Warren Buffett‘s flagship fund, Berkshire Hathaway, yields an average return of 20% annually. As such, beating his portfolio is a difficult task. Nonetheless, I’ve identified three shares for me to buy and aim to outdo him in 2023 and beyond.

1. easyJet

As the travel sector continues to recover, it’s no surprise to see easyJet (LSE:EZJ) shares up 40% this year. Such a stellar showing has already outperformed Berkshire’s flat performance.

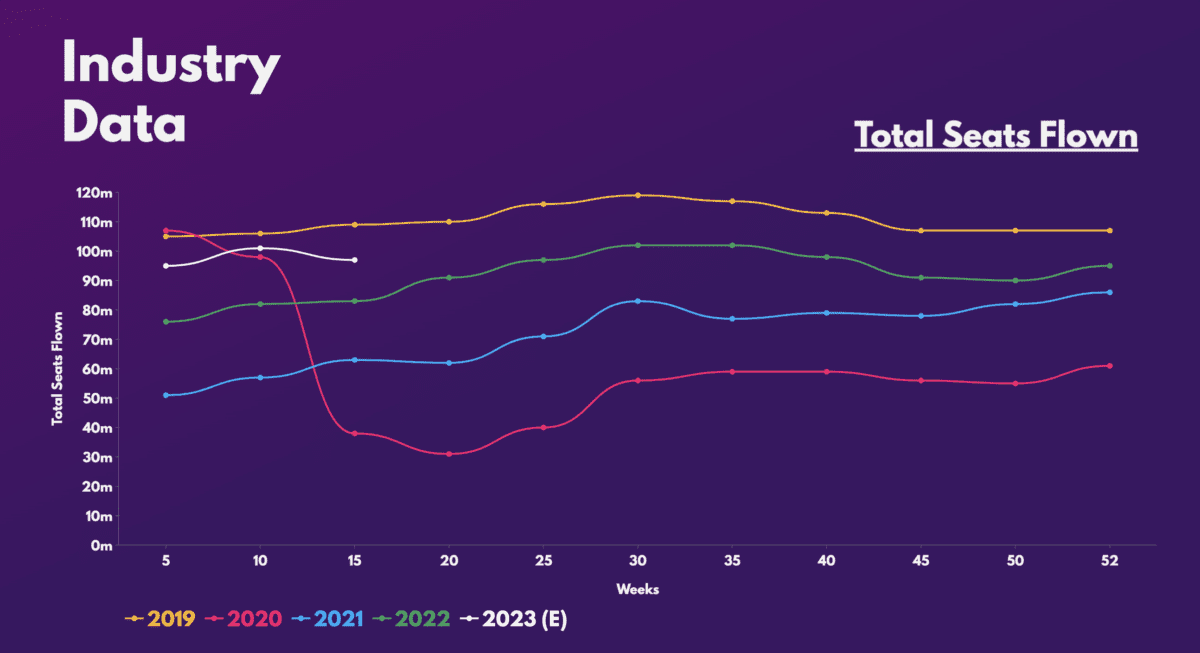

What makes easyJet shares a buy for me though, is its unrealised upside potential. Capacity is still lagging pre-pandemic levels. This means that there’s still a sizeable chunk of the market for the FTSE 250 firm to capture.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

