A potential housing market crash and possible dividend cuts have seen FTSE property stocks crumble over the past year. Nonetheless, Taylor Wimpey (LSE:TW) shares are still my top picks for their long-term potential and passive income avenue.

About Taylor Wimpey Plc

Last updated 02-05-2025, 04:30:00pm BSTUnstable grounds

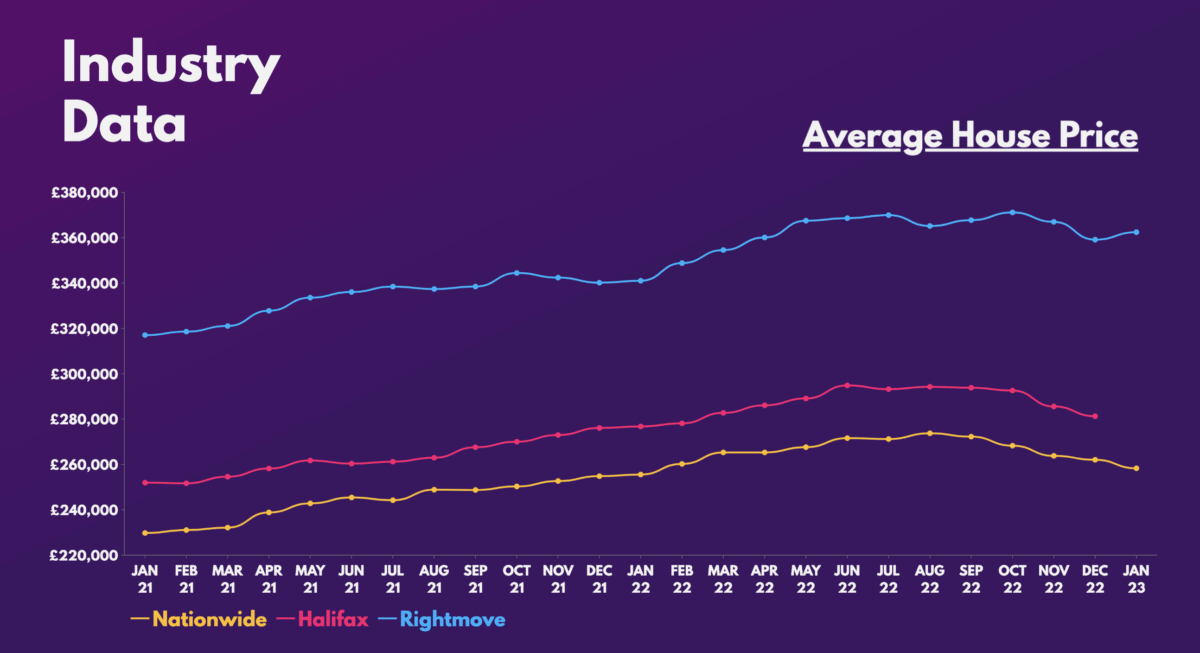

An ugly combination of rising inflation and high interest rates has driven mortgage rates to a multi-year high. Consequently, demand and house prices have cooled, with all three housing indexes seeing declines since the summer.

Hence, it was no surprise to see the disappointing numbers Taylor Wimpey shared in its latest trading update, as the housebuilder posted substantial declines in most areas.

Should you invest £1,000 in Tesco right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Tesco made the list?

