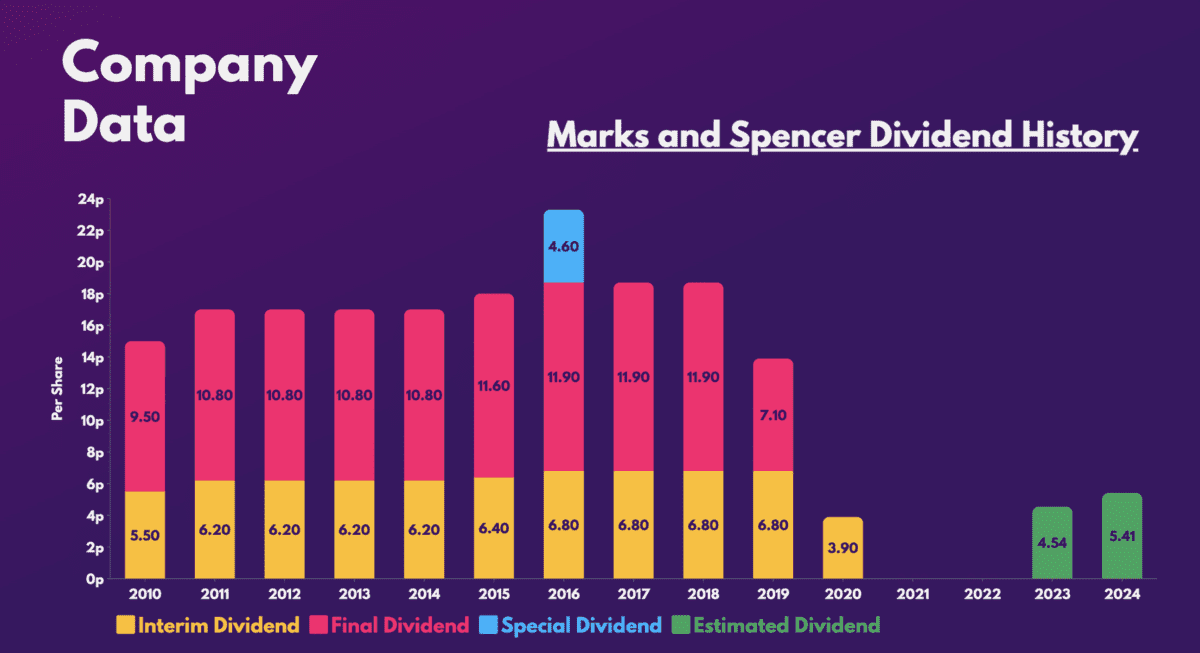

Marks and Spencer (LSE:MKS) shares were once known for steady passive income until the company suspended payouts in 2020. Nonetheless, strong sales and widening margins could soon see it paying dividends again. This has piqued my interest with the stock also up 25% this year.

A rich history

As a former dividend aristocrat, M&S has a history of paying steady dividends. However, its slow progress as it tried to modernise its business and products saw profits declining along with payouts. More recently, the FTSE 250 firm has paused shareholder returns. Instead, the retailer has been using its spare cash to rejuvenate the business.

Analysts are pencilling in a return of dividend payments this year, but this is yet to be confirmed. CEO Stuart Machin mentioned that a decision will only be made when Marks and Spencer shares its full-year results in May.

Although the projected yields aren’t lucrative by any means (2.9%), I invest for the long term. I would imagine given M&S’s strong growth trajectory, a return to its pre-pandemic amount is a realistic possibility in 2026. In such a case, Marks and Spencer shares would have a handsome forward yield of 8.8% if I were to buy at current levels.

