Britain’s medium-cap index is a ground for picking relatively ‘unknown’ shares to invest in. This allows me to pick out potential winners to beat the market. So, here’s one forgotten stock I’ve identified with the potential to outperform the FTSE 250.

Flying higher

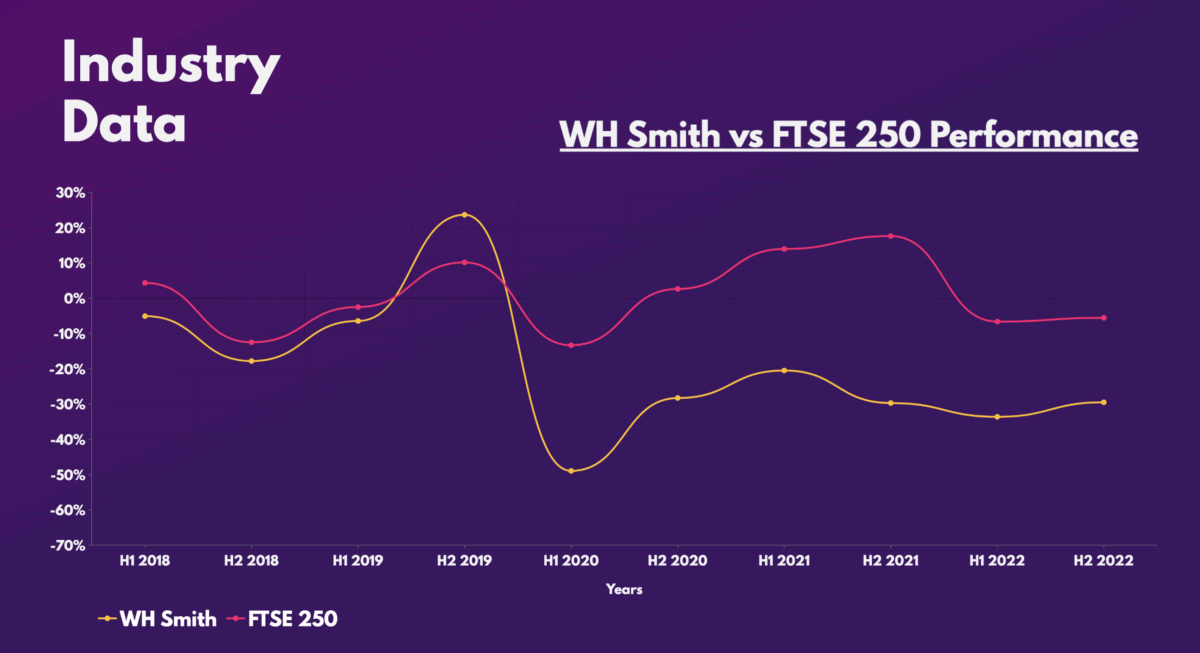

Forgotten-about retailer WH Smith (LSE:SMWH) has a poor history when it comes to its shares’ performance. This is due to the outdated displays and general lack of tidiness in its stores, leading to poor footfall. This wasn’t helped by the pandemic either, as sales suffered.

Having said that, Smith’s performance since hitting a bottom in October last year has been nothing but stellar. Like the rest of the travel industry, its shares have performed well and have even outperformed the FTSE 250 over the last quarter.

This strong rally isn’t without merit either. Just last month, the business released its Q1 trading update, which resonated well with shareholders. The group’s total sales witnessed a healthy 41% increase, with its Rest of World segment posting the most impressive growth.

| Sales growth | FY23 vs FY22 | FY23 vs FY19 |

|---|---|---|

| UK | 70% | 18% |

| North America | 31% | 20% |

| Rest of World | 198% | 30% |

| Group total | 41% | 20% |

| Travel | 77% | 48% |

| High street | -2% | 0% |

On the move

What was most noticeable, however, was where the bulk of WH Smith’s revenue stemmed from. The FTSE 250 firm saw the strongest growth in sales from its travel stores such as in airports and train stations. Management has been trying to shift the brand away from its book store origins to more of a ‘one-stop shop’ for travel essentials. This has been evident in its adoption of new products for travel that include an array of health and beauty items.