| Metrics | 2022 | 2021 | Growth |

|---|---|---|---|

| Total completions | 14,154 | 14,302 | -1% |

| Net private reservation rate | 0.68 | 0.91 | -25% |

| Cancellation rate | 18% | 14% | 4% |

| Average selling price | £313k | £300k | 4% |

| Book value | £1.94bn | £2.55bn | -24% |

| Total landbank | 144k | 145k | -1% |

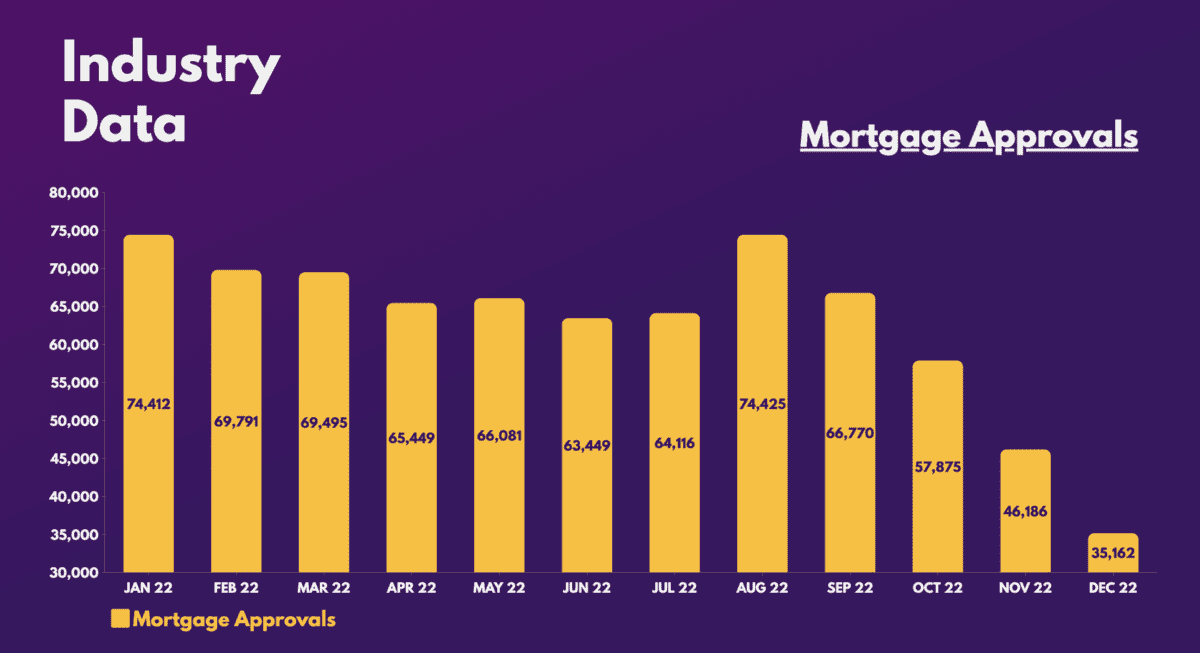

Sentiment surrounding the property market hasn’t improved since either. The latest data from the Bank of England (BoE) showed that mortgage approvals (a leading indicator for the property market) continued to decline in December. In fact, approvals have now dropped to levels not seen since the peak of the pandemic and during the 2008 financial crisis. Therefore, building societies and banks are anticipating house prices to fall from anywhere between 8% and 15% this year.

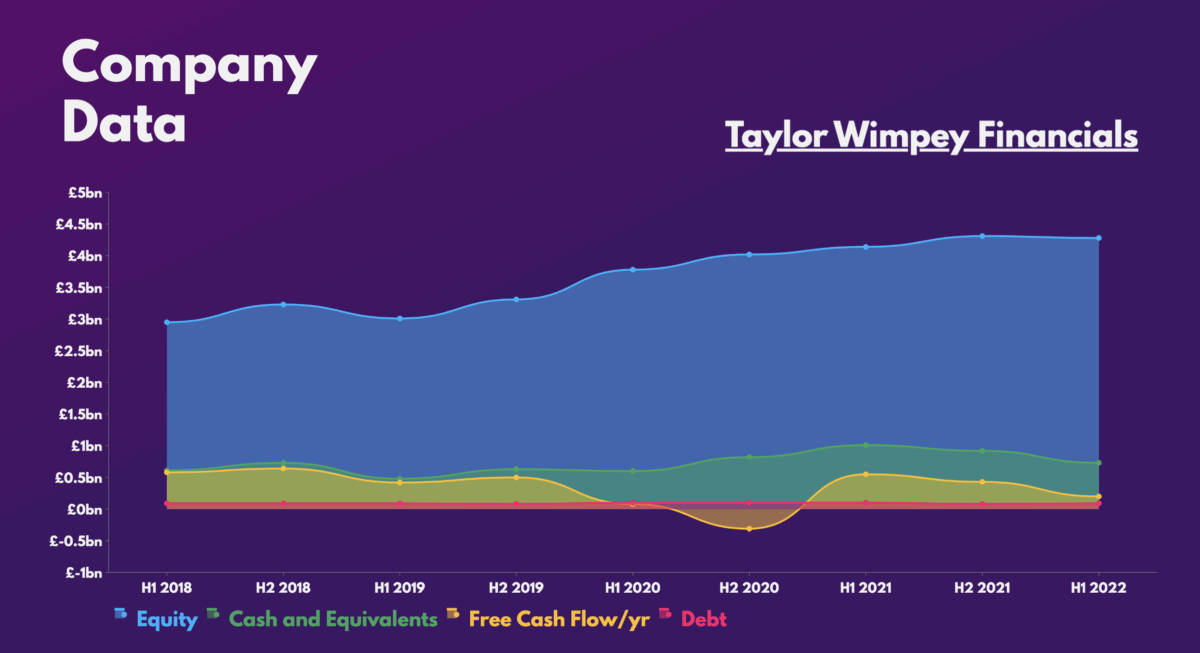

Constructing a second income

Nonetheless, I believe Taylor Wimpey still presents a long-term investment opportunity for growth and passive income. Thanks to its strong fundamentals, it’s unlikely that the FTSE 100 stalwart will have to raise capital through debt or equity, which is great news for shareholders like myself. More importantly, its strong balance sheet gives it a dividend cover of 2.1 times.