Producing growth

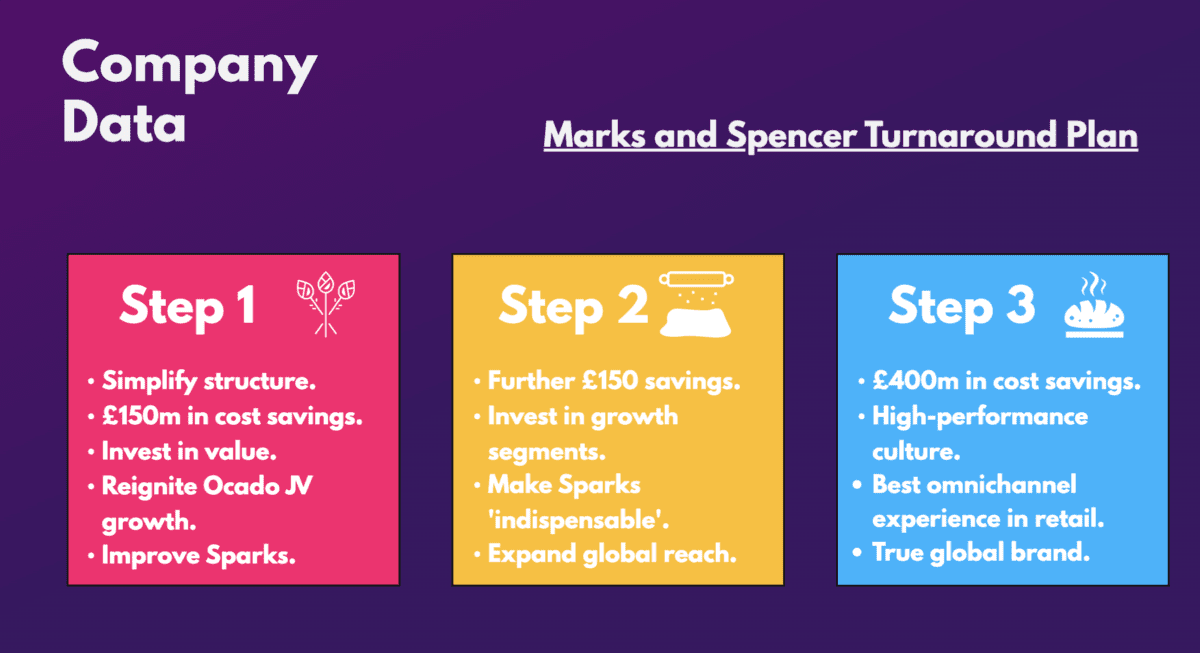

So, how might M&S pay such a high dividend? That would be down to its turnaround plan. When Machin was first installed as CEO last year, he devised a turnaround plan (building on success already seen under his predecessor) to continue driving the retail giant’s recovery.

While the firm may only be in phase one, the turnaround is slowly taking shape. Recently, Marks and Spencer has outperformed many of its supermarket and clothing peers while growing its market share. This was reinforced by another set of strong figures from its most recent Christmas update.

| Metrics | Total sales growth | Like-for-like sales growth |

|---|---|---|

| Food sales | 10.2% | 6.3% |

| Clothing and home (C&H) sales | 8.8% | 8.6% |

| Total UK sales | 9.7% | 7.2% |

| International sales | 12.5% | N/A |

| Total sales | 9.9% | N/A |

The group’s performance has been so good that management has opted to accelerate its store rotation programme. Having witnessed better footfall from retrofitted stores, the board is confident that new stores will boost footfall and sales volumes.

