Getting its share price back above the 50p mark was something Lloyds (LSE:LLOY) struggled to do throughout 2022. However, it found a breakthrough in January as the bank stock is now up by more than 10% this year. With that in mind, I’ll be buying more Lloyds shares in the coming days.

Interest picks up

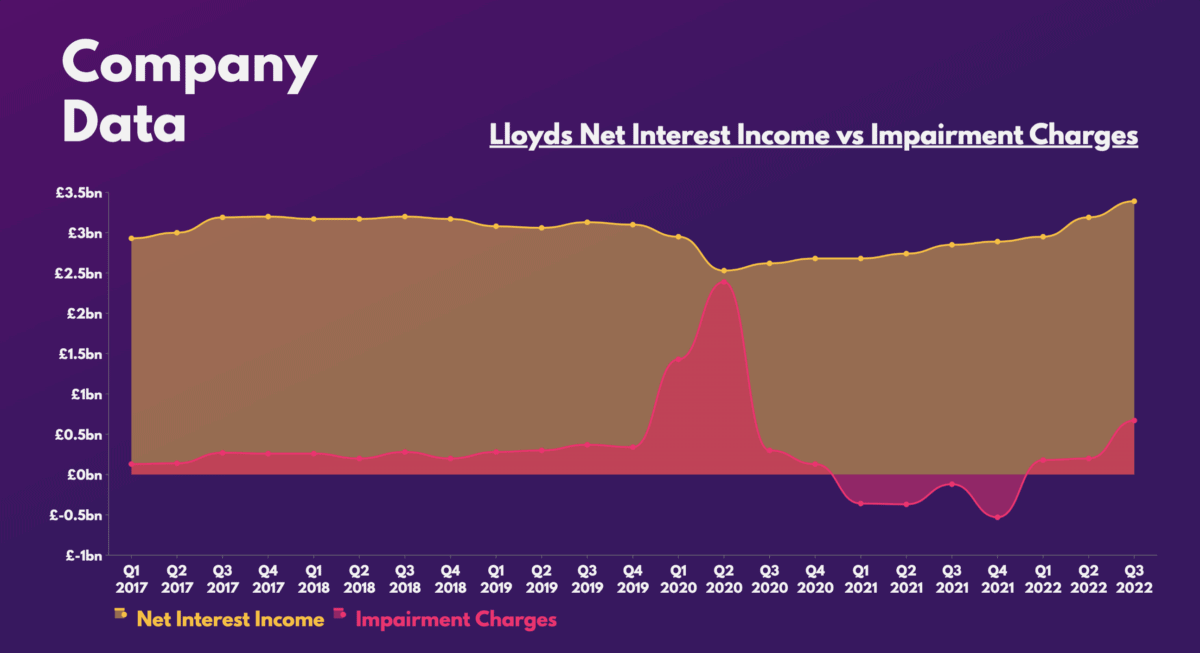

This week, the Bank of England (BoE) raised interest rates by another 0.5%, bringing the bank rate to 4%. This is good news for the FTSE 100 stalwart as it continues to expand its net interest income due to higher rates. That’s because Lloyds’ assets continue to generate bigger revenues than its liabilities.

The institution has approximately £80bn worth of assets stored with the central bank which means that the recent rate hike will add another £400m to its income. Consequently, its bottom line should see improvements this year, which could result in higher dividends.

Should you invest £1,000 in Breedon Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Breedon Group Plc made the list?

Prior to the current rate cycle, the Black Horse bank wasn’t renowned for giant dividends. But given its recent advance, analysts are now forecasting payouts to increase by 13% this year. This would bring its dividend yield to 5.2% if I were to buy Lloyds shares today, which could make it a decent passive income generator.

Banking on a soft landing

Higher interest rates can also be a double-edged sword, however, as customers are more likely to default on their loans. This could result in the bank having to set aside a fraction of its profits to cover those impairment chargers. Nonetheless, impairments should peak soon, as the BoE hinted at a potential pause in its hiking cycle with inflation starting to come down.

More importantly, BoE Governor Andrew Bailey now anticipates the impending recession to be shorter and less severe than expected. This should ease the upward pressure from impairment charges.

Higher ratings

These tailwinds have resulted in a number of brokers upgrading their ratings for the stock. Goldman Sachs in particular, is very bullish on the group with a price target of 76p. This would present a 46% upside if I were to buy Lloyds shares today. What’s more, this bullishness is echoed by other investment banks, with RBC labelling it a “preferred stock“, and UBS calling it a “conviction buy“.

This optimism isn’t unfounded either. There are the firm’s already cheap valuation multiples, and it has a strong balance sheet to complement this too. Boasting a CET1 ratio of 15% and liquidity coverage ratio of 146%, the conglomerate has sufficient cash to hand out in the event of mass withdrawals.

| Metrics | Valuation multiples | Industry average |

|---|---|---|

| Price-to-earnings (P/E) ratio | 8.8 | 10.0 |

| Price-to-tangible-book-value (P/TBV) | 0.9 | 0.9 |

For those reasons, I’ll be buying more Lloyds shares to capitalise on its upside potential and before it gets too expensive.