I don’t have unlimited reserves of capital I can use to invest. But here are two terrific dividend shares — one of which is a soaring small-cap share — I’ll buy for my portfolio if I have cash to spare.

I believe they could provide a healthy second income for years to come.

Central Asia Metals

Investing in mining shares can be a wild ride. Even the best-run raw materials producer can endure profits crashes when commodity prices fall. The Central Asia Metals (LSE:CAML) share price for example sank last summer as prices of industrial metals came under pressure.

Should you invest £1,000 in Brickability Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Brickability Group Plc made the list?

But I’d still buy this mining company for my shares portfolio today. This business — which is listed on London’s Alternative Investment Market (AIM) — produces copper from Kazakhstan. It also owns a lead-and-zinc-producing asset in North Macedonia.

I like this particular business because of its impressive record of production. The mining giant beat output estimates again in 2022 at its Kounrad copper project after another record year. Central Asia Metals also produces metal at extremely low cost.

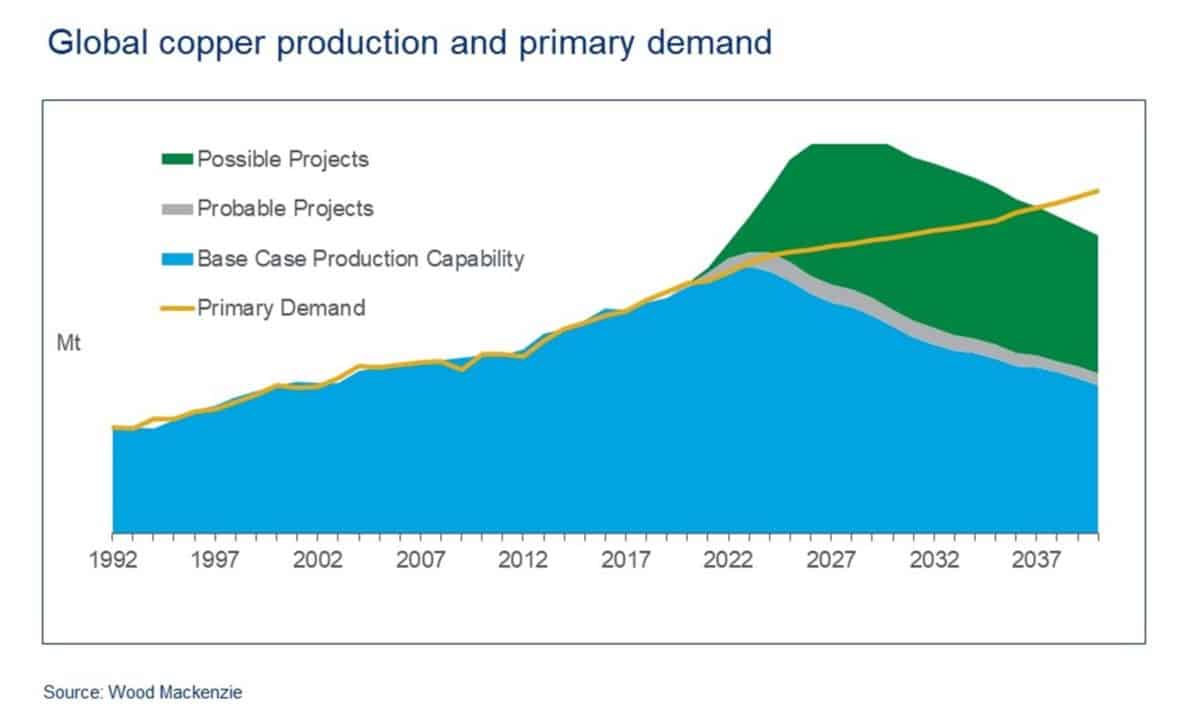

I think profits here could soar from later on this decade if likely supply shortages emerge and prices of base metals rise. The graph below from Wood Mackenzie illustrates how copper demand, for example, could be on course to outstrip future production. Trends like increasing urbanisation and the energy transition will both supercharge demand for the red metal.

I also think Central Asia Metals is a top stock for dividend income. Today it carries a 7% dividend yield. I think this is too big to ignore.

Brickability Group

Investing in small-cap shares can be a great idea for growth-hungry investors. But many smaller UK stocks can also be great investments for passive income. This is where building product manufacturer Brickability Group (LSE:BRCK) comes in.

As the name suggests, this AIM stock makes its money predominantly from selling bricks. Sales volumes of these critical components are tipped to soar as housebuilding activity in Britain picks up (the government is targeting the creation of 300,000 new homes each year).

In fact trading at Brickability is already very impressive. Last week it announced that it “continued to deliver a strong performance across all of its business divisions” and hiked its profit forecasts for the year. That’s even as the housing market suffers near-term softness due to rising mortgage costs.

I’m also expecting a strong repair, maintenance and improvement (RMI) market to underpin strong profits growth at the firm. The UK has one of the oldest housing stocks in the world. This means constant updating is required to stop the country’s homes crumbling into dust.

Now let’s look at Brickability’s dividend forecasts. For the financial years to March 2023 and 2024 the dividend yield sits at a juicy 4.5% and 4.7% respectively.

Making bricks is an energy-intensive process. So Brickability’s profits could suffer if oil and gas prices spike again. But on balance I think this small-cap share could be a great way to make excellent dividend income.