Glencore (LSE:GLEN) shares are a top pick for many analysts in 2023. The miner is expected to be an outperformer this year given its growth potential and strong dividends. Yet with the share price unmoved since the start of the year, I’m keen to buy more for passive income.

Coal demand

The company’s current dividend yield of 4.2% doesn’t particularly scream passive income. However, it’s worth noting that this is a trailing figure. Analysts are estimating its dividend to jump to 43p per share this year. This would give me a handsome forward yield of 8% if I were to buy Glencore shares today.

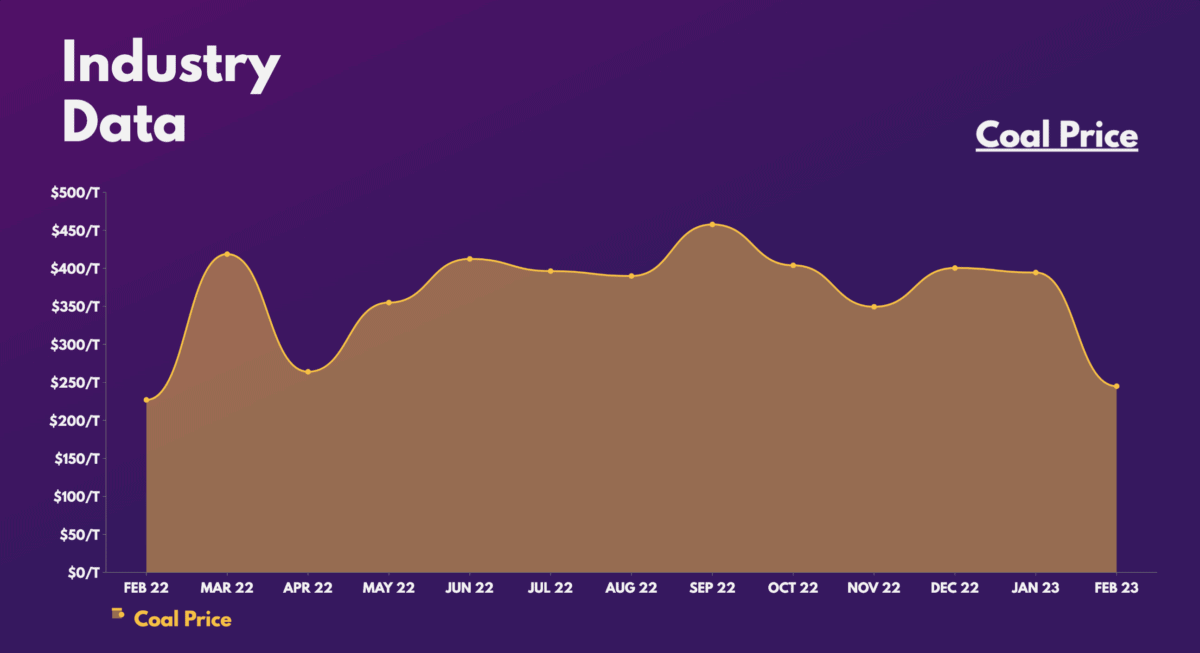

How’s the firm going to double it current yield then? Well, given that Glencore generates the bulk of its revenue from coal, analysts are placing their bets on the commodity to remain at elevated prices throughout 2023.

Having said that, coal prices have now dropped close to their one-year low. Experts are attributing the weakness to prospects of increased supplies and reduced demand from an impending recession. This has been evident from the latest Kpler data, which shows that European imports declined approximately 30% from last year and 23% from December.

Nonetheless, the medium-to-long-term picture remains mostly unchanged. That’s because the rock’s top consumer, China has resumed imports from Australia. As such, China’s strong demand for coal should offset any temporary weakness in the fuel and bring some support to Glencore shares.

Conducting growth

Apart from coal though, the world’s biggest miner also has a number of metals in its portfolio. These include copper, zinc and nickel, which have the potential to rise in price from the transition towards greener technologies.

Therefore, it was a bit disappointing to see the production numbers Glencore shared this week. Copper and zinc saw double-digit declines, with gold and silver also down. Nevertheless, these hiccups should be temporary and were the results of weather disruptions and equipment faults.

