I don’t have a bottomless reserve of cash to draw upon. But here are three top penny stocks I’d buy today if I had spare money to invest.

I think they could deliver spectacular investor returns over the next decade.

Surface Transforms

Should you invest £1,000 in City Pub Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if City Pub Group Plc made the list?

The global sports car market looks set for rapid growth as the number of high net worth individuals soars. But investing in a motor manufacturer carries high risk as the market is super competitive.

So I’d rather invest in companies that make components for these car builders. Surface Transforms (LSE:SCE) is one such business I have my eye on, a penny stock that manufactures ceramic brakes for high-performance vehicles.

The business is steadily ramping up capacity to better exploit this fast-growing market, too. By 2026, it hopes to have £150m worth of sales capacity, up from the £50m that it hopes to have in operation by the second quarter.

Bear in mind, though, that earnings could disappoint in the near term should broader production issues among major car producers continue.

European Metals Holdings

The business of mining is extremely unpredictable and earnings forecasts therefore are fragile. Exploring for mineral deposits, developing mines, and finally pulling raw materials from the ground is highly complicated business.

But I’m still tempted to invest in European Metals Holdings (LSE:EMH). This mining company is in the process of developing Czechia’s Cinovec lithium project, said to be Europe’s largest resource of the metal.

This creates huge earnings potential. Long-term lithium demand is tipped to soar as sales of electric vehicles (EVs) takes off. The element is a key material in car batteries.

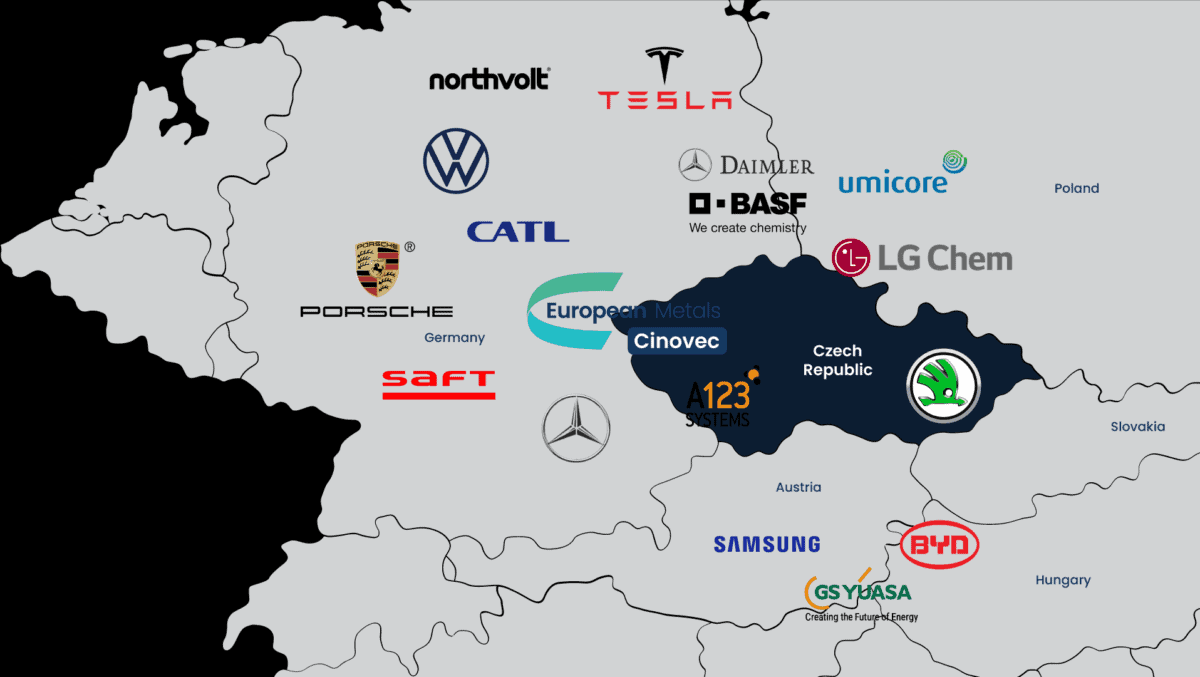

On top of this, I like the geographic position of this particular lithium stock. As the map below shows, it’s on the doorstep of some of the world’s biggest motor manufacturers.

Last week Cinovec was classified by the European Union as a strategic project, too. This gives it priority access to funding from the bloc. All things considered I think now’s a great time to buy this penny stock.

City Pub Group

UK leisure stocks face an uncertain 2023 as the cost-of-living crisis endures. This includes City Pub Group (LSE:CPC), a pub chain that operates 44 establishments across Southern England and Wales.

That said, I believe its focus on the premium end of the pub market could help it weather the storm. More affluent consumers have more money to spend during economic upturns and downturns.

In fact latest financials came as massive reasurrance to investors. City Pub Group saw like-for-like sales growth accelerate to 7.8% compared with 2019. Results would have been even better had it not been for rail strikes.

Brits are spending higher proportions of their income on leisure activities like going out for a pint or a cocktail. I think this penny stock could be a great way to capitalise on this theme.