Having hit a record high in 2018, the UK’s main index spent the next five years underperforming. That was until last week, when it hit a series of intraday highs. Moving forward, the outlook for the FTSE 100 is largely positive. However, I think maintaining such levels may be challenging.

Solid footing

Britain’s flagship index has started 2023 with a bang. Despite an impending UK recession, it’s gained almost 400 points since the start of the year and has even outperformed the Dow Jones. It’s no surprise to see it hit record highs last week. But why has it done so?

Well, the bulk of FTSE 100 companies derive their profits from outside the UK. In fact, a substantial chunk of revenues come from emerging markets and the US. As such, a slowdown in UK economic activity isn’t too detrimental to company profits. What’s more, a number of undervalued stocks have piqued the interest of value investors like myself.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

Although the Footsie has been criticised over the years for its lack of growth and tech stocks, the index’s weighting to blue-chip names has been favourable over the past year. That’s because a bulk of its constituents have benefited from higher oil and commodity prices, rising interest rates, and China’s reopening. As a result, the index has risen 15% from its bottom in October.

| Sector | % of FTSE 100 |

|---|---|

| Consumer staples | 17.9% |

| Financials | 17.8% |

| Materials | 13.4% |

| Industrials | 12.2% |

| Healthcare | 11.7% |

| Energy | 9.5% |

| Consumer discretionary | 6.9% |

| Communications | 4.3% |

| Real estate | 1.4% |

| Technology | 1.4% |

Running out of steam?

I think the FTSE 100 is likely to continue on its upward trajectory towards the 8,000 mark. However, its momentum beyond that could be limited, according to several analysts. This is because a substantial number of stocks have radically shot up in value over the past month-and-a-half. As such, some of them are no longer bargains as their valuation multiples are now more expensive.

A China slowdown, global inflation coming back to 2% and a successful negotiation of peace for Ukraine are all elements which could lose the FTSE 100 its crown in 2023.

TAM Asset Management CIO James Penny

Liberium analyst Joachim Klement expects the FTSE 100 to decline. He anticipates oil prices to drop in the coming months as the US and UK enter a recession. Contrarians will point towards China’s reopening as potentially countering this, but growth has been slow so far. Moreover, financial stocks may peak soon as the Bank of England looks to pause rate rises or even bring down interest rates. This would bring an end to the generous amounts of interest income banks have been receiving.

Predicting is a Fool’s game

That said, it’s worth noting that trying to predict the stock market is a waste of time, as anything can happen over the next 12 months.

We haven’t the faintest idea what the stock market is going to do when it opens on Monday. We’ve not been good at timing. We’ve been reasonably good at figuring out when we were getting enough for our money.

Warren Buffett and Charlie Munger

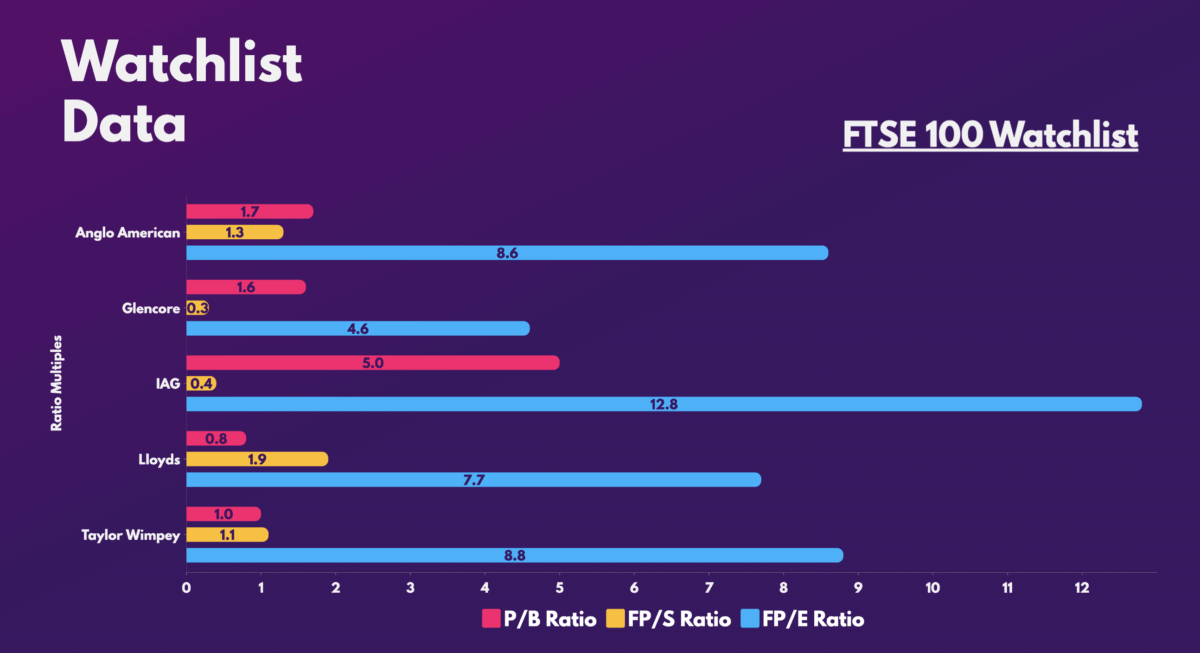

So, even though the FTSE 100 may not maintain a high of 8,000 for an extended period of time, I’m still planning to buy UK shares at a reasonable price. After all, there are many trading at cheap multiples, with solid financials and great growth prospects. Consequently, I’ve identified a number of solid companies I’m buying for long-term growth and solid dividends.