As interest rates continue on their upward trajectory, so do Lloyds (LSE:LLOY) shares, it seems. The bank stock is already up by more than 10% this year, and could rise higher with the company set to report its Q4 numbers next week. With that in mind, I’ll be expanding my position.

A cash machine

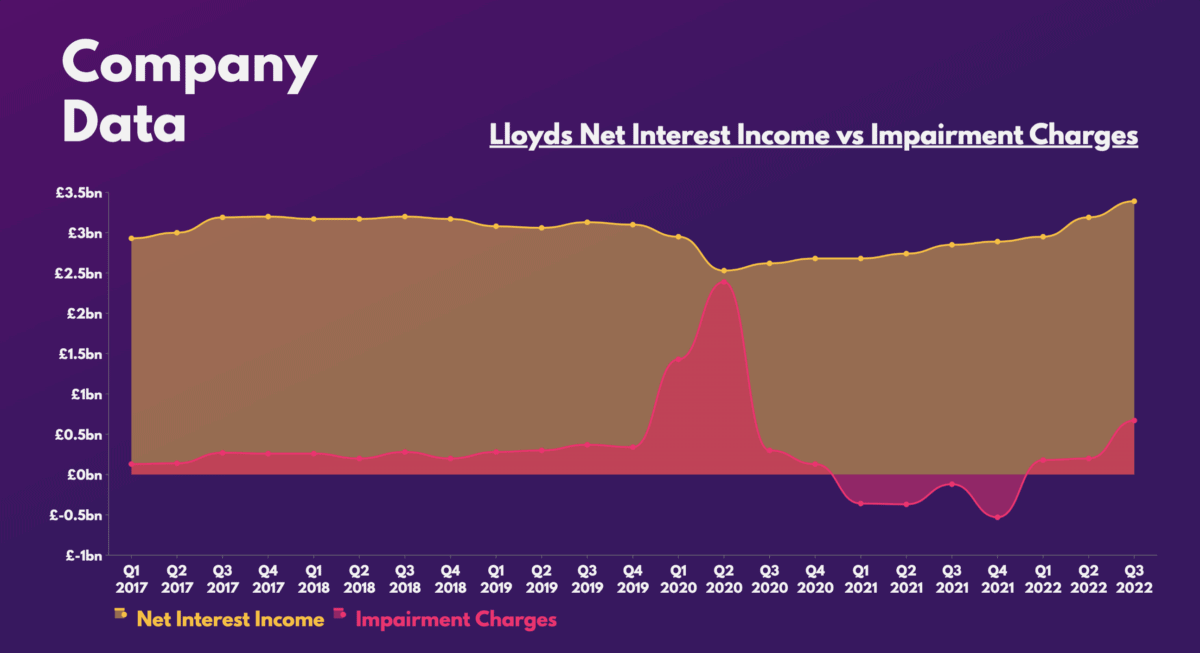

Lloyds’ recent strength in performance can be attributed mainly to the rise in net interest income (NII). That’s the interest the bank generates on financial assets, minus the interest it pays on its liabilities. And with approximately £80bn worth of assets stored with the Bank of England (BoE), Lloyds shares have been a huge beneficiary from interest rate hikes while generating free cash.

Rate hikes are a double-edged sword, however. This is because higher rates usually result in more defaults, leading to higher impairment charges. Nonetheless, the Black Horse bank has been able to offset the rise in bad debt with higher NII. This has resulted in overall profits getting a huge boost over the past year.

Should you invest £1,000 in Coca-cola right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Coca-cola made the list?

Consequently, the stock is now close to hitting a three-year high. As inflation remains stubbornly high, the BoE is expected to continue raising rates, which would be a plus for Lloyds shares.

Gathering interest

This optimism isn’t unfounded either. When Lloyds shared its Q3 results, the board upgraded the company’s guidance. As a result, more brokers turned bullish on the stock. The likes of Goldman Sachs, Barclays, and Deutsche all have ‘buy’ ratings for Lloyds shares, with an average price target of 72p. Given such levels of confidence, it’s no surprise to see expectations for Q4’s numbers being ahead of what the board initially projected.

