Food inflation is now at multi-decade highs. Hence, it was no surprise to see supermarket shares tumble last year. With Tesco (LSE:TSCO) and J Sainsbury (LSE:SBRY) being the UK’s most popular supermarket stocks, I’ll be assessing which one’s a better pick for my portfolio.

The case for Tesco

Tesco is the UK’s biggest supermarket and retailer. It has operations across central Europe, but the bulk of its profits are generated locally and from its grocery arm. It also derives income from its catering business (Booker), Tesco Bank, its F&F fashion range, and more.

Shares in the giant retailer had dropped by as much as 30% at one point last year. Nonetheless, they’ve staged a respectable recovery since.

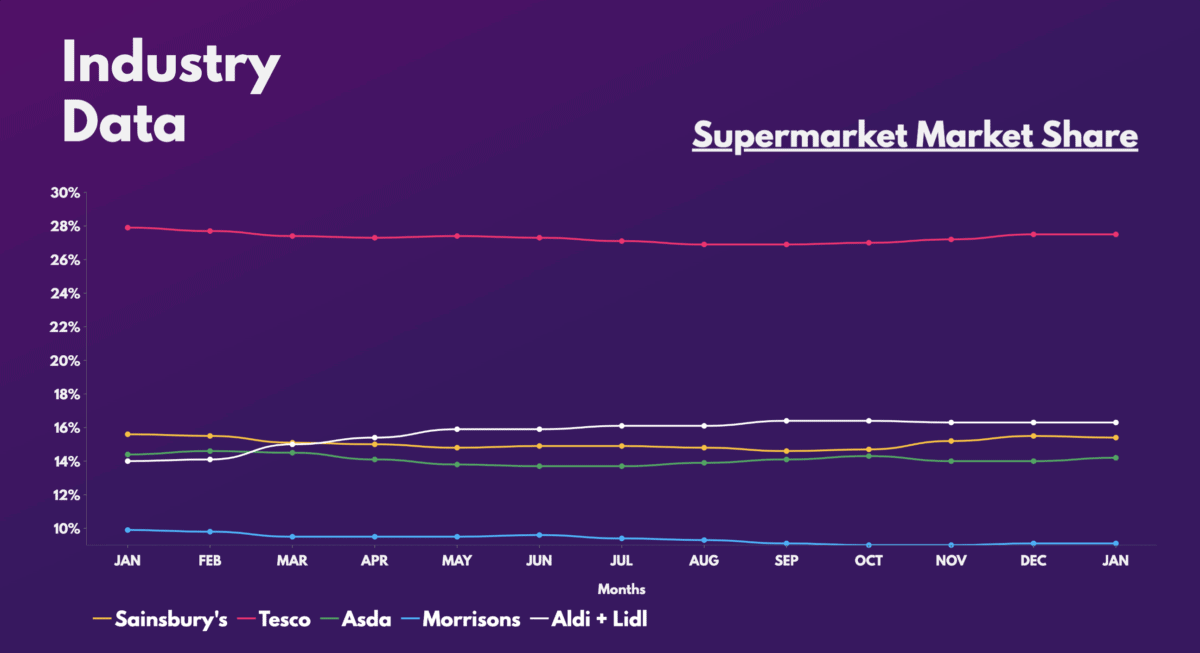

This recovery can be attributed to a number of recent positives. But the biggest one would be that Tesco managed to hold on to its commanding market share. This was despite the cost-of-living crisis and consumers flocking to budget chains. In fact, the company is the only major supermarket to have grown its market share since 2019.

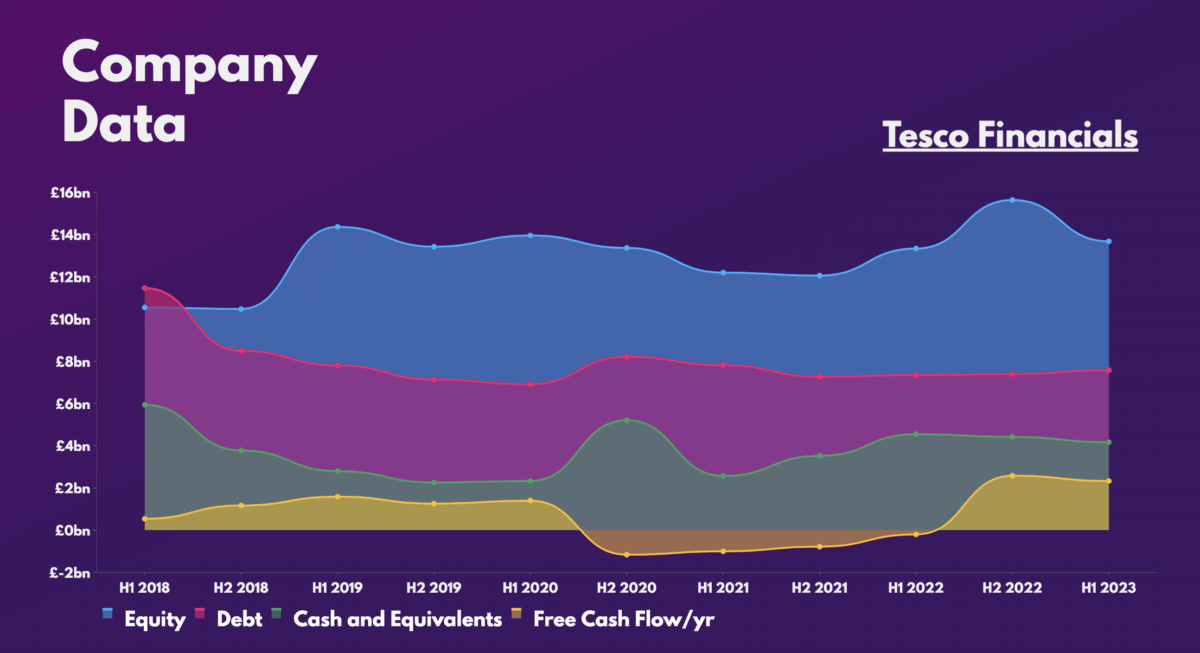

It’s worth noting though, that the FTSE 100 stalwart doesn’t have an ideal balance sheet. Debt levels are usually higher for retailers due to their large inventories. However, Tesco’s cash levels still lag its short-term liabilities, which could impact future earnings potential if free cash flow deteriorates.