Hard as rocks

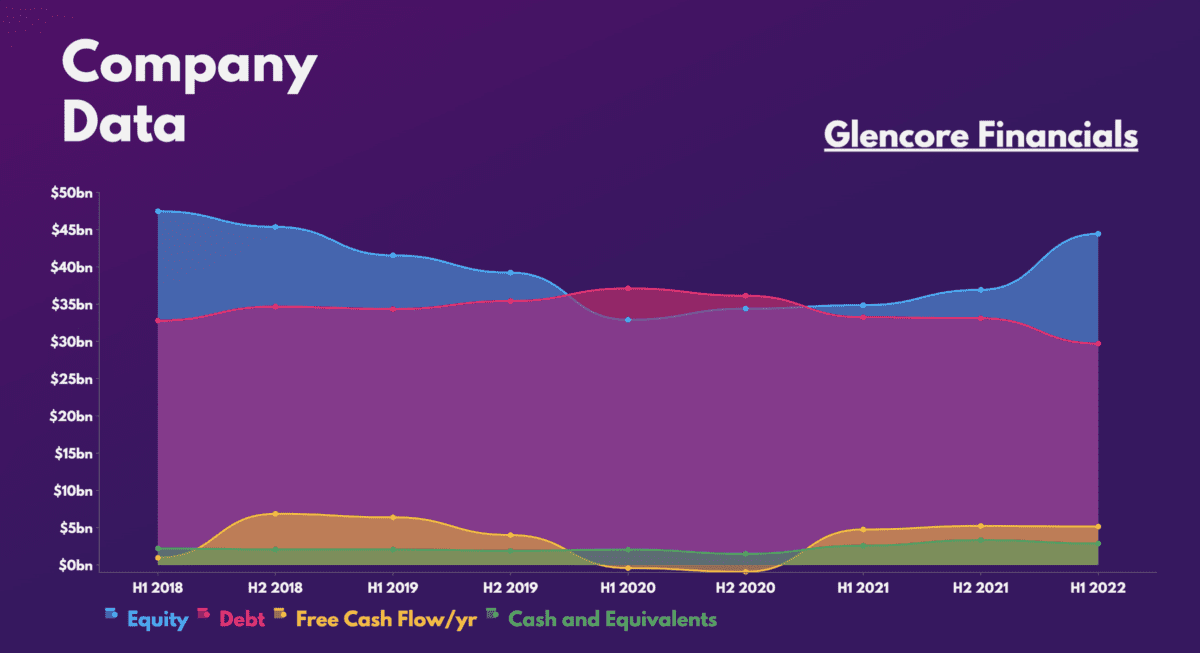

Additionally, the conglomerate has a rather robust set of financials. A declining debt pile paired with growing free cash flow is music to my ears. And with profits forecast to double over the next couple of years, I see a lucrative investment opportunity for me.

Not only that, Glencore shares are also trading at what I see as bargain levels currently. Both its current and future valuation multiples remain cheap versus the market and industry average.

| Metrics | Valuation multiples | Industry average |

|---|---|---|

| Price-to-earnings (P/E) ratio | 5.6 | 6.8 |

| Price-to-sales (P/S) ratio | 0.3 | 1.4 |

| Price-to-book (P/B) ratio | 1.8 | 1.2 |

| Forward price-to-sales (P/S) ratio | 0.3 | 2.2 |

| Forward price-to-earnings (P/E) ratio | 4.9 | 12.1 |

That said, there are a couple of risks worth mentioning. The first is the downside risks of the commodity giant’s portfolio. Despite coming off their highs, coal and metal prices remain elevated on a five-year basis and so could drop further. The second is Glencore’s position as a top pick. A recent report from AJ Bell cites that top picks generally underperform the market, and have done so in seven out of the past eight years.

Even so, I’m still confident about its medium-term prospects, and I think at these prices it could be a once-in-a-lifetime bargain. After all, CEO Gary Nagle reiterated the group’s strong production guidance for 2023. For that reason, I’m inclined to agree with Citi that has a ‘top pick’ rating with a price target of £6.50. I’ll be buying more shares.