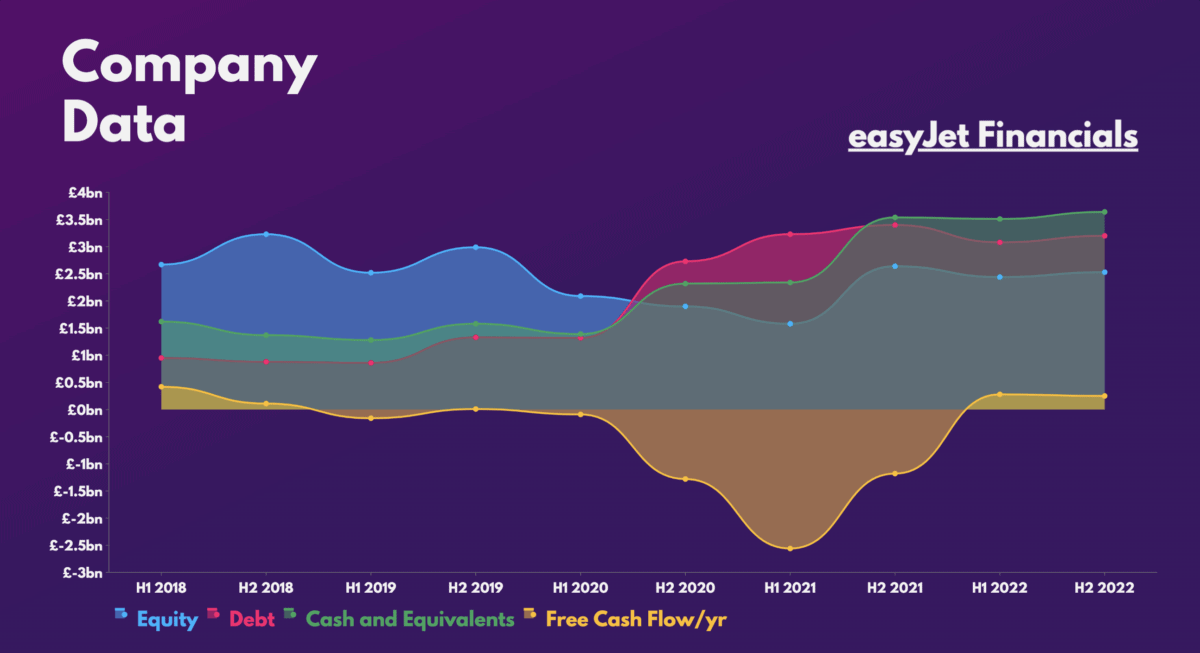

Pair that with its strong balance sheet and I’m a firm believer that it can facilitate strong, long-term growth through expanding its operations. After all, its new and growing Holidays segment is already generating more revenue with growing margins.

More lucratively, the FTSE stalwart is currently trading at cheap valuation multiples. JPMorgan and Liberium both have ‘buy’ ratings on the shares with an average price target of £5.80. This presents a 20% upside from current levels. Even so, its unprofitability for the time being may pose an investment risk.

| Metrics | easyJet | Industry average |

|---|---|---|

| Price-to-book (P/B) ratio | 1.4 | 1.8 |

| Price-to-sales (P/S) ratio | 0.6 | 0.9 |

| Forward price-to-sales (FP/S) ratio | 0.5 | 0.7 |

| Forward price-to-earnings (FP/E) ratio | 19.9 | 29.1 |

2. TSMC

Like many tech stocks in 2022, semiconductor foundry TSMC (NYSE:TSM) suffered too. Despite that, a strong rally could happen this year as the decline for chips is expected to bottom before the second half of the year.

Either way, TSMC’s multiples are currently sitting at multi-year lows. Therefore, I believe this could be a once-in-a-lifetime opportunity for me to buy its shares on a discount, and capitalise on a tech rebound in the medium term.

| Metrics | TSMC | Industry average |

|---|---|---|

| Price-to-earnings (P/E) ratio | 13.9 | 18.3 |

| Forward price-to-earnings (FP/E) ratio | 16.2 | 22.5 |

| Price-to-earnings growth (PEG) ratio | 0.2 | 1.2 |

The foundry’s industry-leading chips also puts it miles above its nearest competitors, giving it a strong moat. This is evident from its large clientele which include the likes of Apple, AMD, and NVIDIA.