The case for Sainsbury’s

The alternative stock pick is J Sainsbury. Sainsbury’s also has an array of operations. They include Argos, Nectar, Habitat, and more. And similar to its retail peers, the orange-branded firm has staged a monumental recovery, and is up 50% from its bottom.

But what’s distinguished it from Tesco this year has been the behind-the-scenes action. The Sainsbury’s share price started flying as soon as Bestway, the UK’s largest independent wholesale conglomerate, disclosed it was buying a substantial stake in the grocer.

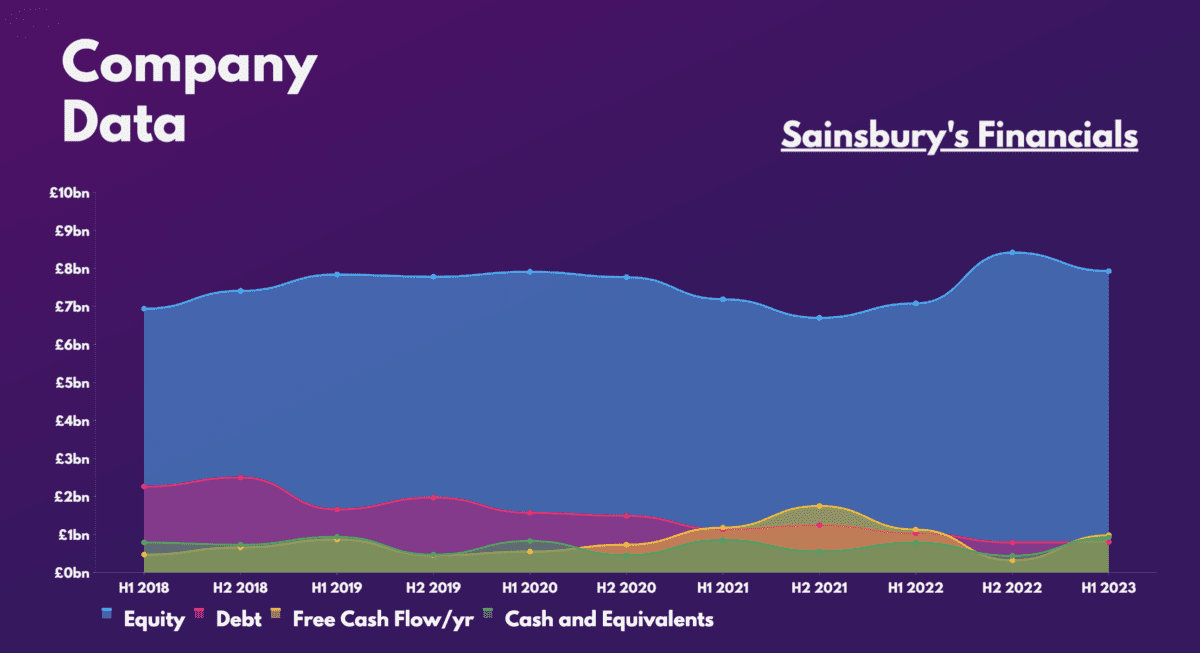

Although a takeover is unlikely for now, Bestway’s purchase certainly has investors excited. That’s because the wholesaler is renowned for its effective cost-saving strategies. So there’s hope that it could be influential enough to help improve Sainsbury’s margins and financials. After all, the group has seen its debt levels gradually decline over the past few years.

My stock pick

Having said that, picking between the two stocks isn’t an easy task. That’s because Tesco and Sainsbury’s are excellent blue-chip shares. What’s more, they have identical dividend yields (4.7%). Nevertheless, the difference between the two lies in their upside potential.

Tesco offers stability and steady passive income, but limited growth. While the same is true for Sainsbury’s, one could argue that there’s more upside potential given the better opportunity to grow its market share. This is especially the case with Bestway’s backing.

So, which stock would I pick for my portfolio? Well, if I was a retiree, I’d probably pick Tesco for its steady dividends and safety. But because I’m willing to seek out more growth opportunities, I’d pick Sainsbury’s. After all, it’s currently trading at cheaper valuation multiples than its industry leader, and has a better balance sheet.

| Metrics | Tesco | Sainsbury’s | Industry average |

|---|---|---|---|

| Price-to-book (P/B) ratio | 1.3 | 0.8 | 1.4 |

| Price-to-sales (P/S) ratio | 0.3 | 0.2 | 0.3 |

| Price-to-earnings (P/E) ratio | 18.6 | 10.3 | 14.1 |

| Forward price-to-sales (FP/S) ratio | 0.3 | 0.2 | 0.7 |

| Forward price-to-earnings (FP/E) ratio | 12.3 | 13.6 | 13.3 |

That said, I’m not a fan of investing in companies with low profit margins. And unfortunately, neither Tesco nor Sainsbury’s exhibit quality earnings yet. Rather, I prefer buying stocks with higher profit margins, such as Marks and Spencer. Thus, I won’t be investing in either of the supermarket giants today.