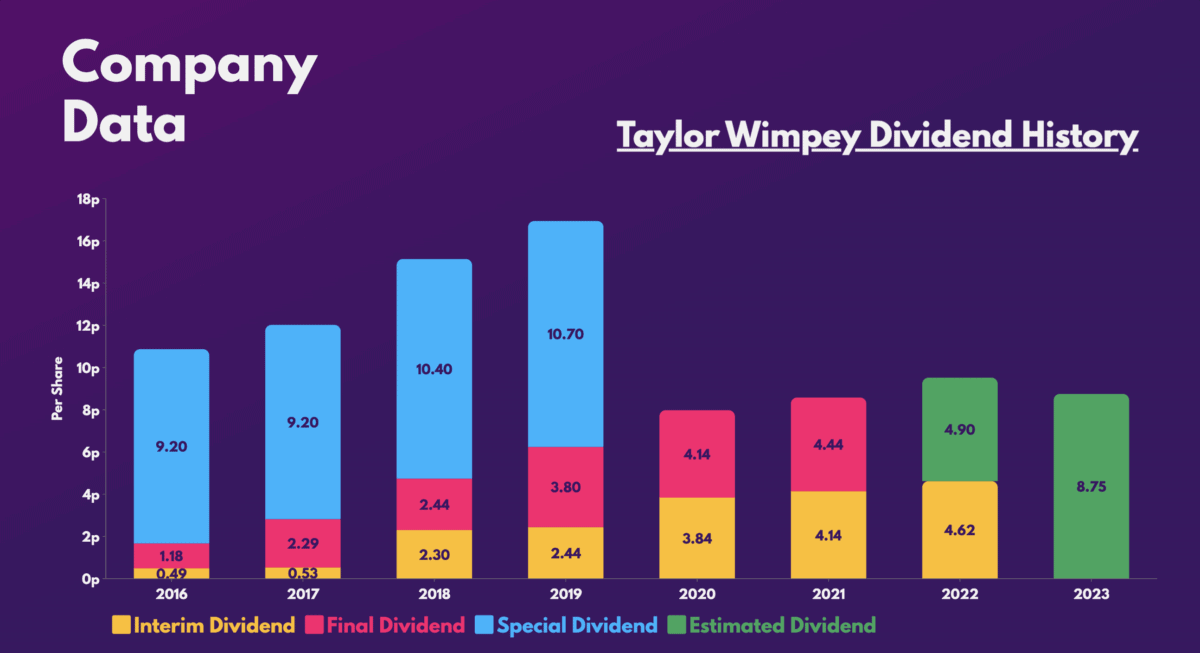

Additionally, Taylor Wimpey shares have a strong history of paying steady and growing dividends, which is what I’m looking for as an investor seeking a second income. Payouts may be lower this year, but a forecast 7.1% forward dividend yield is still generous enough to pique my interest.

That said, it’s the longer term on which I’m focused. I imagine the property market will recover and profits will grow over the next five to 10 years. As such, we could see a return of hefty special dividends. Although there’s no guarantee of that, the prospect of such a huge payout in the future is certainly enticing.

A chance to build wealth

Despite the doom and gloom surrounding the market, it’s been a relief to see last year’s headwinds starting to subside. As inflation continues to drop, the Bank of England is likely to pause its rate-hiking cycle soon. This could see mortgage rates stabilising and even declining, providing some support for house prices and the Taylor Wimpey share price in the medium term.

Nationwide Chief Economist Robert Gardner said there have been some “encouraging signs that mortgage rates are normalising”. And even though it’s still too early to determine whether activity in the market has started to recover, broker Liberium believes the housing market decline isn’t as bad as initially feared.

So, is the stock a buy for me? Well, the likes of Jefferies, Barclays, and Citi all have ‘buy’ ratings. Nevertheless, their average price target of £1.23 would indicate that the shares are currently fairly valued. Current and forward valuation multiples suggest so too. For those reasons, I’ll be looking to add to my current position while the stock is still fairly priced.

| Metrics | Valuation multiples | Industry average |

|---|---|---|

| Price-to-book (P/B) ratio | 1.0 | 0.9 |

| Price-to-sales (P/S) ratio | 1.0 | 0.8 |

| Price-to-earnings (P/E) ratio | 7.5 | 11.2 |

| Forward price-to-sales (FP/S) ratio | 1.1 | 1.2 |

| Forward price-to-earnings (FP/E) ratio | 9.0 | 8.7 |