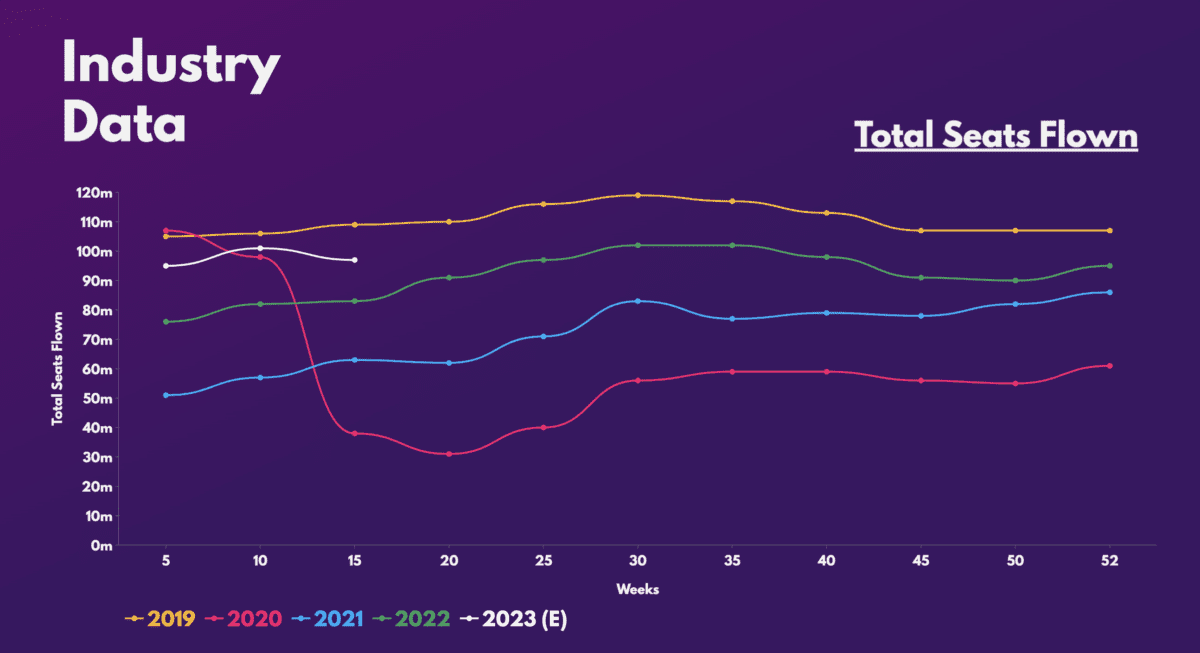

As such, an acceleration away from the high street would be beneficial for several reasons. For one, it would get rid of the stores weighing it down, while allowing margins to expand. What’s more, the board can focus on opening more travel stores to capitalise on the strong and growing travel demand. After all, IATA is forecasting for passenger numbers to hit 7.8bn by 2040. And with total seats flown still lagging pre-pandemic levels, there’s certainly plenty of upside for WH Smith to profit from.

Expensive purchase?

So, do I think this FTSE 250 share is worthy of an investment? Well, its valuation multiples aren’t very favourable. But given its status as a recovering growth stock, it’s more important to look at its forward multiples. And when considering its two-year forward P/E of 17.6, I’d say the stock is fairly valued at its current price.

| Metrics | Valuation multiples | Industry average |

|---|---|---|

| Price-to-book (P/B) ratio | 7.0 | 1.4 |

| Price-to-sales (P/S) ratio | 1.5 | 0.3 |

| Price-to-earnings (P/E) ratio | 44.2 | 11.1 |

| Forward price-to-sales (P/S) ratio | 1.2 | 0.6 |

| Forward price-to-earnings (P/E) ratio | 20.0 | 12.9 |

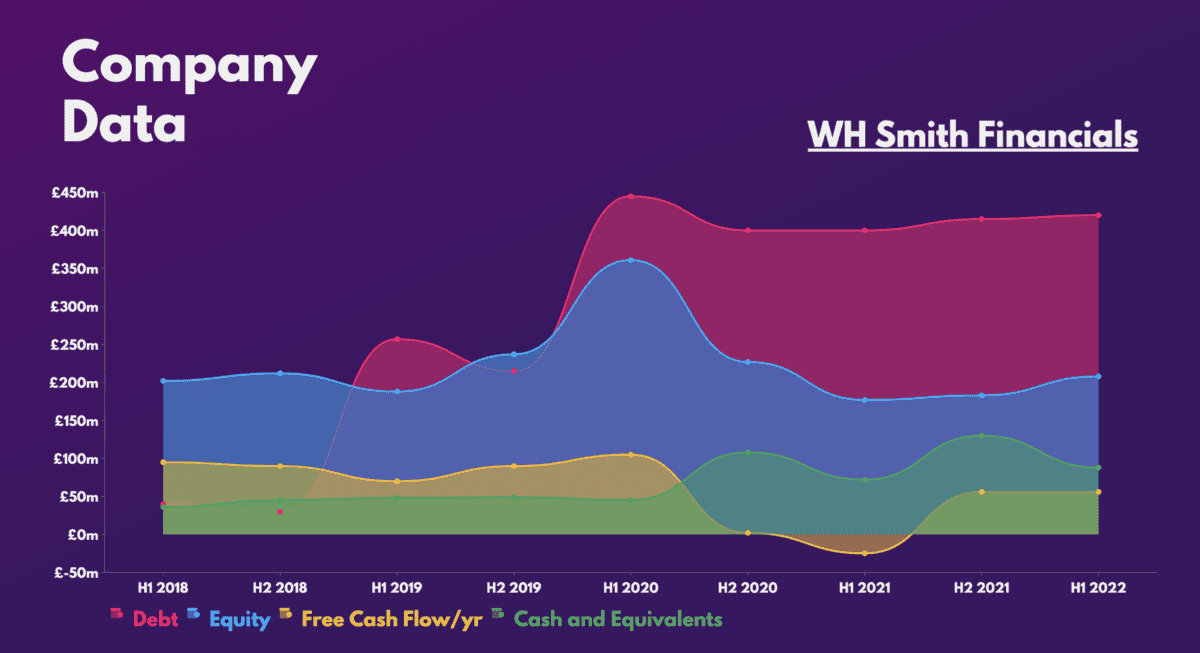

However, it falls short on is its financials. WH Smith’s balance sheet is ridden with debt with barely enough cash to cover it. This is a concern that could possibly topple its investment case.

Nonetheless, brokers such as Barclays, JP Morgan, and Berenberg all have ‘buy’ ratings on the stock, with an average price target of £19.58. This would present a handsome 20% upside from current levels.

I’m definitely bullish on WH Smith’s prospects, and its move to open hundreds of new travel stores in the coming years make it an attractive investment. That being said, I’d like to see more improvement to its business model and financials before starting a position. Thus, I’m keeping it on my watchlist for now.