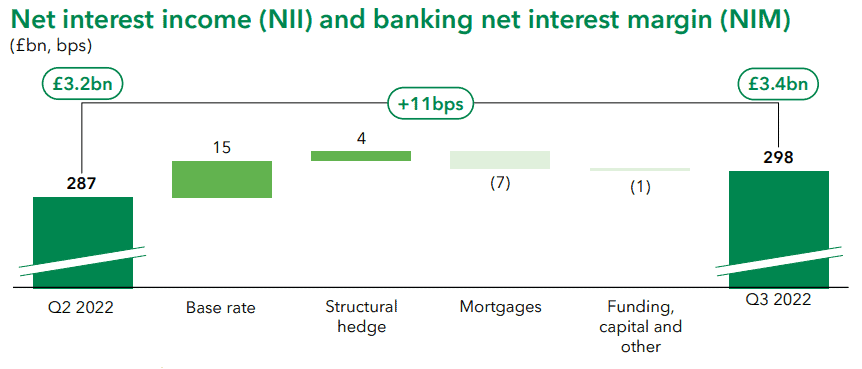

Confronted with double-digit inflation, the Bank of England is widely expected to continue hiking the base rate this year. This is good news for the Lloyds share price, as the black horse bank’s net interest income and net interest margin benefit from rising borrowing costs. Evidence of the positive effects can already be seen in the latest results for Q3.

A cooling housing market is a risk Lloyds might have to contend with as the UK’s largest mortgage lender. The gloomiest predictions call for a 40% crash in 2023, which would be devastating. The banking group is a little more sanguine, anticipating an 8% fall, or possibly as great as 18% in the worst case scenario.

Even so, I think the loan book looks sufficiently resilient to survive a downturn. For instance, 96% of the bank’s mortgages are below 80% LTV. In addition, the average household income for Lloyds mortgage customers is around £75k per year.

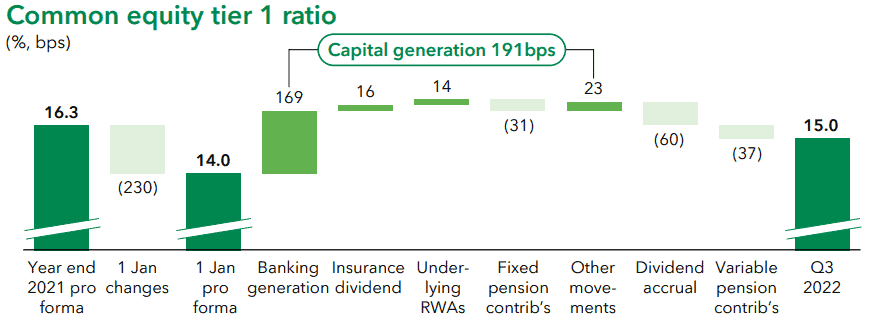

The group also looks well-capitalised. Lloyds’ CET1 ratio is a healthy 15%, which is above its 12.5% target. A price-to-earnings ratio of 8.45 is another attractive feature in my view. This suggests a value investment opportunity at today’s share price.

My passive income portfolio

I think 2023 could be a good year for banking stocks. Lloyds looks like the best of the Footsie bunch to me, thanks to its market-leading dividend yield.

It also has less exposure to investment banking than its rivals Barclays and HSBC. I view this as a positive in a year that’s likely to lack new mergers and IPOs.

I’ll continue investing in Lloyds shares throughout the year to build my passive income streams.