Target Healthcare REIT (LSE: THRL) is one of the top five yielding shares in the FTSE 250 index. The property company operates in the healthcare sector, counting a large number of care homes in its real estate portfolio.

The real estate investment trust (REIT) offers an 8.38% annual dividend yield. This is considerably above the average yields for both the FTSE 100 and FTSE 250.

If I had spare cash to invest, here’s how I’d target £350 in annual passive income by investing in the company.

Dividend income from property

Investing in REITs is a great way to diversify my stock market portfolio. They offer exposure to income-producing real estate in a passive way, allowing me to avoid the headaches that can come from being a landlord.

Target Healthcare is one of the highest yielding REITs in the UK market, so I think it merits serious consideration for my portfolio.

Following a big fall in recent months, the Target Healthcare share price stands at 80.50p as I write. Big share price volatility can create value investment opportunities, and I think this REIT falls into that category. If I had £4,200 to invest in the FTSE 250 stock today, I could buy 5,217 shares.

The share price decline has pushed the dividend yield up. Accordingly, if I invested now, I’d earn a little under £352 in passive income just from holding the shares for a year.

As a long-term investor, I’d be inclined to hold the shares for longer than 12 months. If I reinvested my dividends into more shares, I could begin to benefit from a compounding effect on my investments.

The outlook for Target Healthcare REIT

One reason I’m bullish on Target Healthcare is the demographic transformation underway in the UK. According to the ONS, the number of UK residents aged 65 or older will reach 20.4m by 2066, equating to 26% of the total population. An aging population means increased demand for care provision.

I also like the stock’s defensive qualities. Its lease structures are long term (typically 30-35 years) and inflation linked. It’s also non-cyclical, as demand for social care isn’t dependent on the performance of the wider economy.

In addition, the properties in the group’s portfolio are modern and purpose-built. Medical issues such as incontinence make the provision of en-suite wet rooms an important consideration. Around 96% of the group’s homes have wet rooms, compared to a 29% national comparative.

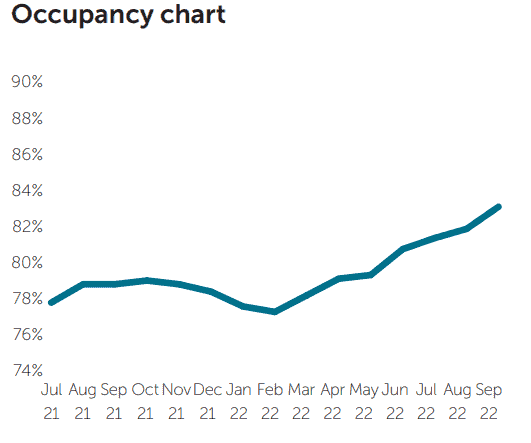

Target Healthcare also continues to make progress with regards to occupancy rates. After a reduction during the Omicron wave during the pandemic, occupancy levels have climbed since March 2022, according to the company’s latest data. High occupancy is essential for the group’s rental income.

There are some risks facing the REIT. Dividend cover is a concern at 72%. If the company’s profitability came under pressure, I’m worried the jumbo dividend yield might not be sustainable.

High inflation is another challenge facing the business. Increased costs for staff, building materials, and energy could erode the company’s margins.

Nonetheless, overall I think long-term tailwinds will boost the share price performance. With some spare cash, I’d invest in the REIT to target a regular passive income stream today.