I knew I had a healthy inflow of cash coming into my Stocks and Shares ISA. So I’d been thinking of ways to use this to boost my passive income.

On Friday, I received £1,611.30 for the shares I previously owned in Biffa. The waste management company was acquired by US private equity firm in a deal that completed in late January.

As a side note, the deal valued Biffa shares at 410p, much higher than the 186.4p I bought them for back in 2017. Not a bad little earner that, once again, underlines the wisdom of long-term investing!

I already had a couple of hundred pounds sitting in my ISA on Friday. This gave me £1,890 which I used to open a position in the Artemis High Income fund.

Rebalancing my portfolio

Regular readers will know that we at the Fool believe stock investing is one of the best (if not the best) way to generate long-term returns.

Through a combination of capital appreciation and dividend income they tend to provide a healthy average yearly return of 8%. This is why my Stocks and Shares ISA is geared heavily towards UK shares.

However, we also believe that a diversified portfolio has big benefits by reducing risk. So I’ve been looking at ways to boost my exposure to less-risky assets like bonds.

In my opinion, Artemis High Income fund is a great way for me to achieve this. This investment fund still provides me with exposure to global stock markets. But it aims to plough the majority of investors’ cash (80-100% of it, in fact) into government and corporate bonds.

A regular outperformer

More specifically, this fund is focused on high-yield bonds. As a consequence, it carries a tasty 6% distribution yield right now.

The downside to this is that 57.4% of Artemis High Income’s portfolio is loaded with non-investment-grade assets. Lower-quality assets like these provide higher yields. However, they also carry a higher risk of default.

That said, the quality of the investment team behind the fund went a long way to reassuring me that I wasn’t investing in a money trap.

Fund manager David Ennett has been described as “a talented high yield bond fund manager” by Hargreaves Lansdown (who has also put Artemis High Income on its shortlist of favourite wealth funds). He also has the support of a celebrated fixed-income team at Artemis.

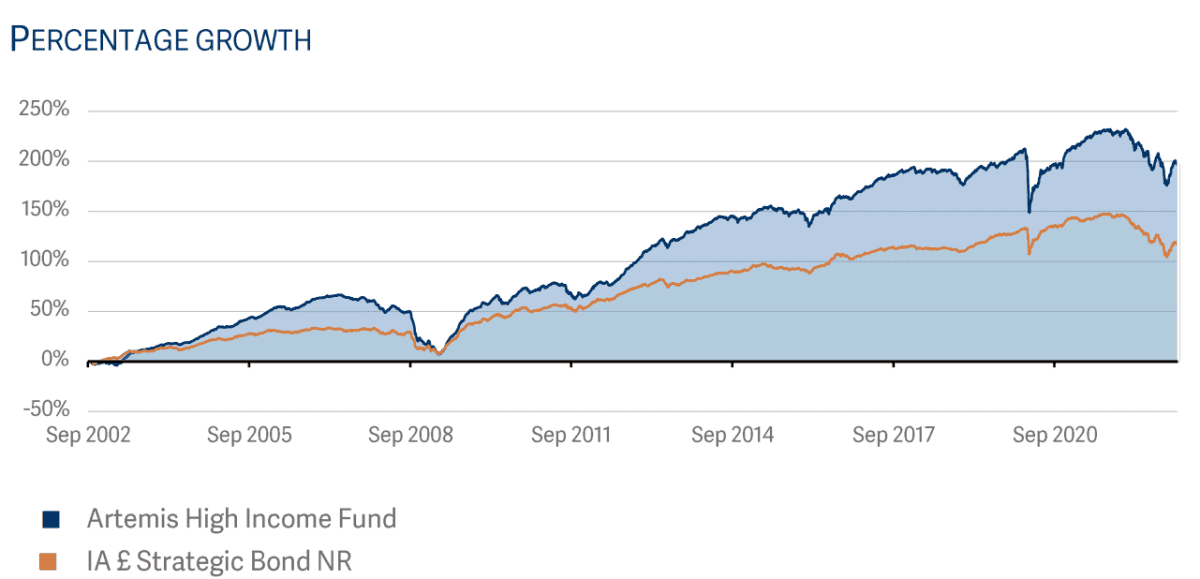

Indeed, the fund’s outperformance versus other funds with similar assets (as the chart above illustrates) is testament to the enduring strength of the team at Artemis.

I also like the fact that Artemis gives me the option to receive my income monthly. This means I don’t have to wait a long time to reinvest the money I receive, giving me a better chance to supercharge my wealth through the miracle of compounding.

I plan to continue devoting most of my spare cash to investing in UK shares. But buying funds like the one above can also be an important part of any winning portfolio. I certainly expect it to significantly boost my own long-term passive income.