| Metrics | Q4 2023 (Consensus) | Q4 2022 | Projected growth |

|---|---|---|---|

| Net interest income (NII) | £3.55bn | £2.89bn | 23% |

| Net interest margin | 3.16% | 2.57% | 0.59% |

| Impairment charges | £380m | -£532m | 171% |

| Net profit | £1.21bn | £0.42bn | 188% |

| Return on tangible equity (ROE) | 12.5% | 2.9% | 9.6% |

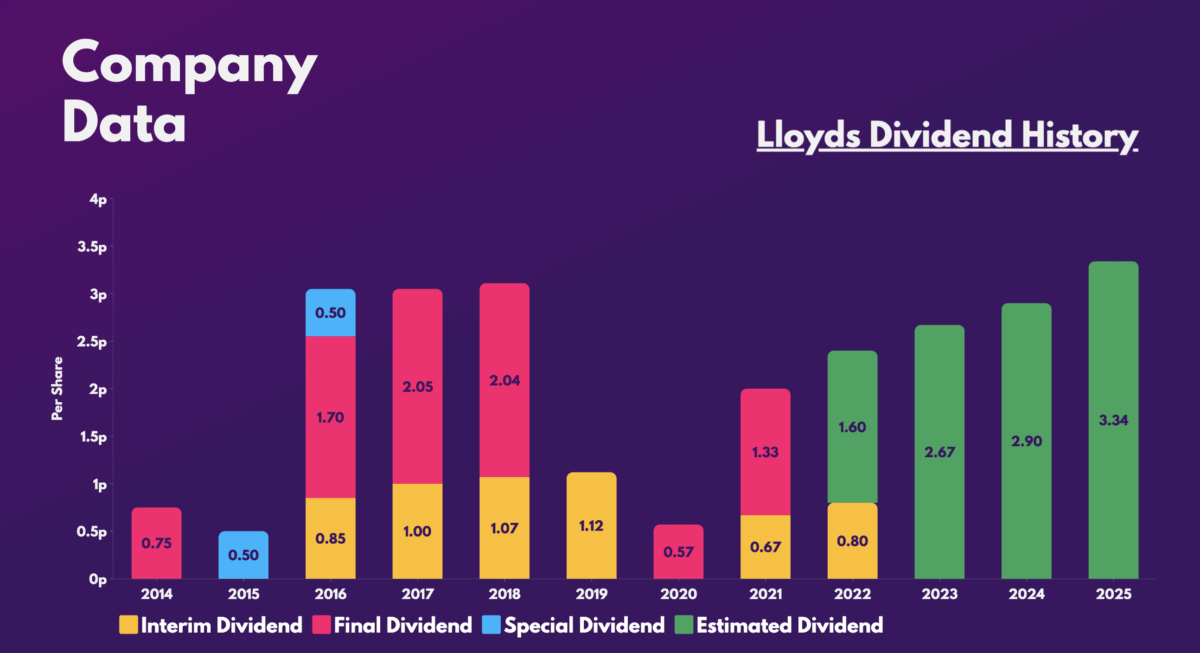

With net profits forecasted to more than double, Barclays is expecting to see Lloyds generate “sector-leading capital returns” through dividend payments and share buybacks in the coming years. The Blue Eagle bank anticipates the firm to return around 45% of its £36bn market cap by 2025.

Banking on a good year

All this adds up into a strong tailwind for Lloyds shares in the short to medium term. Additionally, interest rates are likely to stay higher for longer, which will allow the FTSE 100 stalwart to continue generating free cash from its assets. A shallower recession will help expand its net interest margins too, as impairment charges come in lighter. Moreover, consumer sentiment may be coming to a trough soon, according to the bank’s own business barometer.

| Metrics | January | December | Growth |

|---|---|---|---|

| Pricing expectations | 55% | 58% | -3% |

| Economic optimism | 47% | 43% | 4% |

| Business confidence | 22% | 17% | 5% |

| Manufacturing industry confidence | 28% | 13% | 15% |

| Construction industry confidence | 27% | 29% | -2% |

| Service industry confidence | 25% | 18% | 7% |

| Retail industry confidence | 7% | 13% | -6% |

That said, windfall taxes could be back on the agenda if profits keep flooding in while the economy suffers. A heavy tax would undoubtedly impact the group’s bottom line and shareholder returns, halting its path to 60p and beyond.

Nevertheless, I’m still a huge fan of Lloyds. The UK’s largest lender has got an excellent set of financials. Its CET1 ratio (after dividends and buybacks) sits at a robust 15%, while its liquidity coverage ratio is healthy at 146%. What’s more, its current and future valuation multiples suggest that the stock is still reasonably priced despite recent gains. Thus, I’ll be buying more Lloyds shares before next week’s earnings, for long-term growth and passive income.

| Metrics | Lloyds | Industry average |

|---|---|---|

| Price-to-book (P/B) ratio | 0.8 | 0.7 |

| Price-to-earnings (P/E) ratio | 9.0 | 10.1 |

| Forward price-to-earnings (FP/E) ratio | 7.7 | 7.3 |