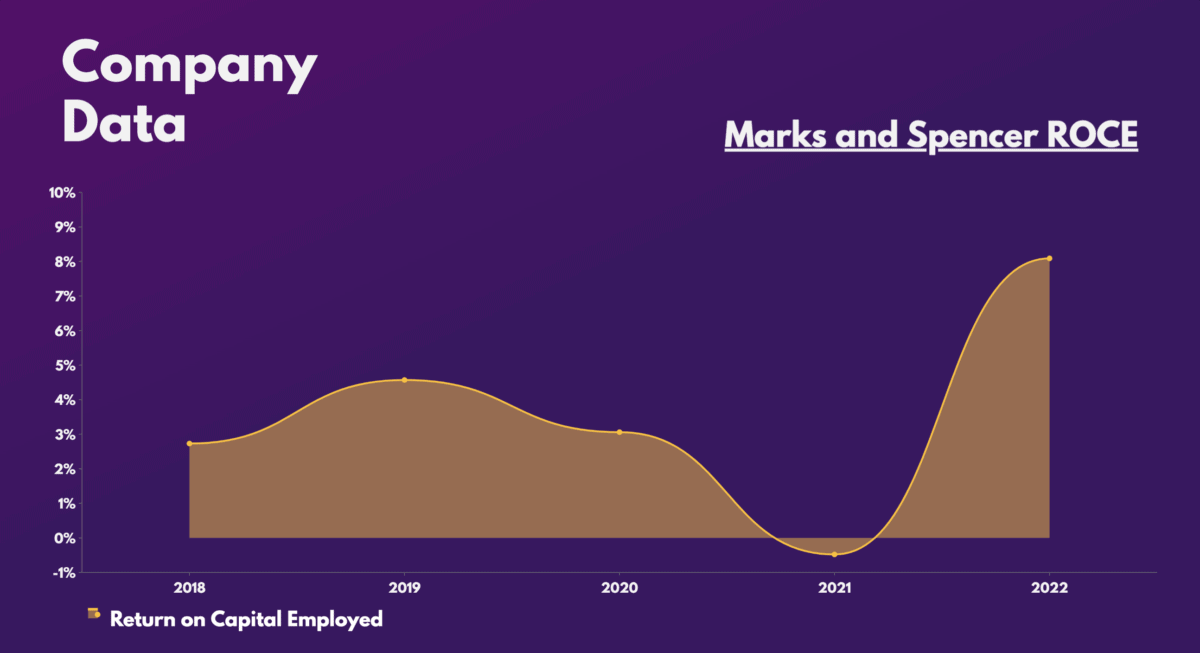

Additionally, M&S has been managing its capital very efficiently with an improving return on capital employed. Its strategic moves to vertically integrate suppliers and acquire modern clothing brands should bring more room for margin expansion. What’s more, its focus on developing a top-class omnichannel experience is something that excites me.

‘Remarksable’ value

Are Marks and Spencer shares a buy for me then? Well, its valuation multiples would suggest so. In fact, the business is currently trading at cheaper multiples than peers Tesco and Sainsbury’s.

| Metrics | Marks and Spencer | Industry average |

|---|---|---|

| Price-to-book (P/B) ratio | 1.0 | 1.4 |

| Price-to-sales (P/S) ratio | 0.3 | 0.3 |

| Price-to-earnings (P/E) ratio | 10.0 | 14.1 |

| Forward price-to-sales (FP/S) ratio | 0.3 | 0.5 |

| Forward price-to-earnings (FP/E) ratio | 11.0 | 12.8 |

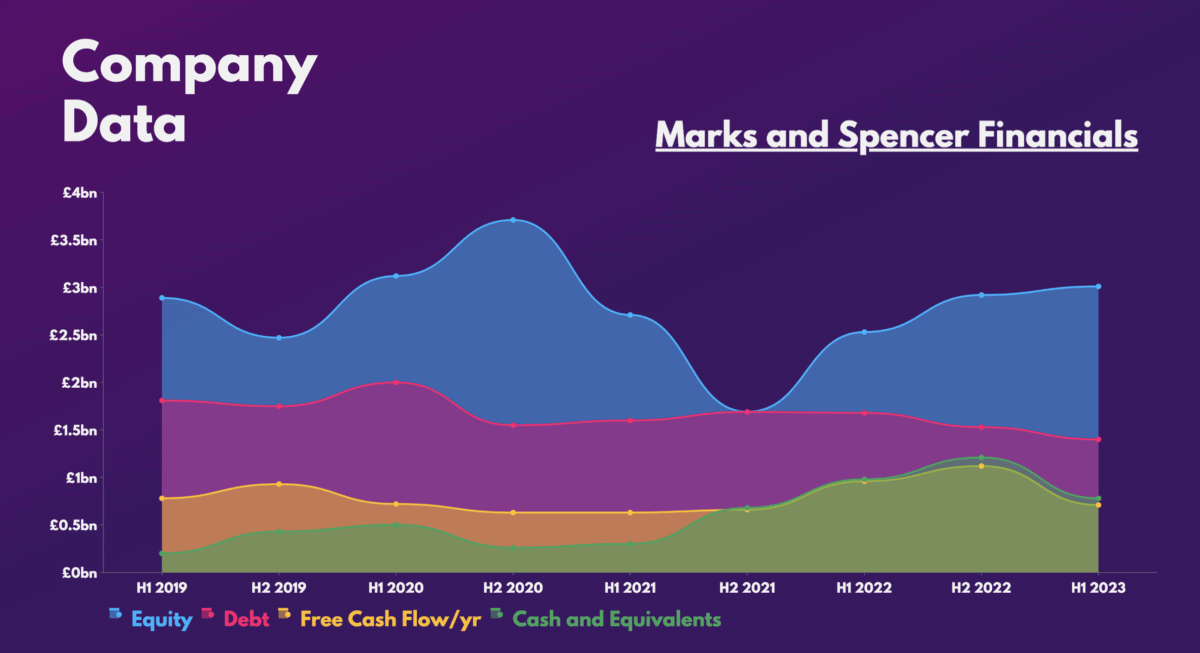

Moreover, M&S has a decent balance sheet. Declining debt levels paired with improving free cash flow should help its case for a return in dividends payments. As such, it’s no surprise to see Deutsche recently upgrading the stock from ‘hold’ to ‘buy’, with a price target of £2.10. This presents a healthy 27% upside from current levels, which looks even more lucrative when I take possible future dividends into account.

Ultimately, all signs are pointing towards the start of a major turnaround for the firm. Machin and his team have done an excellent job so far, and I’m excited to see what comes next. I’ll be expanding my position while the shares are still cheap.