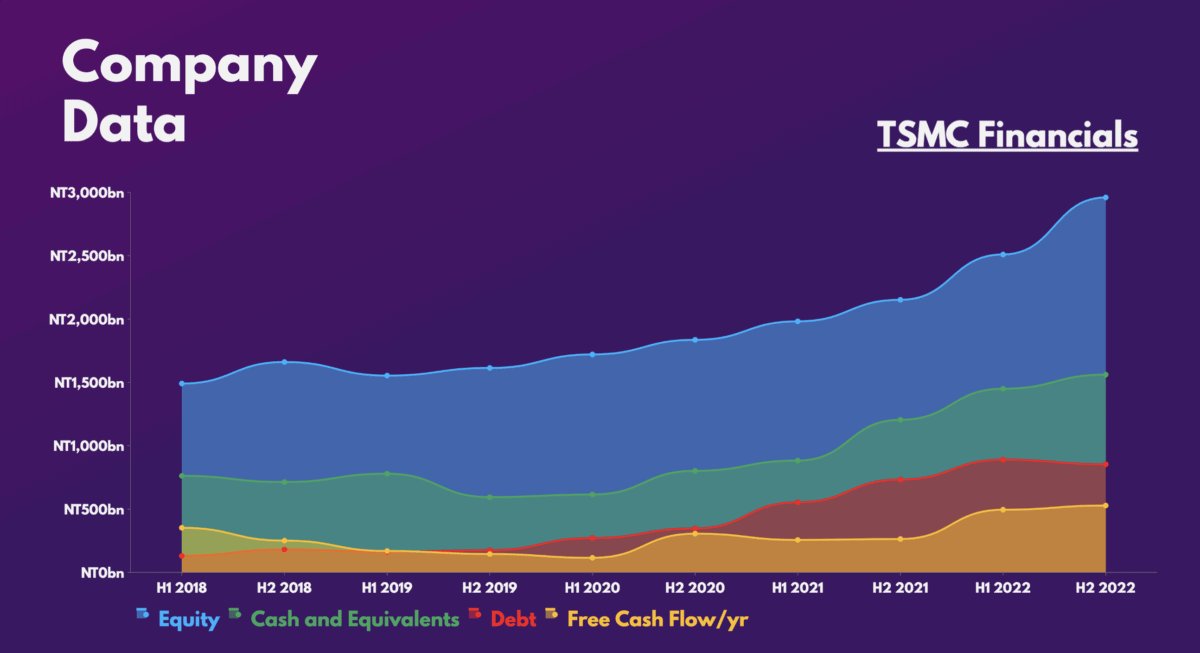

Moreover, with its robust balance sheet, the chip manufacturer is planning to use its capital to expand production and diversify its risks by building more plants outside Taiwan. Hence, I see TSMC stock as one of Buffett’s biggest winners in 2023 and beyond. Nevertheless, I should point out that near-term headwinds could persist for longer than expected, and could cause TSMC stock to drop back down.

3. Pinterest

My final share to buy would be Pinterest (NYSE:PINS). Having fallen from its pandemic highs, the social media company is staging an epic comeback. In fact, the stock is up almost 45% from its bottom.

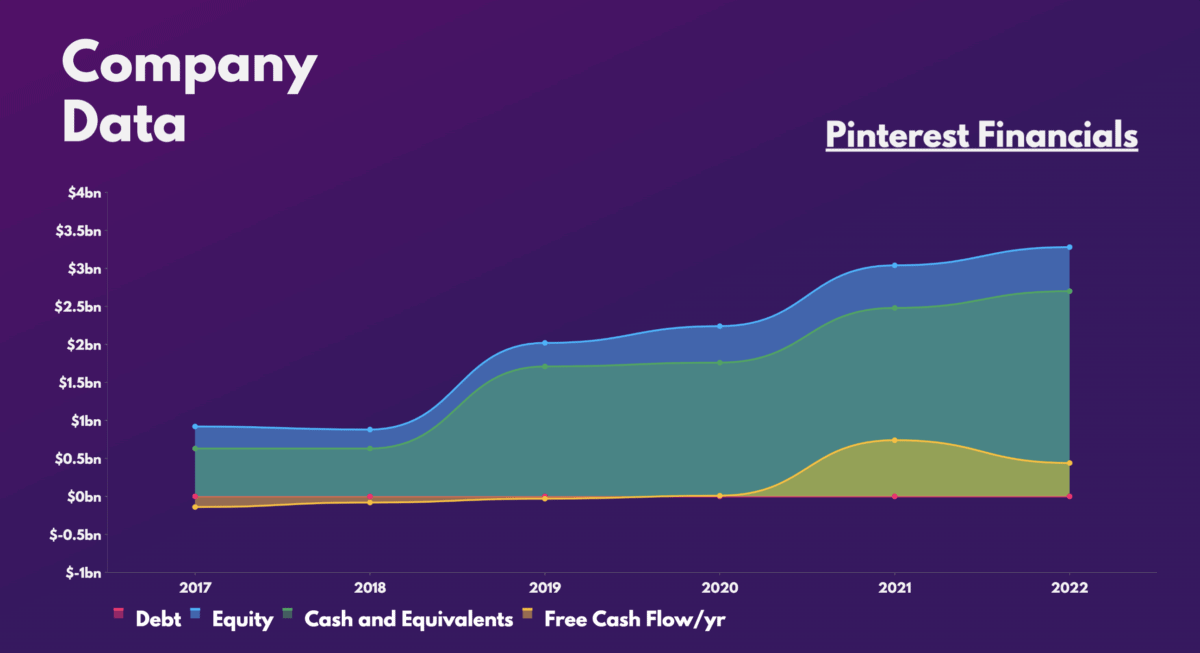

This is thanks to the board’s decision to transform Pinterest into a social media/e-commerce hybrid platform. Strong user intent to purchase items while on the app has resulted in massive growth for its shopping advertising revenues, with plenty more potential to be realised through video content. And with a flawless balance sheet, it solidifies my investment case.

Pinterest’s current multiples are high, which may put off shareholders and cause them to sell, bringing the share price down. But it’s worth noting that it’s a growth stock. I’m more interested in its forward multiples, which look reasonable when compared to the tech industry’s average.

| Metrics | Industry average | |

|---|---|---|

| Price-to-sales (P/S) ratio | 6.1 | 1.7 |

| Forward price-to-sales (FP/S) ratio | 5.6 | 3.8 |

| Forward price-to-earnings (FP/E) ratio | 32.2 | 21.6 |

JPMorgan and Piper Sandler have ‘buy’ ratings on the shares with an average price target of $30. This may only present a 13% upside from current levels. However, I’m confident that the stock can outgrow The Oracle of Omaha’s portfolio over the long term.